The Cattle Futures Market can be somewhat difficult to grasp. Most people aren’t familiar with how it works or how it can be used to grow an investor’s portfolio. Luckily, understanding it isn’t actually difficult. It does require a bit of work, but once you get into it trading cattle can be surprisingly rewarding. Plus, it affords a feasible way to diversify of your portfolio by shifting some of your focus on commodities instead of traditional asset classes, such as stocks and bonds. In this article, you’re going to learn about feeder cattle, and live cattle futures.

As you already know, today’s cattlemen can physically sell cattle any time in a variety of ways. These include auctions, private treaty, video sales, and other venues. Normally, on the day of the sale or a few weeks after the sale, the cattle are moved from one location to another. However, there are instances where the physical ownership of the cattle sold does not change for a few months. Instead, the buyer and the cattle producer agree to conduct the trade at an agreed-upon price and time in the future. This contractual agreement represents the makings of a futures contract.

What are Cattle Futures Contracts?

In simplest terms, cattle contracts are financial instruments that give the buyer the obligation to purchase a set amount of cattle on a certain date and for a certain price. This means that the futures contract buyer and cattle producer can lock down a price in advance so they are not at the mercy of price fluctuations at the time of sale.

Cattle ownership is a pretty significant investment. Therefore, producers need to be able to calculate their break-even points and lock in prices on their commodities for better price management. Instead of waiting and getting whatever the price happens to be in the future. For many cattle producers, a futures contract means they can mitigate risk to ensure they are still operating next year.

You Might Also Like:

- 5 Differences Between Trading S&P 500 E-MINI and Micro E-mini Futures

- A Brief Guide To Trading Dow Jones Futures

Who trades it?

The prices of these futures contracts are negotiated at futures exchanges, such as the Chicago Mercantile Exchange (CME) and the Brazilian Mercantile and Futures Exchange (BMF). The major players in this market are mostly hedgers who are likely involved in a livestock-related business. These might include ranchers, leather manufacturers, and businesses in similar industries.

However, with a brokerage account, anyone can get involved with futures contracts and gain access to the livestock market. For instance, in 1978, America’s former first lady, Hilary Clinton, is said to have converted a $1,000 investment into a windfall of nearly $100,000 through cattle futures trading.

This trading market started as far back as 1964 on the CME. These contracts have become quite popular since then. One vital reason for the popularity is that cattle have many uses aside from turning into the meat we eat. We also produce milk from them and their hides are good for leather. Basically, the value in cattle is clear, demonstrable, and easy to comprehend.

How to Trade Cattle Futures Contracts

There are two kinds of contracts:

- Live cattle

- Feeder cattle

They are both traded on the CME. The underlying difference between them comes down to the age and weight of the cows. The “Feeder” category comprises of cows within the calf stage until they reach a weight of 600 to 800 pounds. This weight gain period can take anywhere from 6 to 10 months after the cow is weaned from its mother.

After that, the cows are transferred to feeder lots, some of which are large enough to accommodate up to 50,000 cows. These cows fall into the “Live” category and are kept there in order to gain enough weight to be ready for slaughter. The largest producers of cattle in the US are Texas, Arizona, Kansas, Colorado, Nebraska, California, and Iowa.

Why You Might Consider Investing in Cattle Futures

Below are some reasons as to why investing in this futures market may be worthwhile:

- Betting on global growth – The global economy and population are growing and with it the demand for animal proteins, including beef. The United States, China, and Brazil are the largest consumers of beef globally. While China, South Korea, and Russia are some of the largest global importers of beef. The growth of these powerhouse economies alone is enough to want to bet on continued solid expansion and profitability, especially when you consider the expected rising demand from emerging market countries and Asian markets.

- Hedging against inflation – Investing in stocks and bonds is a proven way to hedge against the loss of purchasing power due to inflation. The same principle applies to cattle. The steady rise in the prices of goods and services is ubiquitous worldwide. You can expect the livestock price increases should the economy experience higher inflation. This is because meat and milk from cattle fall under the food category, which remains the most basic and fundamental necessity. Might as well benefit from these expected inflationary trends.

