Trading on financial leverage can significantly increase your profit margins without having to put down a massive initial capital. But first, you need to know what you’re doing. As Warren Buffett famously said, “When you combine ignorance and leverage, you get some pretty interesting results.” In this article, we will take a closer look at leverage trading, how it works, and how you can use it as part of your trading strategy.

What is Leverage Trading?

In physics, leverage provides a mechanical advantage by amplifying a small input force to achieve greater output. Financial leverage follows the same principle. In this case, however, it amplifies an investor’s buying power in the market.

Also known as margin trading, leverage trading refers to the use of borrowed capital to get a much higher potential return on your investment. This allows you to open positions that are significantly larger than what your original capital would otherwise allow.

The idea here is to use that additional capital to buy more contracts of an asset, expecting that the position’s returns will be greater than the cost of borrowing. But just as leverage can increase potential rewards, it also raises risk exposure. Hence it is mainly experienced traders who use it.

Leverage can also refer to the amount of debt a company uses to expand its asset base and finance capital-intensive purchases. For example, instead of issuing new stocks to raise capital, the company can use debt to acquire more assets and improve their business operations.

Terms You Should Know About When It Comes to Leverage Trading

- Buying power – This is the amount you have available (plus leverage) to buy the securities.

- Coverage – This is the ratio of the net balance in your trading account compared to the leveraged amount.

- Margin – This is the amount required by your broker to cover possible losses should the trade become unfavorable. It is one of the pillars of leverage trading.

- Margin calls – The broker or financial intermediary will issue a margin call if your trading account balance falls below a specified minimum requirement. It’s basically a warning that your position is exposed to a risk level that the broker cannot accept. You’ll then need to add more funds to your account to meet that minimum required amount. Alternatively, you could close off your trading position and face your accrued losses.

- Open position – This means you’ve opened a trade and have not yet closed it out with an opposing trade. Let’s say you own 1,000 shares of Amazon stock. This means you have an open position in Amazon stocks until you close it out.

- Close position – This just means the value of your investment at the time you closed it. Say you opened a position at $20, and it rose to $25. You close the position at $25 to realize your profit of $5 on the trade.

- Stop-loss – This helps limit risk exposure on a trade by automatically closing a position based on certain parameters. If the trade goes below a specified price level, it triggers the stop-loss, which automatically closes the position in order to limit further losses.

How Does Leverage Trading Work?

You can trade on leverage through your broker. Think of it as getting a loan to purchase an asset. You have your initial capital and the broker finances the bulk of the position’s whole purchase price. Any difference between how much you purchased the asset for (opening price) and how much you sold it for (closing price) is settled in your account balance.

If you have significant leverage and the asset appreciated greatly in value, then the amount owed to the broker is taken out of your profits on that trade. However, if the trade went south and you ended up with a loss on your hands, the amount owed is taken out of what is left in your account.

For this reason, leverage trading facilities are not readily available to every trader. The amount that a broker will be willing to finance will depend on a number of factors. These include how much leverage the trader needs and the current regulations covering online trading in that jurisdiction.

Leverage Ratio

Financial leverage is always shown as a ratio between the total assets and equity. Total assets refer to the sum of the debt or loan amount and your equity or capital. The equity or capital is basically the cash you deposit into your brokerage account. This is the formula:

Financial Leverage = Total Assets / Equity = (Equity + Debt) / Equity

Some brokers allow traders to use a leverage of up to 100:1 or even more. At least in the forex markets. In this instance, this means that you can leverage your trading position up to 100 times.

Let’s say you have $2,000; this is your equity or capital. If your broker allowed leverage of 100:1, you can expose yourself to a position of $200,000 in the market ($2,000 x 100), with just $2,000. Your broker will effectively allow you to borrow $198,000 for the position. Any profit or loss will be magnified by 100 times.

Some brokers offer Negative Balance Protection. This essentially stops you out before your trading account hits negative in the event of a loss. Without this protection feature, you could end up owing money to the broker. This could happen if the position loss turns out greater than the capital you initially invested.

Which Assets Can Have Financial Leverage?

