In this article, we have identified a few of the best-performing stocks in the US markets, both over the last 20 years as well as the best of all-time. This list comprises the big names that have managed to provide more than generous returns for its investors. These stocks have generated returns through dividend income and tremendous capital appreciation over the decades. We have divided them into two categories: The first set of companies would be names that have given high returns since inception, and the other list of firms would be the best performers in the last 20 years.

The Best-Performing Stocks of All Time

You might also enjoy:

- How to Open a Brokerage Account & How to Choose the Right Broker

- Futures Spread Trading – Guide on How to Trade Spreads in Futures

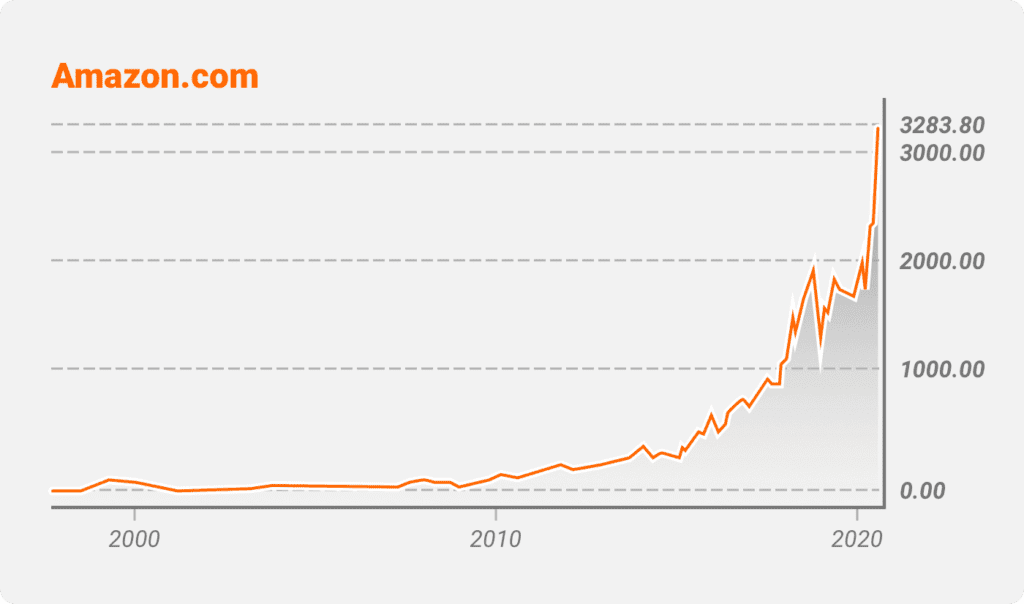

1. Amazom.com (AMZN)

Amazon is a leading player in the technology space. Their price was $1.5 at the beginning of June 1997. Since then, it has managed to climb up to $3,300. The revenues of the company have been growing at high speed as the company expands its business into new territories. The margin on its business has also increased, and because of that, it can offer shareholders a lucrative return. The company tends to invest all its earning into driving future growth. Nothing highlights this better than the revenue estimates that the company provides.