- Portfolio diversification – If you’ve been considering less traditional investments, or are looking to break into the commodities market, the livestock futures market may just be the ideal starter for you. It is a good way to diversify your portfolio due to a low correlation with the equity and fixed income markets.

Live Cattle Futures

As mentioned previously, live cattle futures and options are traded on the Chicago Mercantile Exchange. The price is quoted in cents per pound. Various market players, including cattle producers, packers, consumers, and independent traders all trade using live cattle contracts. The reason this type of contract is so popular is that it gives all interested parties the opportunity to hedge their market positions and reduce the notorious volatility and uncertainty associated with live cattle prices. It also allows market participants to assess and bet on cattle demand and supply in the present and in the future.

| Live Cattle Futures Contract Specifications | |

| Contract Ticker Symbol | LC |

| Electronic Ticker | LE |

| Contract Size | 40,000 pounds (~18 metric tons) |

| Underlying Commodity | Live cattle |

| Price Fluctuation | $10.00 per contract ($0.00025/pound) |

| Trading Months | February, April, June, August, October, December |

| Trading Hours | Monday – Friday: 8:30 a.m. – 1:05 p.m. Chicago Time |

| Termination of Trading | 12:00 Noon Chicago Time on the last business day of the contract month. |

Risk Factors for Investing in Live Cattle

Like with any investment, you need to be aware of what you’re getting into and understand the risks involved. In the case of live cattle, here are some potential risks worth considering:

1. Volatile prices

Unlike with gold or crude oil, the primary traders of live cattle are not speculators, but industry players looking to hedge their risk exposures. This means that sudden events, like changes in feeder cattle supply, consumer demand, weather, among other factors, could lead to extreme price volatility.

2. Healthier living and environmental concerns

The beef production process is heavily energy-intensive. In addition, the Amazon rainforest and other forests are being cut down to make room for livestock. This only fuels negative perceptions about beef consumption as not only a poor dietary option but also one that affects the environment at large.

3. Bovine spongiform encephalopathy (BSE)

Also known as mad cow disease, BSE is capable of crippling demand for beef products on a huge scale. Naturally, an outbreak affects the trading volume adversely and cattle prices plummet.

Feeder Cattle Futures

Feeder cattle are crucial to the global ecosystem of beef production and are a vital commodity in the world. The industry is also responsible for millions of jobs, including suppliers, distributors, and retailers. Consumption of beef worldwide is teetering at around 60 million metric tons annually, and the economic impact in the United States alone means the meat and poultry industry is worth $1 trillion. One of the most appealing features of feeder cattle futures is that they allow traders to play an active role in the all-encompassing market, which includes price demand for feed grain and the cattle themselves. In addition, traders are able to address price risk among those involved in the trade of feeder cattle for both the current and future outlook.

When it comes to trading, it is important to understand that the CME feeder cattle contract is settled on a cash basis. As such, the CME calculates an index for cash prices of feeder cattle based on a seven-day average. This index is calculated by averaging feeder cattle prices from the largest feeder cattle-producing states in the US, as compiled by the U.S. Department of Agriculture (USDA).

| Feeder Cattle Futures Contract Specifications | |

| Contract Ticker Symbol | FC |

| Electronic Ticker | GF |

| Contract Size | 50,000 pounds (23 metric tons) |

| Underlying Commodity | Feeder cattle |

| Price Fluctuation | $12.50 per contract ($0.00025/pound) |

| Trading Months | January, March, April, May, August, September, October, November |

| Trading Hours | Monday – Friday: 8:30 AM. – 1:05 PM Chicago Time |

| Termination of Trading | Last Thursday of the contract month with exceptions for November and other months, 12:00 PM |

Risk Factors for Investing in Feeder Cattle

Feeder cattle investing share similar risk factors with live cattle. It doesn’t attract much open interest or trading volume, yet the market tends to be volatile and uncertain. There’s also the fear of BSE diseases, which can impact feeder cattle prices on a global scale. In some cases, outbreaks have resulted in outright bans in certain countries, which led to the destruction of livestock in a bid to reduce the risk of spreading the disease. Other potential risks worth considering include:

1. Open interest gap between live cattle and feeder cattle contracts

As the trade volume between the two types of contracts widen, increased vulnerability starts to set in. This is especially true with the weight of spreading and crush trades derived in the live cattle market which overwhelms the feeder cattle contracts. This eventually makes prices nothing more than a reflection of the direction of the deferred live cattle contracts.