You can apply leverage trading to several financial instruments including stocks, FOREX, commodities, futures, options, ETFs, indices, and even cryptocurrencies. Financial leverage is also used when buying real estate. Your mortgage is the debt in the financial leverage formula. Your downpayment is the equity in the formula.

Each asset class has its maximum leverage limitations in line with market regulations, as well as the broker’s own efforts in promoting leverage trading on their platform.

Examples of Trading With Leverage

In the leverage ratio example above, we looked at how a 100:1 ratio with an initial $2,000 can allow you to control $200,000 worth of an asset or currency. Let’s take it from the very beginning and see how much profit or loss you make with and without financial leverage.

Let’s assume you decide to buy the asset or currency at a price of $10 per unit. During the day, the price goes up to $10.50 and you close the position. What would be the results of your trade?

- Without leverage — The asset gained $0.50 and for $2,000 you bought 200 shares. Your total profit in this case is $100 ($0.50 x 200).

- With leverage: You applied leverage of 100:1 to your investment, which means bought 20,000 shares. Your total profit on the trade becomes $10,000 ($0.50 x 20,000).

That’s just a glimpse of how much profit you can make from the same $2,000. Of course, this is only a general overview of how leverage trading works. The actual process will differ depending on the market and the type of security being traded. Let’s look at a few specific scenarios.

Trading With Leverage in the Stock Market

Take a look at this snapshot of Tesla stock.

As you can see, the trading day opened at just over $440. But then the price went down to $438.58. Let’s say you decide to open a position for 100 shares. You’ll need to have at least $43,858 in your trading account to execute the order.

It turns out that the trading day closed at $442.59, meaning you would have made a profit of (442.59 – 438.58) x 100 = $401. But considering you just put up $43,858, the return does not seem that significant.

If you executed the trade using leverage, you’d need to put up much less to earn that same $401 profit. If the brokerage allowed for 3:1 leverage, you would be able to earn the same amount with only 43,858 / 3 = $14,619.33 of your own capital.

The profit is the same in both cases since you bought the same number of shares. But because of your financial leverage, you were able to get it with much less capital invested.

Leverage Trading in Futures

Gold Futures Contract Specs

| Contract Unit | 100 troy ounces |

| Price Quotation | USD per troy ounce |

| Trading Hours | CME Globex: Sunday – Friday 6:00 p.m. – 5:00 p.m. (5:00 p.m. – 4:00 p.m./CT) with a 60 minute break each day from 5:00 pm (4:00 p.m. CT) CME ClearPort: Asia: Sunday – Friday 6:00 p.m. ET – 3:30 p.m. China London a.m.: Sunday – Friday 6:00 p.m. ET – 10:32 p.m. London London p.m.: Sunday – Friday 6:00 p.m. ET – 3:02 p.m. London |

| Minimum Price Fluctiation | Outright: 0.10 per troy ounce = $10.00 |

| Product Code | CME Globex: GC CME ClearPort: GC Clearing: GC TAS: GCT TAM: “GCD”,”GC7″ |

| Listed Contracts | Monthly contracts listed for 3 consecutive months, any Feb, Apr, Aug, Oct in the nearest 23 months and any Jun and Dec in the nearest 72 months |

| Settlement Method | Deliverable |

| Termination of Trading | Trading terminates at 12:30 p.m. CT on the third last business day of the contract month. |

| Trade at Market or Trade at Settlement of Trading | TAS Table |

| Settlement Procedures | Gold Settlement Procedures |

| Position Limits | COMEX Position Limits |

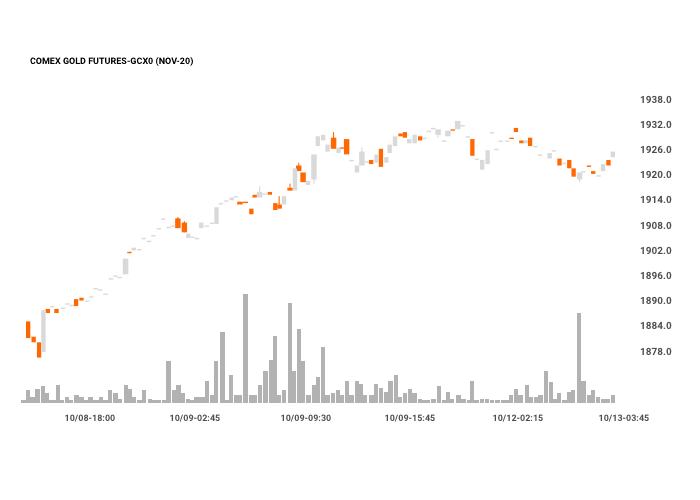

Let’s assume that you are bullish on the value of gold. If your prediction is correct, buying a gold futures contract would allow you to realize a healthy profit.

