Due to the specifics of the asset class and the high-profit potential, options trading often seems like a tempting opportunity for beginners. Many jump into it with а very limited understanding of how things work. However, for many of them this turns out to be a major mistake. Options trading is very complex and requires experience as well as a specific set of skills. In this article, we will shed light on the bull spread, one of the popular strategies professionals’ prefer to use. We’ll also reveal how you can use it to optimize your performance and capitalize on options trading’s potential.

Table of Contents:

- What is a Bull Spread?

- The Bull Call Spread

- The Bull Put Spread

- Advantages and Disadvantages of Bull Spreads

- How to Calculate your Profits and Losses

- Bull Put Spread vs Bull Call Spread

- FAQ

What is a Bull Spread?

The bull spread is a trading strategy used by options traders when they expect a rise in the price of the underlying asset and want to capitalize on it. The strategy involves the trader simultaneously buying and selling either call or put options that have the same expiration dates and underlying asset, but differ in their strike price. The idea behind strategy is to buy the option with the lower strike price and sell the one with a higher strike price.

Depending on the type of options, the strategy has two variations. The strategy that uses put options is known as a bull put spread, while the one that uses call options is known as a bull call spread. The core difference is rooted in the timing of the cash flows.

Don’t get surprised if you hear some people refer to these strategies as “debit call spread” or “credit put spread”. The idea is that once you open the trade, you basically generate a net debt/gain to the account. The reason for it is that the cost of the purchase is higher/lower than that of the option sold. However, this is just another way name for the same strategy, so it essentially makes no difference.

You might also enjoy:

- Heiken Ashi – Candles, Trading Strategies, Charts, and Tips

- Aroon Indicator – How to use it? Definition, Formula and Settings

How The Bull Spread Works

As its name suggests, for the bull spread to work, there should be a “spread” and an upcoming upwards market movement. The strategy works through simultaneous buying and selling of a put/call option in a bid to profit from the difference in their strike prices.

Bull Call Spread

The bull call spread strategy, for example, requires the trader to place a call option with a higher strike price than the one of the current long calls market. To make it work, the trader should simultaneously buy and sell a call option with the same expiration date (i.e., a short call). He then gets a premium that is enough to cover a part of the costs for the first long call.

In the end, the investor profits from the difference (AKA spread) between the strike prices of the long and short options minus their net costs. The maximum loss that he is potentially exposed to is capped at the premium he paid for the options.

Bull Put Spread

The bull put spread, also known as “credit put spread”, on the other hand, requires the trader to write a put option with a higher strike price than the one of the long call options. When the trader applies the strategy, they at first generate credit to their account, since the option that they purchased usually costs less than the sold one.

They pay and get paid a premium for the whole thing. The premium the trader pays is for the purchase of the put option. Meanwhile the premium they receive is for selling it at a higher strike price.

So, what is the maximum profit a trader can earn when applying this strategy? It equals the difference between the premium they paid and the premium they received for the traded put options. In this case, the loss is capped to the difference between both strike prices minus the credit received initially.

The Bull Call Spread

The long call spread or bull call spread as it is more popularly known, is applied when the trader expects a moderate increase in the price of the traded instrument.

The strategy involves purchasing an in-the-money (long call) option with a lower strike price and selling an out-of-the-money (short call) option with a higher strike price, both with identical expiration dates.

When using the bull call spread strategy, the trader makes an upfront payment for acquiring both instruments. This means he makes an initial investment that he hopes will turn out profitable once the instruments expire.

As the underlying security’s price starts growing, so does the bull call spread’s profitability. The profit grows to the level of the short call option’s strike price. However, if the instrument’s price surpasses it, the gains don’t follow. It remains capped, so the trader knows exactly how much he is going to potentially earn right from the very start.

The case is quite the same when it comes to losses. If the trader mistakes the upcoming trend and the price of the underlying instrument starts falling, he would incur losses. No matter how low the price drops, his losses won’t exceed the long call option’s strike price.

The Bull Call Spread Example

Let’s assume you are interested in a call option for XYZ stock. You buy it on June 15 when it trades at $190 and at a strike price of $200. You pay $5 per contract.