2. Fluctuations in feed prices

These include prices of hay, corn, and soybean. Any of these can directly affect the feeder cattle market. If the feed prices are too high, cattle are often sold at lower weights which results in price drops for the cattle market.

3. Extreme weather

High temperatures can decrease the appetite of the cattle, which in turn, reduces the amount of weight they gain while at the feedlot. This again results in lower cattle prices.

Important Strategies for Trading Cattle Futures

Cattle may be risky contracts to trade, but it is undeniable that there is potential to make significant profits. This is especially true if you have a good grasp of your investment strategy. If you’re thinking of giving it a go, here are some strategies you may want to look into:

1. Invest in a diversified basket of commodities that includes cattle contracts

Due to the price volatility of futures, you’ll want to think carefully before taking large speculative positions in the commodity. One good way to mitigate this risk is to invest in a basket of commodities that includes cattle, poultry, other agricultural commodities, metals, and energy. This approach can help you accomplish two goals:

- It protects your portfolio against inflation.

- It protects against the volatility of price movements of individual commodities. Even if one cattle futures contract goes down in value, you have other types of investments to bank on to make up for the dip. In short, you would be reducing your security-specific risk in the portfolio.

2. Look for imbalances in the prices between live and feeder cattle

The prices of live cattle and feeder cattle are highly correlated, which often leads to traders trying to profit from the spread between the two. For instance, some traders capitalize on the price spread between live cattle and feeder cattle, as well as the price of the corn and hay needed to feed them. So what traders often do is buy futures for live cattle and sell them for feeder cattle and corn.

While this is a sound strategy, traders can also benefit from price discrepancies between the two types of cattle. Feeder cattle represent future supply, so any disruption will most likely influence the price and the demand for live cattle. In the event of live cattle oversupply, the price for new cattle coming onto the market will also be affected.

3. Trade-in meat production and processing stocks

If you’d rather skip the nitty-gritty of futures trading, then you could invest in the finished products of cattle; beef. Buy stocks of large beef exporters like Tyson Foods or Cranswick, and then treat it as you would your other investments. However, you must be willing to consider the myriad of other variables that applies to stocks like this. The price of cattle is just one of the many factors that drive their share prices.

If you’re looking for more in-depth and technical trading strategies for trading cattle, check out this CME guide. It outlines hedging strategies for both inventory and procurement protection.

Seasonal Fundamentals of the Cattle Futures Market

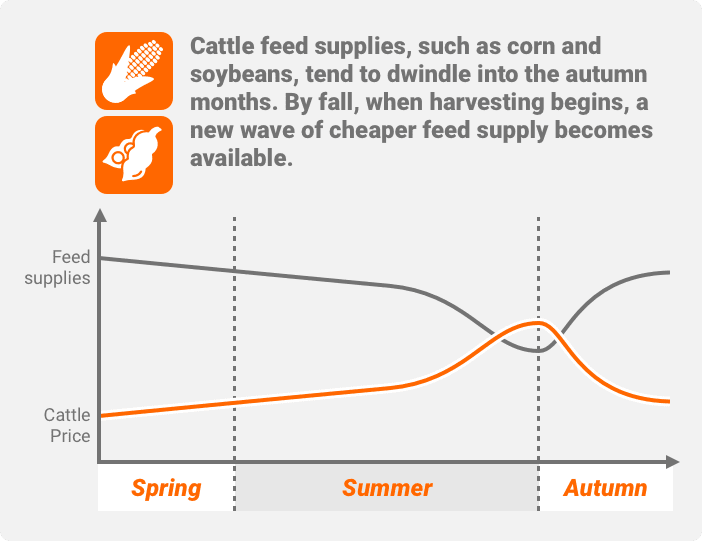

Based on historical data, cattle prices tend to increase just before and during the summer months – but not necessarily because it is prime grilling season. After all, the feeder cattle used to supply that beef were already being priced back in February and March. Conversely, summer is when feed supplies are lower and more expensive.