CME offers a standard gold futures contract with a unit value of 100 troy ounces. Assuming the futures price of gold is $1,925 per ounce, purchasing the contract lets you own 100 ounces of gold for $192,500.

Most investment vehicles would require you to deposit the full amount ($192,500) before taking ownership of the gold. But with leveraged trading, you will only need to put up between 3% to 12% of the contract’s value.

Let’s say the broker allows a 10% margin requirement, then you only need $19,250 to get exposure to $192,500 worth of gold.

Leverage Trading in Forex

With over $5 trillion worth of currency being traded every day, the Forex market is the world’s largest financial market. This extensive liquidity means most brokers are willing to offer leverage ratios as high as 100:1. Some might even offer higher leverage since it’s so much easier to open and close positions.

In forex trading, we measure currency movements in pips. These represent changes in fractions of a cent. For example, if the GBP/USD pair moves 100 pips from 1.8900 to 1.9000, it just means the exchange rate moved by 1 cent.

Because of these tiny movements, forex transactions are usually carried out in huge volumes so that these fractional pip changes can translate to greater profits.

With this, you can already see how leverage trading can impact forex. If you can potentially control an investment worth $100,000 with just $1,000, you have the potential to get phenomenal profit. But remember to also consider what would happen if the trade results in a heavy loss.

What is the Difference Between Leverage and Margin?

Although closely interconnected, leverage and margin are not the same. Financial leverage means you’re taking on debt to boost your buying power. You do this because you believe the asset or security you’re buying will bring in more profit than the original cost of the debt.

On the other hand, the margin is the amount of capital you need to create and maintain leverage. Similar to a downpayment before you can access a loan. If your account balance falls below a predetermined level during the trade, you will incur a margin call.

What determines how much leverage you can get with your margin account? The list includes the security you want to trade, your trading account balance, your trading expertise, and the broker’s leverage policy.

Pros and Cons of Using Financial Leverage

Pros

- Amplified buying power to purchase more units with only a fraction of the actual cost.

- Potential for higher profit on each trade.

- It can reduce nonsystematic risk since you only need a small percentage to control a large position of diversified assets.

Cons

- Amplified risk exposure. Even with the ability to set up stop-losses, leveraged trading carries significant risk.

- Losses sustained while trading with financial leverage are usually way more than would have incurred if you didn’t trade on leverage at all.

How to Make the Most Out of Trading With Leverage

Because of the risks, leverage trading is more suitable for traders with experience. Still, if you’re looking to try it, here are some tips that might help:

Know Your Financial Situation

Work out how much of a loss you’re willing and able to incur on a trade based on your financial situation. Start small and work your way up taking on only leverage ratios that you can firmly manage.

Do a Detailed Analysis Before Opening Your Position

It seems obvious but there is no room for guesswork when it comes to trading with leverage. Use a mix of leading and lagging technical indicators to determine and confirm price movement before opening a position.

Stop-Loss Is a Must

Outside of your trading experience, applying a stop-loss order to your open positions is the first practical measure to minimize the risks associated with leverage trading.

Set up a Take Profit Order

If a stop-loss is your defense, a take-profit order is your attack. This tool automatically closes out your position once it has hit the profit target you set.

Final Thoughts

Leverage trading is one of the most powerful tools available to traders and investors who are looking for huge returns. But like any tool, it all depends on the experience and expertise of the one wielding it.

In the right hands, financial leverage can drastically amplify returns; but in the wrong hands, it can wreak havoc and result in a dreaded margin call.

In any case, constantly educating yourself on best practices is the key. Over time, you can start trying out trading with leverage using all sorts of financial instruments, and start developing your own unique trading strategies.