If you want to get the essence of the financial markets, the best thing to start with is the bull and bear market definitions. During the former, the price of an asset (or the whole market) is on the rise. The latter, on the other hand, describes situations where prices are going down. The names of both market conditions pay homage to the way these animals attack. When it comes to financial terminology, “bearish vs. bullish” is a phrase that has become just as popular as “day and night” or “good vs. bad” in our everyday lives.

What is a Bear Market?

A bear market is a declining market. This usually takes place during times when the economy is in recession and companies struggle. Although there isn’t a unified rule, according to theory, for the market to be declared bearish, price should drop by 20% or more from its recent highs. Price drops during descending markets are continuous and can last anywhere from a few days or weeks to months or even years.

There are two types of bear markets – cyclical and long-term. The former usually last no more than a couple of months. The latter, though, can continue for years or even decades. Beginners often mistake quick price drops for bear markets. In reality, they are just short periods of increased selling activity and prevalence of investors with pessimistic views. The difference is best understood by taking a look back in history.

Among the most devastating bear markets are the Great Depression (lasting 34 months and markets falling by 86.1%), the Dot-Com bubble (lasting 30 months and markets falling by 49.1%), and the Financial Crisis (lasting 17 months with losses of 56.4%). Among these, the Great Depression is the most painful as it erased 15% of the global GDP.

You might also enjoy:

- Weighted Moving Average – What is it and How to Calculate it?

- Parabolic SAR Indicator Settings and Strategies

How To Invest In A Bear Market

Bear markets are the worst fear of the majority of investors. However, this doesn’t mean that they don’t create opportunities, and you can’t make profits when the market is nose-diving. During the Financial Crisis of 2008, for example, John Paulson, a hedge fund manager, who will remain in history for his opportunistic views, made $15 billion in just a single year. How? He made a series of calculated bets that homeowners will default on their mortgages.

What this comes to show is that some instruments and strategies have proven to work well during descending markets. Here are some of them:

Gold

This precious metal has a negative correlation with bear markets. Gold is considered a safe-haven asset and many investors turn to it when the economy starts to struggle. Its value usually increases when the market goes down and vice-versa. Whether it is futures, bullions, digital coins, etc., gold is the go-to asset in times of economic stress.

Stocks

Aim for the high-quality ones – shares of companies with little debt, strong earnings, and steady revenues. You can also take into account the reason behind the bear market as it will help you find potential opportunities. During the COVID-19 pandemic, for example, the stocks of Netflix, Microsoft, Procter & Gamble, and biotech companies trying to find a vaccine or cures boomed.

Normally, in a bear market, the previous winners get hit the most.”

– Peter Oppenheimer, chief global equity strategist at Goldman Sachs

ETFs

You can consider sector-specific ETFs. If, for example, the recession hits hard and companies start cutting costs by decreasing their staff, a likely scenario is that they would invest in technology. You can consider ETFs on tech indices. Thanks to financial engineering, today we also have inverse ETFs. Their value increases when one of the markets goes down.

What is a Bull Market?

A bull market is a market that is on the rise. During such times, the economy is usually sound, the global political stage is calm, companies innovate, sectors flourish, and people have more disposable income. Bullish markets are investors’ dreams as they are easier to navigate (less volatile) and provide favorable profit opportunities. This type of market condition is characterized by optimism and confidence. Positive market rallies are the easiest ways for beginners to make money, and also a hard benchmark for active fund managers to compete with.

There are no specific metrics to define when we are entering a bull market. However, there is one key condition that should be met – the prices of the certain asset or the whole market should be ascending for an extended period of time instead of just marking a price jump that lasts a couple of days. Bullish markets come to an end when the asset experiences a price drop of 20% or more.

There have been several notable bull markets in our history that make even the best fund managers envious. In the period of October 1990 – March 2000, for example, the market registered a 417% return. The longest ascending market in history lasted 134 months and came to an end in March 2020. The result was a 348% return for the S&P 500. These numbers make even professional investors and fund managers turn their heads.

How To Invest In A Bull Market

Let’s see what investments can help you get close to returns of this scale:

ETFs

If there is a bull market, why not just… buy the market? ETF instruments like the SPDR S&P 500 are a great way to get exposure to the S&P 500. This way, you will be able to make profits by just holding for the long-term. If you don’t believe it, listen to the best investor of all time:

Over the long term, the stock market news will be good. In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11 497.”

– Warren Buffet

Stocks

When there is a bullish market, the majority of the industries are collectively doing well, and most shares’ prices are going up. However, make sure to analyze each sector and the particular company before buying. For the last three decades, for example, tech stocks have proven to be wonderful investment opportunities. Before you allocate capital, though, don’t forget a simple rule:

Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

– Warren Buffet

Commodities

A booming economy means more consumption and spending power. As a result, commodities like corn, oil, gas, and others usually tend to perform well during bull markets. The best way to take advantage of such investments is through futures contracts. Take a look at our in-depth Trader Survival Guides to learn everything essential about the most popular and widely-traded commodities.