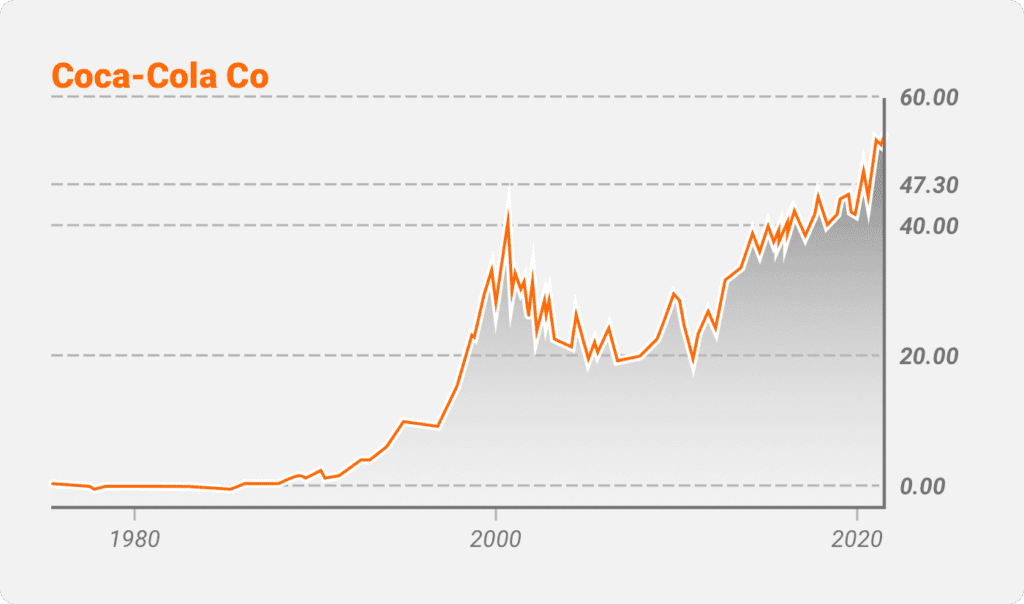

2. Coca-Cola (KO)

Often a staple among top brands, Coca-Cola has been one of the most popular companies in the non-alcoholic beverage industry. While revenue has been on the decline due to an increase in competition from other brands, the company still boasts a high return on equity. In the past, the company has grown by managing to acquire smaller brands and marketing them to increase revenues. Their robust supply chain also ensured that the company was able to enter new markets. The dividend income remains high, along with a tremendous rise in the share price.

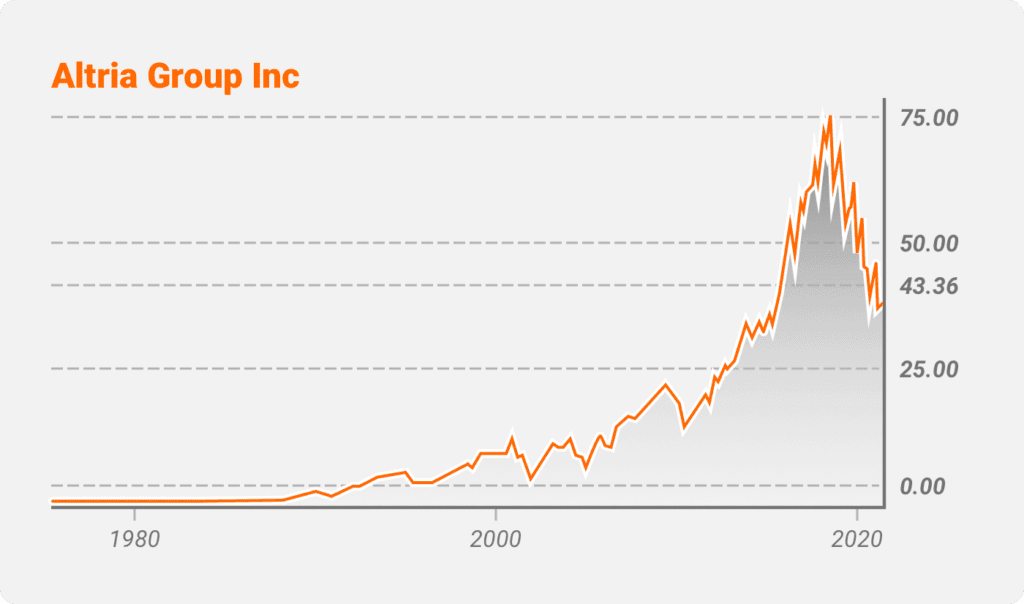

3. Altria Group Inc. (MO)

Earlier known as Philip Morris, Altria was formed in 2008 after the company separated its international business. The growth was more pronounced before the split, but Altria has managed to generate steady revenue income. Even despite the hit in profitability due to impairment charges on its latest acquisitions. The company should rebound back as the core business remains strong with good brand recognition. The dividend payout of the company, along with the growth rate of dividends, has been a noticeable factor. Even after existing in the sector for so many years, or maybe because of it, the current yield of the company is still significant enough for investors to consider it.