Simultaneously, you sell one XYZ call option at a strike price of $210 and receive $2.5 per contract. The net cost to create this spread is $2.5 (multiplied by the contract’s size, let’s say 100, it equals $250 premium or net cost).

Now, if XYZ falls below the strike price of $200, both of your options will expire worthless and you will lose the premium paid (the net cost of $2.5 per contract).

If the XYZ stock hits $211, however, the value of your $200 call option would rise by $10, while the value of the $210 call would remain $1. Any additional profits in the $200 call are basically forfeited. Your total profit on both call options would equal $9 ($10 gain – $1 net cost) per contract.

Or in other words, even if the stock hits $100, your maximum loss is $1 per contract. Even if it hits $300, however, all you will earn is $9 per contract.

The Bull Call Spread Strategy

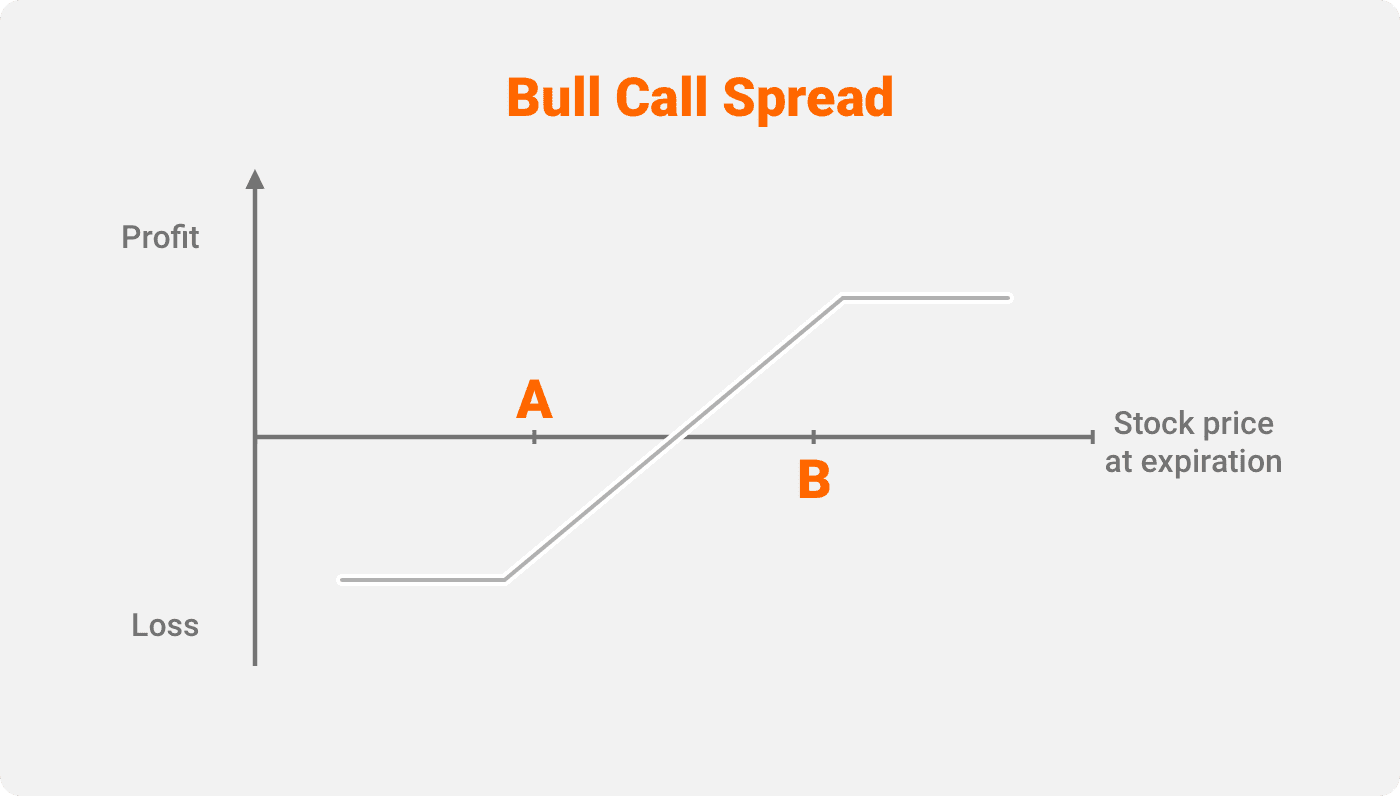

As an example, let’s use the buy and sell call options with the strike prices depicted by the points A and B on the image below. Your potential profit will be limited to the difference between both strike prices minus the premium paid. The loss is limited to just the amount of the premium.