Bullish vs Bearish – Characteristics and Differences

One of the things people often wonder about is why the markets are named what they are. The most popular theory is that the terms, describing the two states of the market, come from the way both animals attack. Bulls usually attack with their horns, gouging upwards. Bears, on the other hand, attack with their paws, slashing down.

Some theories suggest that the bear market term originated from a proverb and was later on popularized during one of the most famous and first market crashes, the South Sea Bubble in 1720. According to others, the idea of bullish markets comes from the early London stock exchange, where traders filled bulletin boards (or “bulls” for short), during volatile trading sessions. When the market was calmer, the board was left bare (this evolved in “bear”).

Although there is no unified theory for the real origin of these terms, one thing is clear – the shift between bullish and bearish markets is an inevitable part of the way the financial ecosystem operates.

Now, let’s find out the things that make them different and what unites them.

Differences

The economic and market conditions they describe

The main difference, of course, is that bull markets describe situations where asset prices move upward, while during bear markets, the prices move downward. Or in other words – the bullish state indicates positive market momentum, while the bearish one indicates a negative movement.

They also differ in the way they describe the economic situation. During descending markets, the economy is shrinking, while during ascending markets, it expands, and the GDP grows. The case is the same with factors like fiscal policy (higher taxes during economic booms; lower taxes during economic busts), interest rates (high/medium during rising markets; low during decreasing markets), inflation, exchange rates, unemployment, and other similar characteristics.

Sitting at the opposite ends of the spectrum

Investors and financial experts often use the terms “bearish” and “bullish” to describe their sentiments towards particular security, asset class, or the whole market. This sentiment is usually dynamic and can change depending on shifts in events, the analysts’ expectations, news, and more. That is why traders often consider the opinion of the renowned investment professionals before making a trading decision. One of the metrics that helps them with this is the bull/bear ratio.

The ratio is a market-sentiment indicator, published weekly by Investors Intelligence. The indicator uses information polled from professional financial advisors and investment experts to formulate a general estimate of their views towards the market. If the value is greater than one, then the investment professionals show a bullish sentiment, and vice-versa.

Prevalence in the financial markets

Another difference between bull and bear markets is their longevity. Although both can last for decades, the overall market direction has always been upwards. Thanks to innovations, the rise of new sectors and companies, technological progress, increasing wealth, diminishing inequality, etc., the market always finds a way to get back on its feet.

A rule of thumb is that no matter how long the market has been descending, in the end, it always breaks above its pre-crisis levels. To confirm this, let’s take a look at history. Depressions, recessions, wars, global political instabilities – none of this has managed to stop the long-term bullish market movement. Since the S&P 500 was created in 1957, for example, it has grown with over 5 800%.

Investor behavior during both situations

During bearish market periods, investors are less confident in the profit opportunities and tend to be less active. One of the main reasons for this is the increased volatility and market uncertainty. To overcome this, investors focus on asset classes that can preserve their wealth (gold, bonds, etc.) and avoid taking too much risk.

On the other hand, in bullish market periods, investors adopt a looser approach and actively seek profit opportunities. They tend to be more active and willing to invest in riskier assets. That is because the economic terms are favorable, and lost capital can be regained quicker.

Similarities

You can make money in both

Embracing the bull wave is basically the easiest way for someone to make money. It is how you react when things turn ugly what really matters. However, the good thing is that profit opportunities are always present, despite the state of the market.

At no point in history had there been a moment when each and every corner of the market was going down in a synchronized manner. Stocks of utility companies, fixed-income instruments, gold, etc. – there are opportunities to make steady returns despite the dominance of bearish investors.

Both are inevitable

Neither a bull nor a bear market can continue forever. Even if there is an equilibrium for a while, at some point, it is inevitable that one will be replaced by the other, and vice-versa. This cycle will continue forever due to the factors that affect financial markets. They change continuously, which may stabilize or destabilize the system.

However, thanks to the lack of balance in the financial markets ecosystem, we can benefit from profit opportunities during both market conditions.