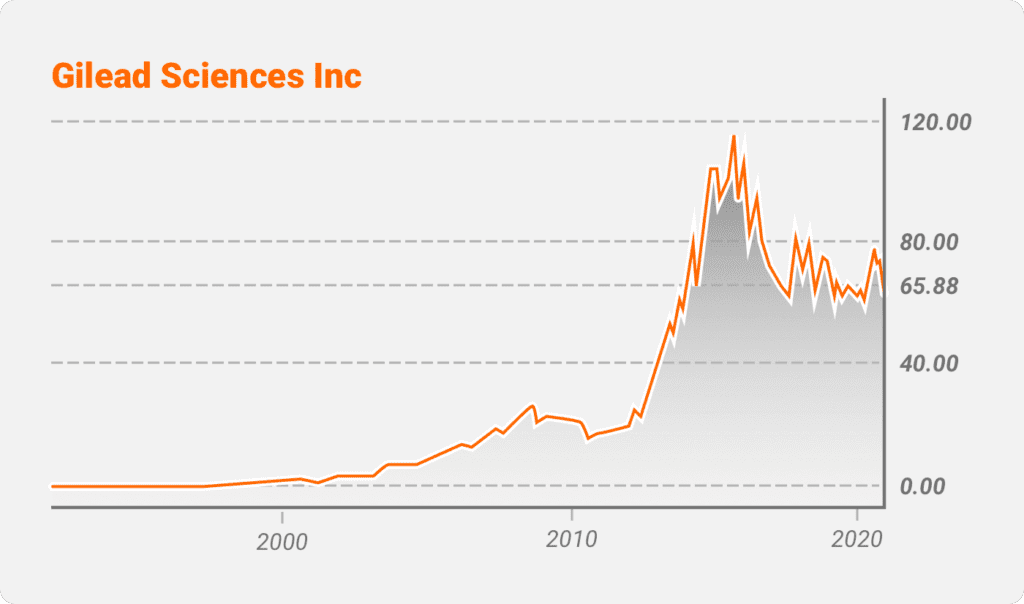

4. Gilead Sciences. (GILD)

Gilead Sciences is a pharmaceutical company founded three decades ago and has been in a continuous uptrend until 2015. It was its foray into retroviral drugs that made Gilead one of the biggest biotechnology firms in the world. The company has a strong line of products, some of which were obtained through acquisitions. Share prices have been volatile since 2015 as the company has been acquiring new companies to find another breakthrough. Dividend income has also been a substantial source of income for shareholders.

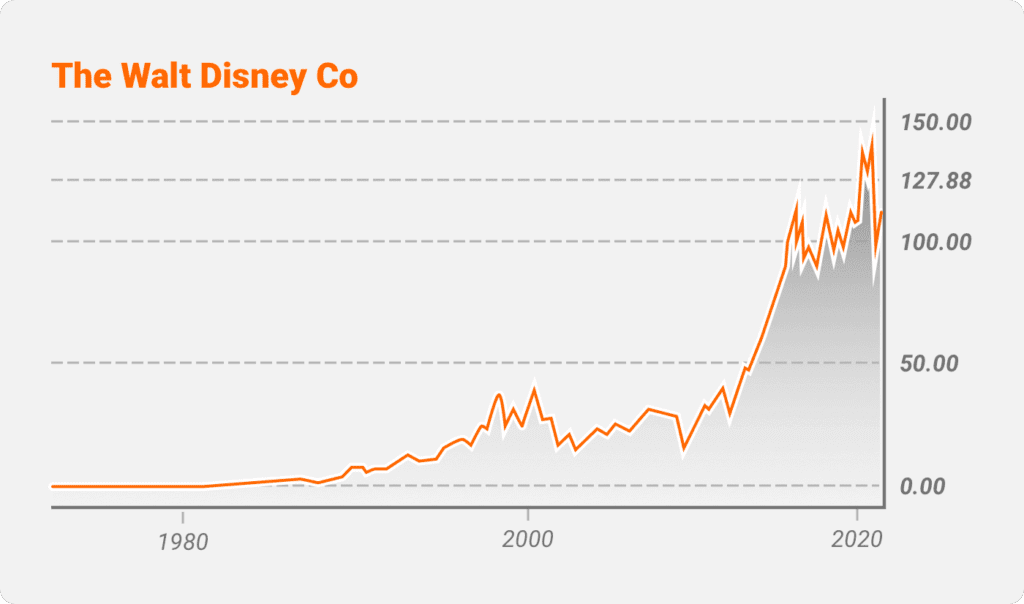

5. Walt Disney & Co. (DIS)

The leading entertainment company founded a studio in 1923, and there has been no looking back since then. Walt Disney has adapted to the changing landscape in the entertainment industry by making significant acquisitions in the last few decades. Some of these include Pixar, ABC, and Marvel. It now also provides online content, which could sustain its revenue going forward. While its income looks relatively moderate, they have a healthy balance sheet that helps the profits they give out in dividends.

