Today, there is an abundance of trading journal options available. As a result, newer traders, knowing that they need a journal, end up gripped by paralysis of analysis and often struggle with finding which software has the best features for their trading style or even what functionalities to look for in such a solution. However, one thing is sure – you need a journal to be successful as a trader. To help you find the best trading journal solution, we’ll look at some of the most suitable options available today and their pros and cons. Furthermore, we’ll explain how to build a trading journal through Microsoft Excel.

What’s a Trading Journal?

If you haven’t read our article dedicated to trading journals, don’t worry – we’ll recap the details quickly.

In short, a trading journal is a record of your trades over time that you can look back to and analyze. You can keep those records manually, but the technique is time-consuming and lacks automated statistical and analytical tools. That is why most traders prefer ready-made solutions.

Trading journals can help you in two ways:

- Strategic management: Building a no-nonsense record of trades you execute under a strategy is critical in analyzing whether the technique works. It’s hard to remember all the trades you execute daily, let alone those from months ago. A trading journal acts as a memory bank to help you analyze your trade history and nail down the variables that impact your strategy.

- Emotions management: Keeping a cool head is mandatory for all traders, and a trading journal helps manage emotions. By plotting your strategy on paper (metaphorically) and keeping yourself accountable, you can short-circuit the lizard part of your brain that might panic and blow a trade.

Now, let’s dive into the different trading journal options and their pros and cons.

Journalytix

Journalytix is one of the top options for futures traders needing excellent analytical capabilities. Available free during your Earn2Trade subscription, Journalytix’s base rate is $47 monthly or $399 annually. For prop firms or teams, Journalytix offers an enhanced option priced according to their needs.

Journalytix covers the full suite of tradable assets: forex, futures, stocks, CFDs, and crypto trade logs are all available on the platform. Furthermore, there is an AI-driven real-time trading assistant. The tool monitors your day trades and helps identify misalignment with your strategy or trading goals. This can help you stay on track and avoid letting your emotions get over you after a losing trade.

Journalytix also gives traders real-time news updates and breaking information as it unfolds, 24 hours a day. Since many traders optimize screen real estate and there’s precious little to spare, Journalytix also offers an audio news feed to avoid sacrificing space. The news feed pulls from over 75 sources, including Bloomberg, CNBC, Zerohedge, Zacks, and more – this bundle, bought separately, would far exceed the Journalytix subscription price. Access to this comprehensive feed alone is worth the cost of entry.

Finally, one of Journalytix’s shining strengths is its analytics dashboard. The tool helps traders dive into the tiniest details of the day’s trading activity and pick out the crucial moments they may otherwise miss when analyzing the day. This level of detail is beneficial for finding good trading opportunities.

Data can be categorized and analyzed in many ways, but the most popular Journalytix offerings are:

- Trade distribution by the hour or day of the week.

- Performance by the hour or by day.

- Distribution and performance by account, trade type, asset, and more.

- Statistics that include average holding times, profit factor, average P&L, and more.

- Backtesting and AI-driven “what if” scenario assessments.

Journalytix Advantages and Disadvantages

Advantages

- AI-driven real-time execution assist

- User-friendly intelligent analytics interface

- Real-time news updates

Disadvantages

- The blog and educational resource section is lacking and hasn’t been updated since 2019.

Edgewonk

Edgewonk is both a trading journal platform and a comprehensive educational resource. For users from countries outside of the European Union, it costs a flat $169 annual fee, while VAT inclusion makes EU pricing slightly steeper:

Edgewonk offers journaling and logging tools for all major markets, including forex, stocks, futures, CFDs, crypto, and commodities. Edgewonk is unique because it adds a “gamification” element to trading. If you need extra motivation, you can set your sights on preprogrammed milestones and trophies and snag them as you progress in your trading journey.