A long call spread increases in value the closer it gets to its expiration point. The ultimate goal is for the stock to be at or above point B at expiration. However, judging by the previous example, you shouldn’t be concerned about how far off from the points A and B it is, since it won’t matter for the size of your gains or losses.

When applying the strategy, it is worth noting that the investor should be confident that the market is about to rise. Otherwise, in case the market turns against you. Even if the losses are capped, your portfolio can quickly wipe out a big part of its value, when trading in large quantities.

It is also worth bearing in mind the implied volatility effect. Although you are both buying and selling and it may be neutralized to some degree, it still concerns you. In the case that the stock price rises above strike price B, your ideal scenario is for the implied volatility to decrease. On the other hand, once the stock’s price gets close to or below point A, your best-case scenario is for the implied volatility to increase.

Due to its complexity, the bull spread option strategy is intended only for veterans or professionals.

The Bull Put Spread

The bull put spread, or long put spread as it is also referred to, is useful when the trader expects upcoming bullish price moves (usually a moderate increase). To capitalize on them, the trader buys and sells two put options – one with a higher and one with a lower strike price (both have equal expiration dates). Once he does that, he receives an initial credit, based on the difference between both premiums.

When applying the bull put spread, the trader collects money upfront. His goal is to hold on to as much of it as possible once the option expires. Or, in other words, to conserve a bigger part of his initial profit.

When trading bull put spreads, the maximum potential profit is equal to the net credit. This means the moment the trader applies the strategy, he basically earns the maximum profit. His next goal is not to let it slip. To avoid that and capture the maximum profit, the price of the underlying instrument should close above the higher strike price at the expiration date.

On the other hand, the trader starts losing money when the instrument’s price is below the higher strike price. The reason is that the holder of the put option will most likely exercise it as the price will be very attractive. The good thing, however, is that the net credit the trader received at the start covers the losses in case there are moderate drops in the price of the underlying instrument.

Should the stock price fall way below the lower strike price, both put options start losing money. The maximum loss is equal to the difference between both strike prices and the net credit received upfront.

The Bull Put Spread Example

Let’s say you are interested in buying shares of Tesla (TSLA) because you expect a bullish scenario in the next month. Currently, the stock trades at $1 000 per share. To implement the bull call spread strategy, you should do two things: first of all, sell a put option with a strike price of $1050 for a premium of $15 with expiration due in one month. Next, you buy a put option with a $990 strike price and expiration in one month for a premium of $5.

Now you have earned your net credit of $10 (the difference between both premiums). Considering the fact that an option contract is equal to 100 shares, you have basically earned $1 000 with a single trade.

How to Keep Your Profits

So far, so good. But let’s see the conditions that should be met for you to hold on to the whole profit. Let’s not forget to also examine the maximum amount you could lose.

If Tesla’s stock starts surging and hits $1 200, for example, at expiry, you will be able to keep hold of the entire amount of the net credit you received initially ($1 000). Or in other words, the stock’s price should be trading above the upper strike price. However, as long as it is above that level, it doesn’t matter how much it grows with. That’s because your maximum profits are capped.

On the other hand, if the stock drops below the lower strike price, you will incur the maximum loss of $50 per contract (the difference between both put options, minus the premiums or simply: $1050 – $990 – $10. Multiply it by 100 (the number of shares), and the maximum loss for this particular trade equals $500.