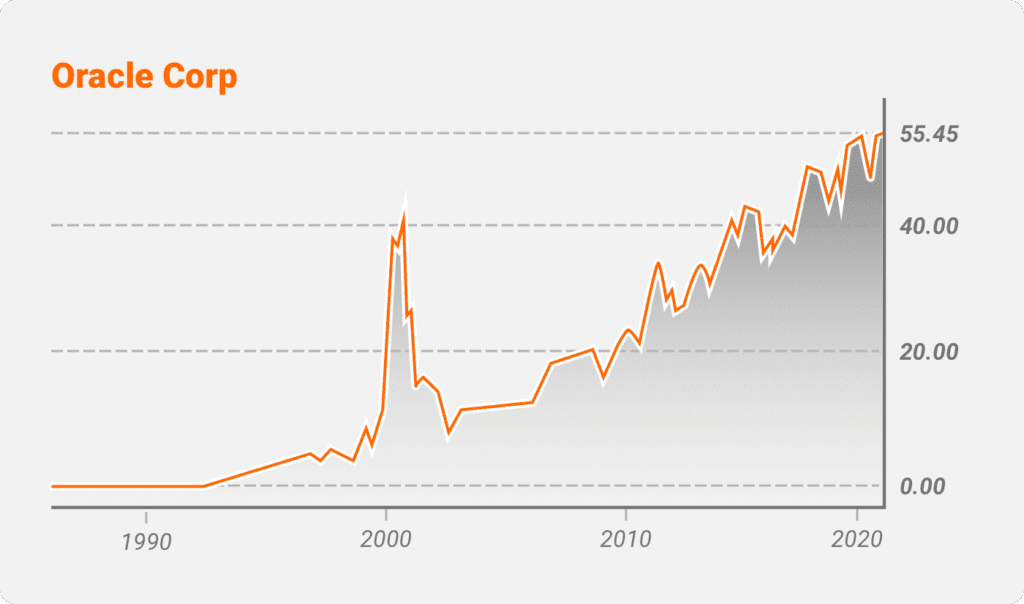

6. Oracle Corp. (ORCL)

Oracle focuses on enterprise-level technology. The company first went public in 1986. Stock price initially rode the technology bubble during the late 1990s but retraced back to earlier levels. Since then, it has been steadily climbing upwards as the company has continued to develop new technologies with time. Currently, it is banking on its cloud-based platform to generate revenues. Many investors generally value the company higher than its peers in the technology space.

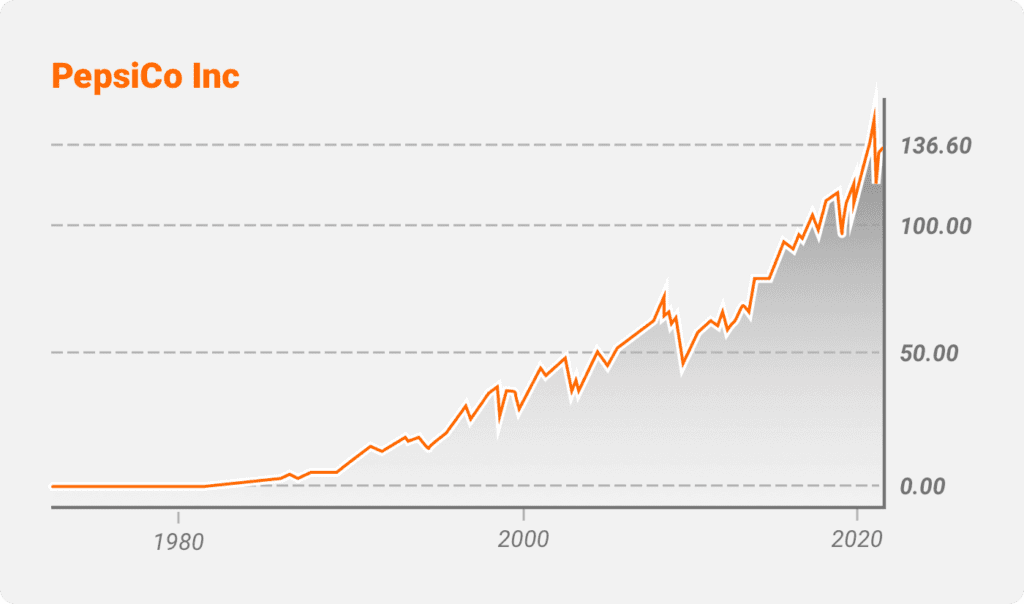

7. PepsiCo (PEP)

This list features another major player in the non-alcoholic beverage space, and it is none other than PepsiCo. The company has been able to dole out dividends that have been growing consistently for decades. While the sale of carbonated beverages has been under some pressure, PepsiCo has been expanding its product offerings. Some of the popular products offered by this brand are Lays chips, Gatorade energy drink, Aquafina water, and Tropicana fruit juice. The range of products PepsiCo provides is actually broader than that of the Coca-Cola company.