Edgewonk’s AI testing tools are also robust. The software offers both strategic backtesting and future account projections based on your trading strategy. You can even input trades you chose not to take and see how they would have performed if you had – all three of these intelligent, AI-driven trading projection tools help refine your strategy. Rather than simply showing you what happened, Edgewonk shows what might have happened and what could happen.

Edgewonk’s website also boasts a free, robust blog section to educate traders on markets, trading strategies, and the platform itself. A comprehensive help center guides users toward setting up, understanding, and optimizing their use of Edgewonk’s trading journal.

Edgewonk Advantages and Disadvantages

Advantages

- Advanced AI forecasting tools and trophy system

Disadvantages

- Pricing may be confusing for EU traders.

Trademetria

While lacking some of the forecasting features of other trading journals, Trademetria excels at diving deeper into the data and statistics underlying existing trades. This makes it suitable for both – advanced and beginner traders.

Trademetria offers three pricing tiers. All of them support the same assets but vary in order quantity and some other key features:

- Free – capped at 30 orders monthly, the free option is best for users who want to experience Trademetria without committing, as 30 orders are far too few for an active trader but are sufficient to understand the “nuts and bolts” of the journal.

- Basic – $29.95/month: the basic version lets traders import up to 100 monthly orders, which may be insufficient for very active traders. The basic version, however, does unlock additional tools that are unavailable to free users, including:

- P%L simulations

- Distributions

- Strategy rankings

- Watchlists

- Trade exports

- And more

- Pro – $39.95: finally, the pro-option comes with all the basic version features but gives users unlimited order imports and the ability to track as many as 50 accounts (compared to the basic and free versions, which cap accounts at one).

Some of the most popular analytical tools that Trademetria offers include:

- Pattern analysis

- Strategy analysis

- Profitability by asset class

- Timing of the most successful trades

- Period overview and comparison between periods, i.e., month-to-month comparisons.

- Note-taking targeting emotional management and mistakes to capture the moment as it happens for future reflection.

Trademetria Advantages and Disadvantages

Advantages

- Detailed analytics for past trades to inform future strategies.

Disadvantages

- Fewer forecasting tools than other platforms.

Tradervue

Tradervue offers fewer tradable asset options, limiting users to stocks, options, futures, and forex but makes up for this via a robust community. As much a social media site as a trading journal, the limited asset options, and group discussion make the platform ideal for newer traders who may need fewer features than advanced traders who manage diverse portfolios.

Tradervue’s tiers (free, $29/month, and $49/month) differ primarily in the available analytics tools. The Silver and Gold tiers let traders input unlimited monthly trades, while the free version restricts inputs to 30 monthly. The primary difference between Silver and Gold is that the latter gives you access to the following:

- Risk reporting features

- Exit analysis

- Support for commission and fee import

- Liquidity reporting

The paid tiers can have a 7-day trial period, so traders can explore the full functionality of each and compare their features.

In addition to quality analytics, Tradervue boasts a community where users can share trades and analytics, and discuss what’s happening in the market. That way, newer traders can learn from more experienced peers. The best part? The community is accessible to all tiers.

Tradervue Advantages and Disadvantages

Advantages

- Advanced community lets users interact and help each other.

Disadvantages

- Fewer supported asset classes than other platforms.

Tradersync

Tradersync, free for seven days, is one of the most popular options for digital nomads as their mobile app functionality is second-to-none. Also boasting a comprehensive tutorial section, Tradersync brings together some of the most popular analytics and forecasting features for traders of all skill levels. Offering tiers at (per month) $29.956, $49.95, and $79.95, the priciest option unlocks access to advanced AI tools. However, all options offer app functionality and can be tested with a free trial.

Since Tradersync offers many standard baseline analytics for stocks, options, futures, futures options, and crypto, we’ll look primarily at the premium-tier AI selection. After assessing your strategy over time through machine learning models, Tradersync calculates each trade individually and as part of the overall strategy. Then it identifies patterns you may have missed and showcases its assessment results in an intuitive dashboard.