The Bull Put Spread Strategy

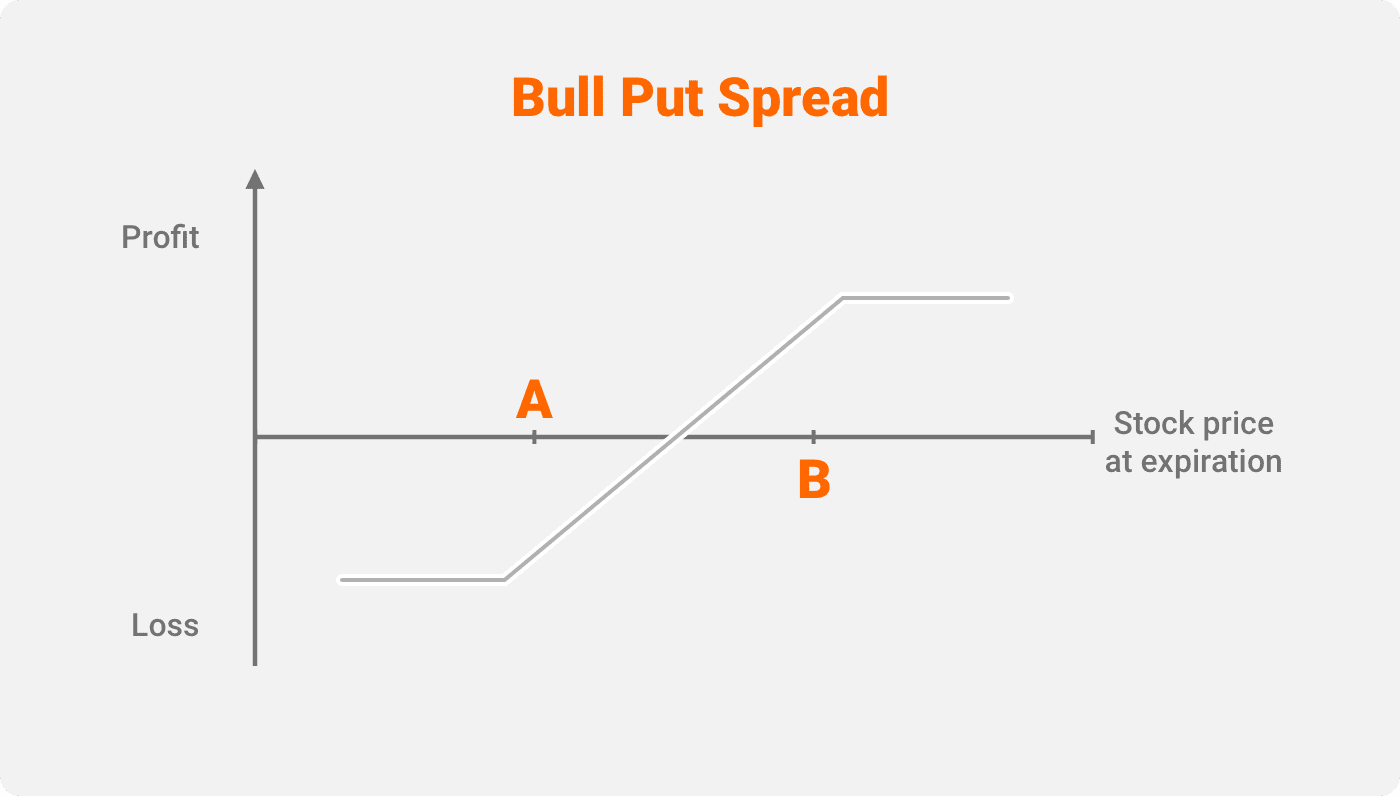

The bull put spread strategy’s potential is realized when the price of the underlying asset moves or remains above the higher strike price. That way, the sold option expires while losing its value, since no one will want to exercise an option at a price lower than the market one. In that case, the trader retains the entire credit he received initially.

What you do here is buy a put option at point A and sell one at point B. The ultimate goal is for the price to be soaring above point B so that the sold option isn’t exercised.

The risk here is limited to the difference between both strike prices (A and B). The case is similar for the profit too: it can’t exceed the initial net credit, so it practically doesn’t matter how much the underlying asset rises in value.

Similar to the bull call spread strategy, this one is also best left to be used only by professionals and seasoned veterans. Before using the strategy, you should get reliable confirmations that the market really is going bullish.