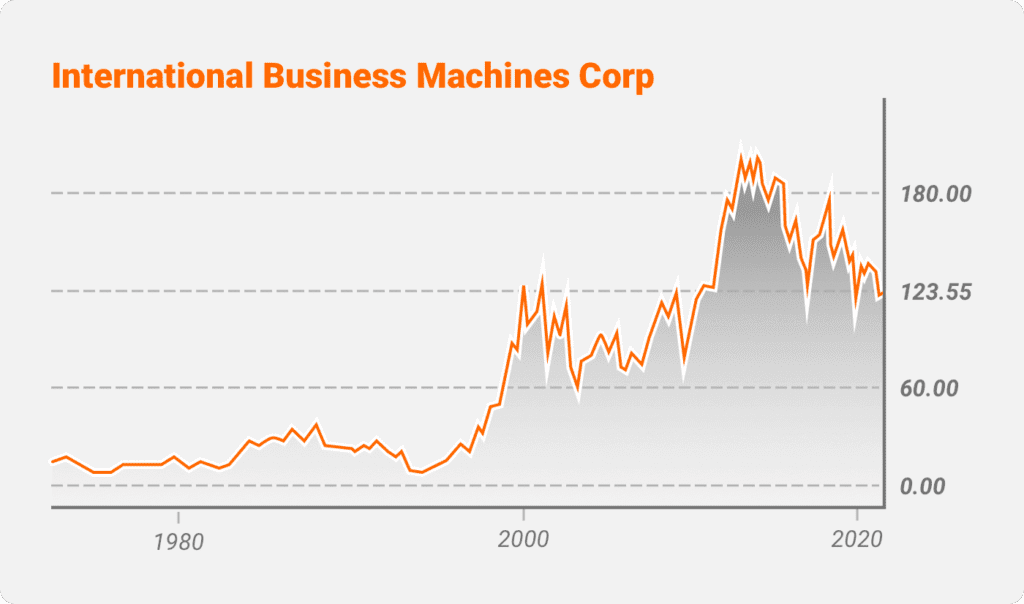

8. International Business Machines Corporation (IBM)

IBM has been operating for quite a few decades and faces tough competition in its cloud business from players like Google and Amazon. It was a pioneer in the last century, offering both hardware and software technologies. It has been able to weather the storm, and its returns to shareholders have been quite generous. The dividend has been growing at a consistent rate over the past few years, but the share price has not increased significantly compared to its peers.

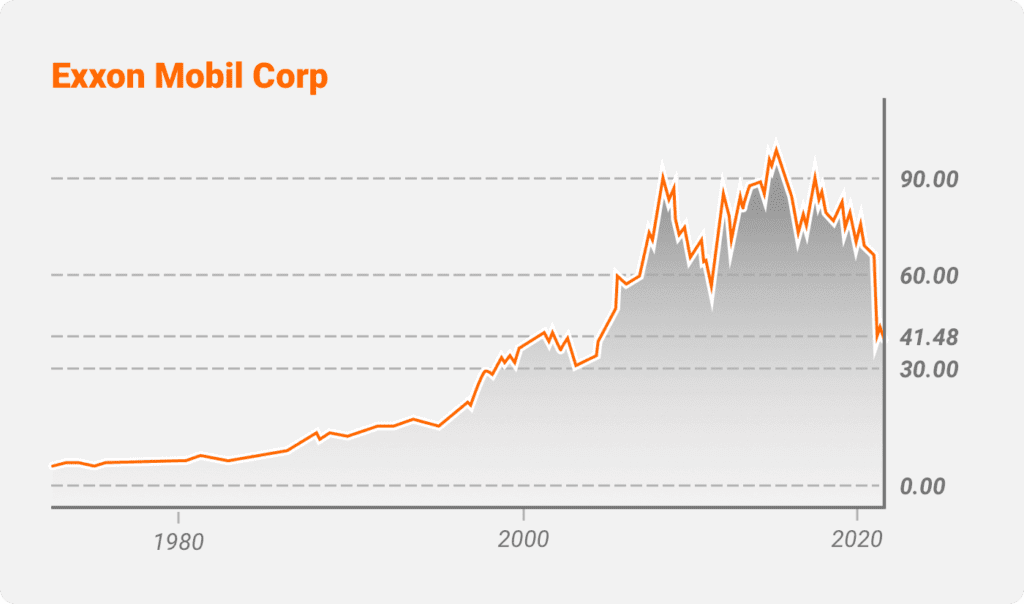

9. ExxonMobil (XOM)

Exxon is one of those old horses that has created a significant amount of wealth for its shareholders over several decades. The stock was characterized by a reliable and growing dividend payment for a really long time. Even so, there has been significant downward pressure on its price. The sustainability of crude is also under threat. The company has been able to ride over many shocks, but it will be interesting to see how (or if) it manages to turn the tide in its favor in the future.