Furthermore, Tradersync offers a comprehensive and advanced simulator that drills down into each “could have” or “what if” you can imagine, showing you the actual performance compared to your simulated performance. This feature is a great way to test or tweak strategies in a low-threat, low-risk environment without risking your cash.

One of the few with a mobile app, Tradersync’s Apple and Android apps give traders the platform’s full functionality in an equally intuitive format that doesn’t suffer at all from mobile migration. Tradersync lets users import data from more than 240 brokers.

For each Tradersync feature, the platform offers a detailed breakdown of what it is and how traders can use it in their extensive tutorial library. For visual learners, Tradersync provides video tutorials to follow along with.

Tradersync Advantages and Disadvantages

Advantages

- Mobile functionality and advanced AI tools.

Disadvantages

- AI features are only available at the priciest tier.

Microsoft Excel (Building Your Own Journal)

For users who need a highly customized experience or want to try building their journal, Microsoft Excel is the best program. Basic literacy with the program lets traders comprehensively log and chart their trade history and draw deep analytical insight from the data.

While this section mentions Microsoft Excel specifically, you can also consider Google Sheets or OpenOffice as viable alternatives. For more details on how to use Exel for your trading journal, you can check out our other article.

That said, your Excel-based trading journal is only limited by your capabilities and strategy. Because of the high degree of variability, there isn’t often a one-size-fits-all solution for traders developing an Excel trading journal. We’ll look at some core tenets you might want to include in a journal, but ultimately your variables and inputs are dictated by your mentality, methodology, and strategy. Below are a few examples of what you can do with Excel, but the experience can be endlessly customized to the individual. Still, the core fundamentals apply to most asset classes, including crypto, futures, and similar equities.

Basic inputs with an Excel trading journal usually include:

- Date: lets the trader track progression over time.

- Ticker: the trader must know what he’s trading, so having the ticker or asset name is critical.

- Previous close, pre-market high, and after-hours change percentage: because the gap strategy relies on big moves outside market hours, these variables help the trader see what minimum or range of percentage change is best. He can also track what stock price range works best, i.e., whether small caps like IONQ outperforms blue chips like AAPL or MSFT.

- Long/short: the trader’s signals include whether to go long or short the stock.

- Entry, time, stop-loss, and exit: these are mandatory in a journal, no matter the strategy or asset class.