Advantages and Disadvantages of Bull Spreads

Let’s take a look at the pros and cons of the bull spread options trading strategy to help you find out whether it is suitable for your trading style, experience, and needs:

PROS

Limits the potential losses

The best thing about the strategy is that it won’t let your position enter a freefall. The maximum loss that you can incur is known initially. It is limited to the difference between the premium you pay and the premium you receive in the case of bull call spreads. In the case of the bull put spread, it’s the difference between the strike prices minus the net credit.

Applicable in the most popular market conditions

The strategy is typically used when the trader expects moderate increases in the price of the underlying asset. However, when it comes to financial markets, sudden and massive price surges or continuous drops are much less likely to occur than moderate and steady price increases. This means the strategy is usually in tune with the overall market environment.

Reduces the option-writing costs

When traders buy and sell options contracts (either put or call) simultaneously, they basically offset the writing costs as they both pay and receive a premium. However, for this to work effectively, it is essential that both options are comparable (have identical expiration dates and underlying assets).

CONS

Limits the gains

Bull spread strategies are a two-way street – while they limit the losses, they also put a cap on the maximum profits. In fact, profits are known right from the beginning. In the case of the bull put, they are limited to the difference between the premiums, while in the case of the bull call, the profits can go up to the strike price’s level.

Risk of the buyer exercising the option

US options can be exercised on any given day. This basically means that you, as a holder of a short option, are obliged to fulfill the requirement and don’t have any control over when it may happen. This means you are facing the risk of early assignment. If you aren’t prepared and don’t have sufficient equity in your account, you may face a margin call.

Bull call spreads, on the other hand, have the risk of time decay. In other words, a decrease in the price of the option as its expiration date approaches.

Suitable only for veterans

Bull spread strategies require an advanced understanding of options trading, which makes them a pretty risky choice for beginners. Although widely popular, they are used predominantly by industry veterans and professional traders. People who know their game and can manage all associated risks.

How to Calculate your Profits and Losses

The maximum profit for both the bull call spread and the bull put spread strategies is achieved once the price of the underlying asset closes at levels equal to or above the higher strike price.

The trader suffers the maximum loss for both strategies if the asset’s price closes below or at the lower strike price.

You can calculate the breakeven points of both strategies (before commissions) via the following formulas:

Breakeven Bull Call Spread = Lower Strike Price + Net Premium Paid

Breakeven Bull Put Spread = Higher Strike Price – Net Premium Received

Bull Put Spread vs Bull Call Spread

To get a clearer understanding of both strategies, let’s take a look at the following comparison table:

| Bull Call Spread | Bull Put Spread | |

|---|---|---|

| Strategy | Buy In-the-Money Call OptionSell Out-of-the-Money Call Option | Buy Out-of-the-Money Put OptionSell In-the-Money Put Option |

| Level | Advanced | Advanced |

| Expectations | Bullish – a moderate increase in the price of the underlying asset | Bullish – a moderate increase in the price of the underlying asset |

| Options Type | Call | Put |

| No. of Options Purchased | 2 | 2 |

| Losses | Limited | Limited |

| Gains | Limited | Limited |

| Breakeven | Lower strike price + premium paid | Higher strike price – premium received |

| Maximum Loss | = Net Premium Paid | = (Strike Price 1 – Strike Price 2) – Net Premium Received |

| Maximum Gain | = (Strike Price 1 – Strike Price 2) – Net Premium Paid | = Net Premium Received |

| Maximum Loss Scenario | Both options expired | Both options exercised |

| Maximum Gain Scenario | Both options exercised | Both options expired |

| Payment | Debit | Net credit |

FAQ

In the bull call spread scenario, you have already bought a call and sold a call option. To close them, you should sell to close the first one and then buy to close the second one. The perfect scenario is if you manage to secure your profits by closing the bull call spread before its expiration.

A practical example of how to determine profit from a bull spread is provided in the “Bull Put Spread Example” and the “Bull Call Spread Example” sections of this article. If you want to estimate the maximum profit, please refer to the table above.

Use the bull spread strategy when you expect the prices of the instruments you are interested in trading, to experience a moderate increase. Also, make sure to use it only if you have advanced understanding of options trading.