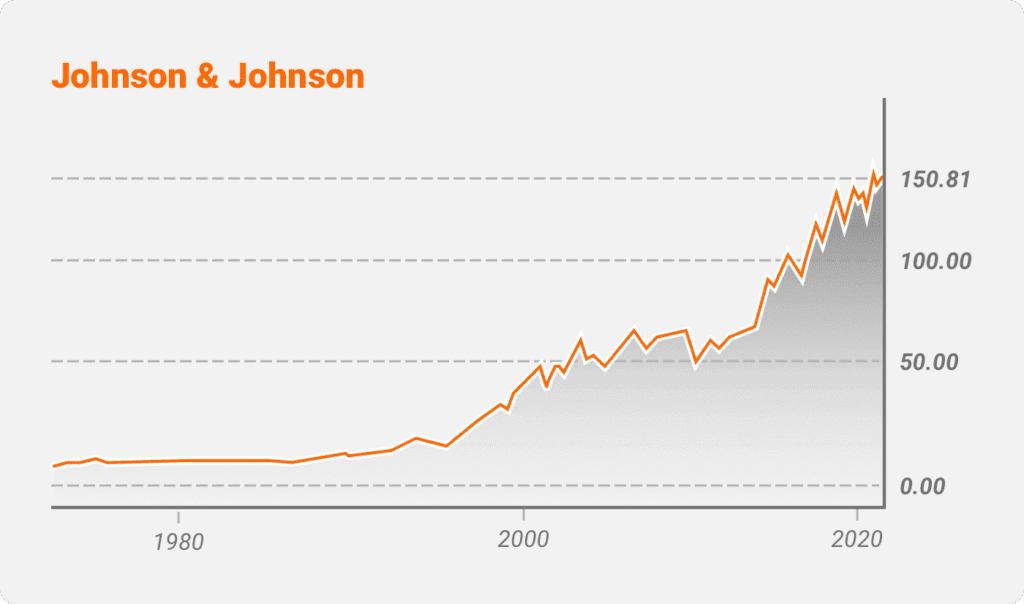

10. Johnson & Johnson (JNJ)

Johnson & Johnson has a diversified portfolio in the healthcare segment. Its product offerings include baby care products, over the counter medicines, oral care products, and other beauty products. Compared to other age-old names in this list, their volatility has been relatively low due to the broad range of products they offer. It is also a name that isn’t expected to become redundant any time soon owing to the prominence of its products. Cash payments to stock holders have also been growing steadily over all these years.

Top 5 Best-Performing Stocks in the last 20 years

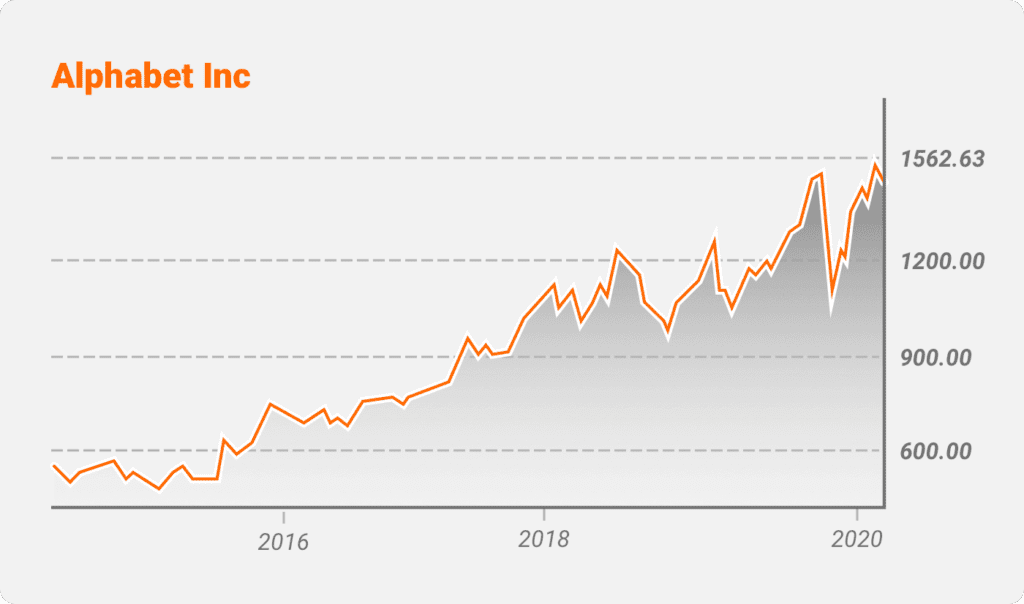

1. Alphabet (GOOG)

The parent company of Google has been one of the best-performing stocks in the technology sector. Some of their products, like Ads, Android, Chrome, Google Cloud, Google Maps, and Google Play, have a massive customer base across regions. While the company does not distribute dividends, the return on equity is exceptionally high. The company is continuously evolving and venturing into new businesses like payment channels to bolster its growth. While data laws across countries have been highly regulated, the company has been able to gain the confidence of the lawmakers for the time being. This is another good sign for their future.