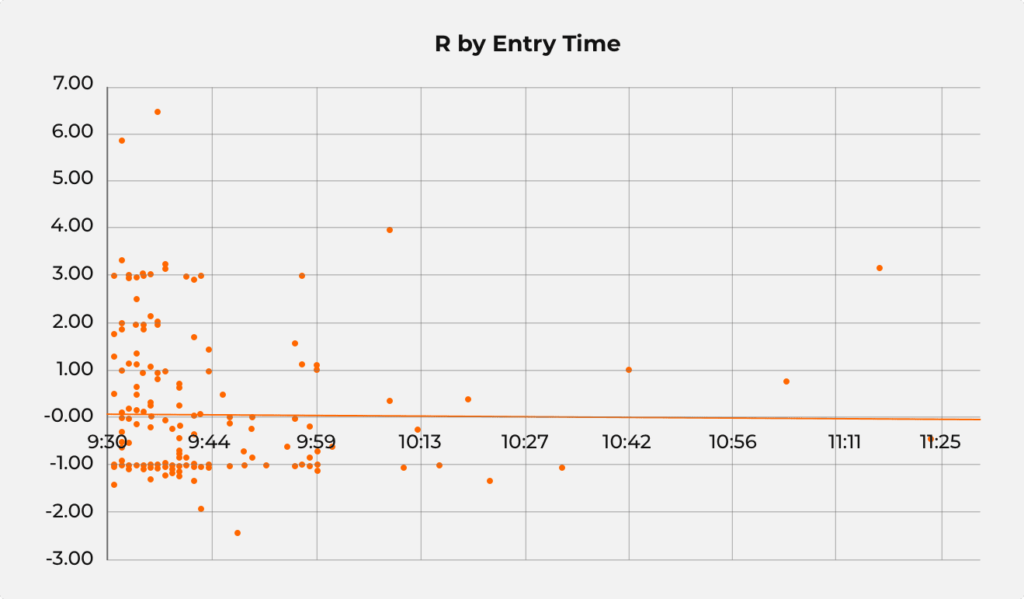

- R: this trader, rather than assessing trades based on strict P&L, determines success as a function of units of risk R. The mechanics of using risk units to evaluate performance are beyond the scope of this article. Still, units of risk are more objective and scale better than dollar value as risk units stay the same while profit and loss totals scale.

|

DATE |

Ticker |

ATR |

Prev. Close |

PM High |

AH Change |

Type |

Entry |

Entry Time |

SL |

Exit |

R |

| OCT.28.21 | |||||||||||

| LCID | $1.63 | $27.01 | $28.60 | 6% | Long | $28.923 | 9:37 | $28.60 | $29.561 | 1.98 | |

| F | $0.48 | $15.53 | $17.24 | 11% | Long | $17.549 | 9:43 | $17.24 | $17.230 | -1.03 | |

| BUD | $0.91 | $57.21 | $63.80 | 12% | Long | $64.068 | 10:23 | $63.82 | $63.740 | -1.32 | |

| OCT.29.21 | |||||||||||

| LCID | $2.43 | $35.44 | $38.78 | 9% | Long | $39.680 | 9:37 | $38.79 | $40.430 | 0.84 | |

| LCID | $2.43 | $35.44 | $38.78 | 9% | Long | $40.363 | 9:38 | $39.52 | $39.500 | -1.02 | |

| X | $1.11 | $23.43 | $26.19 | 12% | Long | $26.728 | 9:37 | $26.21 | $26.220 | -0.98 | |

| LCID | $2.43 | $35.44 | $38.78 | 9% | Long | $37.739 | 10:33 | $36.96 | $36.910 | -1.06 | |

| X | $1.11 | $23.43 | $26.19 | 12% | Long | $26.508 | 10:42 | $26.26 | $26.760 | 1.02 | |

Traders with Excel journals also typically use formulas to automate some of the analytics. You can even capture images and generate charts in Excel, so the program has much of the same functionality as other options.

Excel Advantages and Disadvantages

Advantages

- Highly customizable to trader needs

Disadvantages

- Lacks automatic forecasting features; traders can only analyze past trades and must draw their own conclusions.

Top Five Best Trading Journal Comparison

Features Comparison

| Journal | Features |

| Journalytix | Execution assist, intelligent data analytics, real-time news updates |

| Edgewonk | Advanced AI forecasting tools |

| Trademetria | Detailed analytics for past trades to inform future strategies |

| Tradervue | Advanced community lets users collaborate |

| Tradersync | Mobile functionality and advanced AI tools |

| Excel | Highly customizable and accessible |

Costs Comparison

| Journal | Features |

| Journalytix | $47 (monthly) or $399 (annually) |

| Edgewonk | $169 annually (outside of the European Union) |

| Trademetria | Free (basic), $29.985 – $39.95 monthly |

| Tradervue | Free (basic), $29 – $49 monthly |

| Tradersync | 29.956, $49.95, and $79.95 monthly |

| Excel | Free (if you have the Microsoft Office suite) |

Which one is the Best Trading Journal?

No matter which solution you decide to go with, maintaining a journal is mandatory for any serious trader. Key factors in selecting the right one for you include your experience level, strategy, and which of the many analytical or forecasting tools you need in your toolkit. Whether you need an affordable option like Tradervue or the full suite of analytical and trading assist tools of Journalytix – having a reliable, objective, and data-focused journal is one of the cornerstones your trading career rests upon. Ultimately, one of the most important factors to consider are familiarity and ease of use. Journalytix is included in your Earn2Trade subscription, so we highly encourage traders to give it a try; you might find yourself hooked and want to keep using it after you pass your funding evaluation.