So while some of the cattle can be replaced on the feedlots, it is not always enough to meet the increased demand. That’s because cattle feed supplies, such as corn and soybeans, tend to dwindle into the autumn months. By fall, however, the cattle feed is harvested, bringing in a new wave of cheaper feed supplies. This prompts cattle producers to begin rebuilding their inventory — beginning the new cycle.

This seasonal aspect of meat production, feed availability, and consumer’s desire for meat products directly affects the prices of live cattle prices. That said, it is also one of the features that make the cattle futures contract market attractive to commodity futures traders.

Outlook for the Global Cattle Market

The United States Department of Agriculture (USDA) estimates that beef exports will increase by more than 2.7% in 2020. This is mainly because of the potential expansion of markets in Asia. For instance, on May 17, 2019, the overall CME market surged, following news that Japan was reopening full beef trade with the United States.

On the global scene, the production of cattle is forecasted to grow 1% this year to 63.6 million metric tons. This growth is driven by Argentina, Brazil, and the US. These top producers and exporters are looking to increase their output to meet growing demand in Asian markets. They are also looking to capitalize on the weather-related herd reduction in Oceania as the anticipated competition in Asian markets is lowered.

With this anticipated rise in cattle supply, it is likely that the cost of feeding cattle will also rise this year. Especially as the feeds industry will work to keep up with the higher demand for live and feeder cattle.

Other Cattle Trading Methods

While this article focused solely on futures trading, you’d be pleased to know that you can also trade using other methods:

1. Cattle Options on Futures

The CME offers option contracts on both live and feeder cattle. Like futures contracts, these options have an expiration date but differ in that they have a strike price — the price above or below which the option finishes in the money. Using this trading method, option buyers pay a premium to purchase contracts. These contracts give the trader the right, not the obligation, to buy (call option) or sell (put option) the underlying asset, in this case, live or feeder cattle, at the strike price. A call option bet is deemed successful if the cattle price is higher than the strike price by an amount higher than the premium paid for the contract. A put option bet is deemed successful if the cattle price is lower than the strike price by an amount higher than the premium paid for the contract. This is quite tricky and requires option traders to be accurate about the size and timing of the move in the cattle market to make a profit.

2. Livestock ETFs and ETNs

Exchange traded funds (ETFs) and exchange traded notes (ETNs) can hold all types of assets such as stocks, commodities, and bonds. You can gain exposure to livestock by buying ETFs and ETNs that hold livestock futures or companies. These funds trade on exchanges, the same way as stocks. Therefore, they can be bought and sold during regular exchange open hours. Keep in mind, however, that there is no ETF and ETN that specifically invests in live or feeder cattle. Instead, you can get in on ETFs or ETNs that invest in a more diversified basket of livestock, such as the iPath Dow Jones-UBS Livestock Subindex Total Return ETN (COW).

3. Contract for Difference (CFD)

This is a derivative instrument that allows traders to speculate on the prices of live and feeder cattle. Its value is the difference between the current price of the cattle and its price at the time of purchase. One key advantage of CFDs is that traders are exposed to live and feeder cattle prices without the need to purchase shares, ETFs, options, or futures. That being said, you should know that CFDs are complex instruments and when used poorly can expose the trader to high levels of risk due to their implied leverage. They are suitable for experienced traders only.

The Bottom Line

Beef need not only be on your dinner plate, but can also be part of your investing portfolio. Due to the modernization in emerging markets, demand for a protein-rich diet has risen. Hence, the demand for beef is growing at unprecedented levels year over year. This longer-term demand could see cattle becoming a key profitable investment for traders and investors alike. That’s why even though the cattle futures market is smaller in comparison to other securities, it’s still worth taking a closer look at.

Whether it’s live or feeder cattle, futures contracts can definitely yield some pretty juicy gains. The key is to pay attention to fundamentals and the various factors that can influence its price.

If you already have a grasp on the technical side of trading and are ready to navigate the futures market, sign up for The Gauntlet Mini™ here and take your first step to become a professional trader.