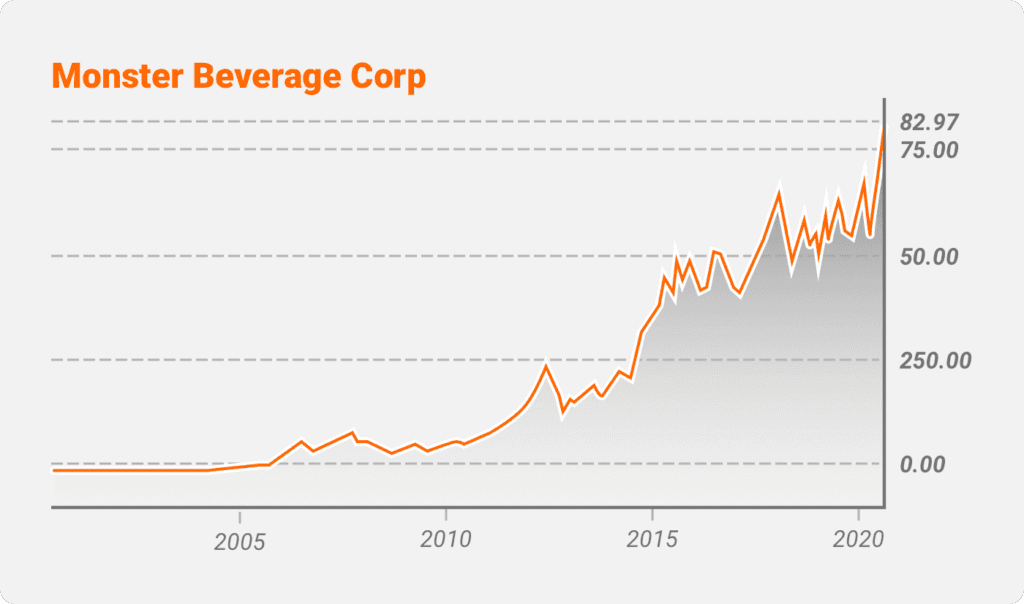

2. Monster Beverage Corp (MNST)

Monster has been a leading brand in the last couple of decades after launching its energy drink. Their sales grew exponentially, and many people attribute the success of the brand to an aggressive marketing campaign. While its range of products may not be as diverse as PepsiCo, Monster has been able to effectively establish itself to its customers as a leading brand in the much narrower energy drink sector. Profitability continues to be high, and the return offered to shareholders is also positive.

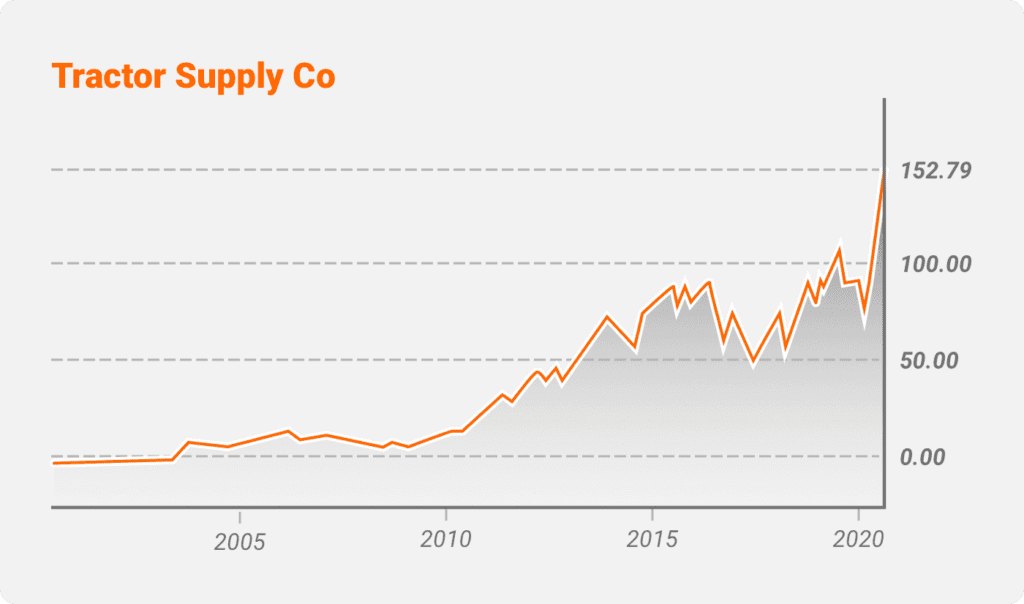

3. Tractor Supply Co. (TSCO)

Tractor Supply runs a unique business, offering different products to people seeking to pursue farming as a recreational activity. Considering their growth in revenue and the rise in their stock price over the past years, it is possible that their stocks still haven’t reached their full value. While yields on the stock have been moderate, the price has grown at a very high rate. As people embrace farming as an activity, we expect the price of this share may rise further.