Both are identified through technical analysis tools

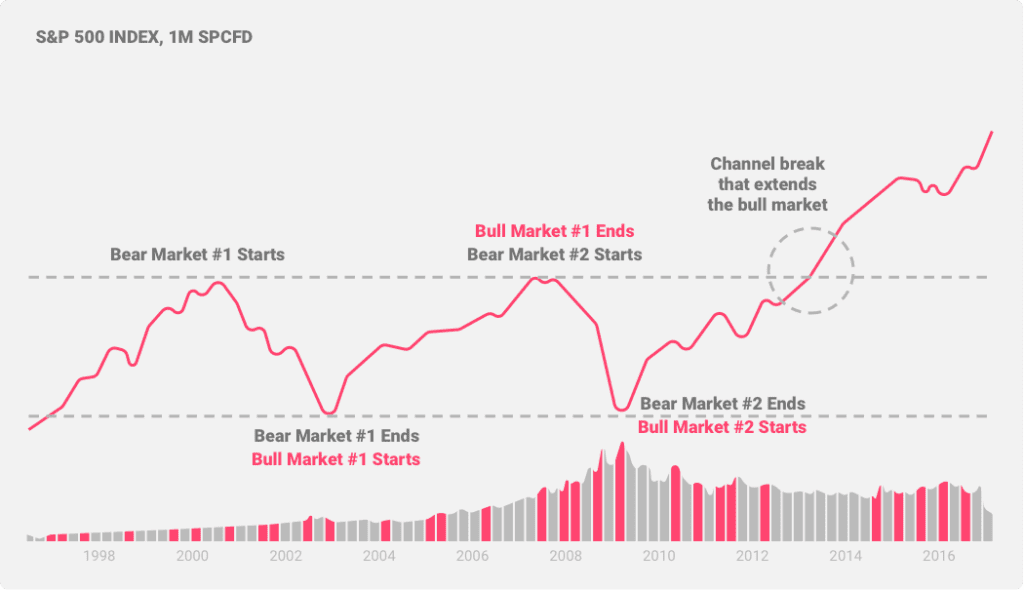

Below is an example of the S&P 500 and the bear and bull markets for the last 20 years.

Looking in the past, bull and bear markets can be clearly distinguished. However, when it comes to the future, things are quite different. To predict bear and bull markets, we use trading indicators. Through the analysis of their signals, traders can easily spot a reversal or a continuation of the trend.

The list of the most popular indicators includes candlesticks (Harami Cross, Engulfing, Morning Star, Rising Star, Hammer and Inverted Hammer, etc.), trend indicators (MACD), momentum indicators (RSI, stochastic oscillator, etc.), and many more.

Equally powerful influence on the market

In the history of financial markets, there have been numerous cases when influential people and important figures from the investment community have expressed their views and tanked a particular security or a whole asset class. The opposite has happened as well. Depending on who they come from, publicly expressed bearish and bullish sentiments can have a notable effect on the price of a particular investment.

In 2018, for example, Bitcoin dropped more than 8% after Warren Buffet and Bill Gates both criticized the foundations of the cryptocurrency and admitted they would never invest in it.

F.A.Q

Buying on margin basically means a multiplication of the purchasing power. One investor borrowing money to buy 4x the amount he initially intended to is equal to four investors buying the particular stock. This way, one investor can generate as much buying interest in the instrument as several others, which reinforces the bull market.

It lasted for 134 months, from March 2009 to March 2020. During this time the S&P 500 grew with over 348%. It was driven by loosened fiscal policies, the boom in the tech industry, record corporate profits, and other similar factors. It was ended by the COVID-19 crisis, which led to halted operations, worsened GDP forecasts, and job losses.

The bull market run marks an extended period of time during which the economy is sound, and the market is on the rise. During the run, investors are showing optimism and increased positivity towards the future of the market. The bullish market run can last anywhere from a few months to a couple of years.

The secular bull market is driven by sustainable and powerful forces that can remain in place for decades. This means the prices of the market or a particular asset can mark above-average returns for a period of 10 or even up to 20 years. Secular bullish markets can be interrupted by short-term bearish moves, but always proceed to mark an even higher high.

The bear market is usually favorable to sectors like mining (due to gold’s status of a safe-haven asset), materials producers, consumer goods and retail (discount stores, supermarkets, cheap clothing brands, etc.), tech, and more. Of course, it depends on the type of bearish market. During the COVID-19 crisis, for example, healthcare and biotech shares exploded.

Yes, you can make money in a bear market. There are several possible ways. One is by investing in sectors that perform well during a recession like consumer goods, tech, or others. The next is to switch to assets like fixed-income securities or gold. You can also make money through investments in inverse ETFs.

It can be good to invest in a bear market, if you do your research and tailor your trading strategy to it. The usual investments in broader market indices usually don’t work. If you focus on short-selling, sector-specific investments, or assets that are bullish during a descending market, then you can make some profitable moves.

Most of the time, when we talk about the general market, the reason for its bearish move is related to a recession in the economy. However, a bear market isn’t always caused by a recession or periods of worsened economic and business climate. For example, since 1929, there have been 25 bear markets and only 14 recessions.

A bear market can also be caused by a variety of events, including geopolitical decisions (bans on particular goods or specific companies), unexpected crises (the COVID-19 crisis affecting the shares of airline companies), regulation decisions (bans on cryptocurrencies in some countries), and more.

It started in 1946 and lasted for 37 months. It followed the end of the stock market’s boom due to the increased production and demand during wartime. The wealthiest nations started saving, while those affected by WWII the most fought poverty and tried to rebuild their countries. The period was marked by recession and deflation.

Although widely-believed, this concept is wrong. The reason is that junk bonds, unlike other bonds, are less affected by interest rates. Having higher yields, shorter maturities and often being issued by companies they are much closer to stocks, rather than bonds. Due to this, they are more affected by the overall state of the economy.