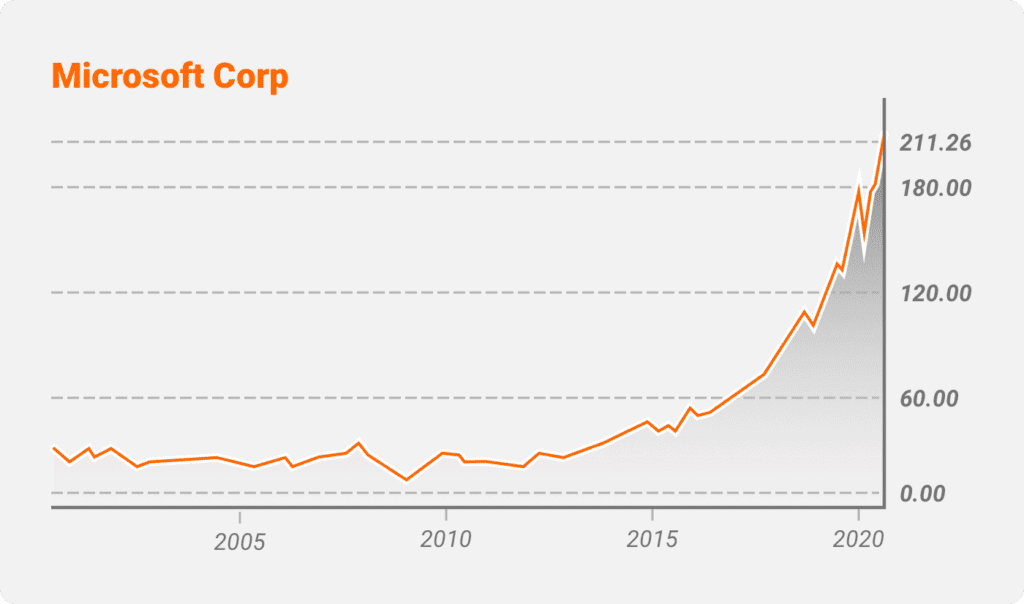

4. Microsoft (MSFT)

Microsoft is another giant in the technology space that has been a treat to its shareholders. It was founded in 1975, and it gained popularity after launching the Windows operating system. Its software is used by both enterprises and individuals. Unlike many other fast-growing technology firms, Microsoft does distribute dividends to its shareholders. It is one of those shares that have been continuously growing as the company diversifies its revenue stream into other territories like gaming, cloud services, hardware, and consulting. It has faced tough competition from peers like Apple, but the company has risen above these challenges.

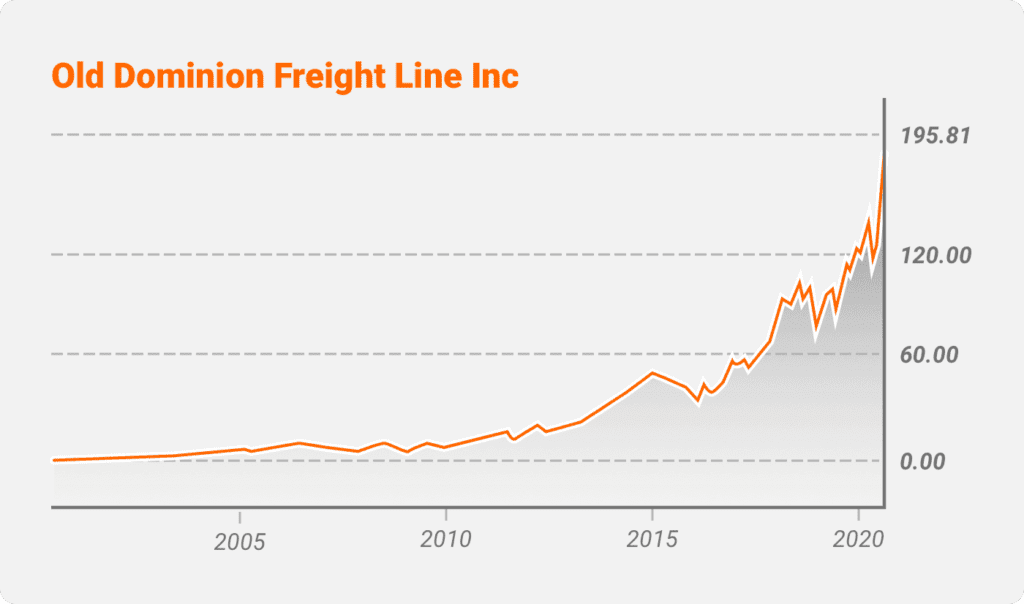

5. Old Dominion Freight Lines Inc (ODFL)

Founded in 1934, Old Dominion Freight Line operates as a very efficient trucking company in the “less than truckload (LTL)” space. While most companies have brought about changes in their business to drum up more business, Old Dominion focuses on the efficiency of its existing model to generate high income. It has improved on its on-time delivery ratio and has managed to cut down on costs. The company has also ventured into supply chain consultancy to capitalize on the experience gained over all these years.

Conclusion

While we have seen companies across different sectors do well since their inception, technology giants have performed exceptionally well in the last twenty years. The ability of these companies to innovate and identify new revenue streams has kept their businesses thriving. In the face of multiple recessions in these times, the companies in the above list have managed to innovate and adapt their ways into new markets, new technologies, and take advantage of the modern economies created. This is what makes them some of the best-performing stocks in the market. It will be interesting to see what happens in the next 20 years.