Options trading is a common way traders try to multiply their earnings. While commonly perceived as risky, there are certain strategies with limited downsides that you can use to lower your risk. A long straddle is one such popular strategy.

What is a Long Straddle?

The long straddle strategy is a combination of a long call and a long put, both having the same strike price and expiration date. The strike price is generally close to the current price of the asset. Either the call or put can be in the money depending on how price deviates from the strike price.

The trader loses all his money if there is no movement in the price of the asset. Because, in this case both the call and put would be worthless. Since the trader is purchasing both a call and a put, a long straddle option incurs a higher cost than what the trader would have paid for only buying either one or the other.

This strategy is particularly useful for traders who expect a significant price movement, but don’t yet know the direction of this movement. The trader gains more profit the farther the share price moves away from the strike price irrespective of the direction.

You might also enjoy:

- Bullish vs Bearish – Complete Guide to Bull and Bear Markets

- Aggregate Demand Curve | Definition, Determinants and Components

Understanding How a Long Straddle Works

For the sake of simplicity let us consider each possible outcome of a long straddle on an individual basis. There are three scenarios that can exist based on the spot price of the asset:

1. When the Spot price equals the exercise price

Value of Call = 0

Value of Put = 0

2. When the Spot price (S) exceeds the exercise price (X)

In this case, the value of the put is 0 since it is out of the money

Value of Call = S – X

3. When the Spot price (S) is lower than the exercise price (X)

In this case, the call expires worthless since it is out of the money

Value of Put = X – S

To summarize the above three scenarios, we can say that we calculate the value of the long straddle by taking the difference between the Spot Price and the Exercise Price. Mathematically we can express it like this:

Value of long Straddle = max (S – X, X – S)

The above equation further validates the core assertion that the farther the price of the asset deviates from the exercise price, the better is it for the straddle buyer. The direction of the price movement is irrelevant in this case.

One key factor the concept outlined above neglects to mention is the cost of buying a straddle option. In the next segment, we will use another example that also considers the cost of buying the options and how that affects the trader’s profitability.

Long Straddle Example

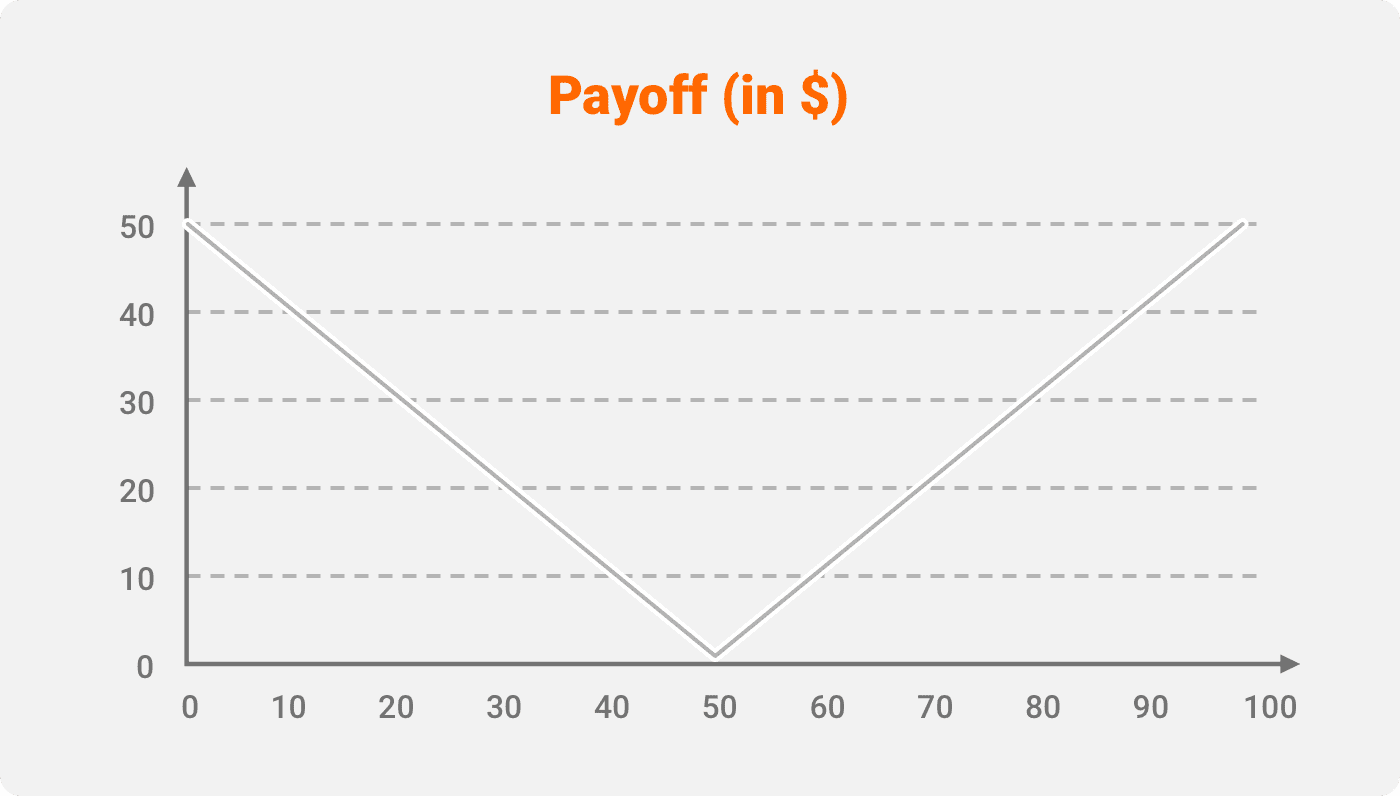

Let us consider a straddle that has an exercise price of $50 and the cost to purchase it is $10.

First we will calculate the payoff ignoring the costs, using the following equation:

Value of long Straddle = max (S – X, X – S)

Below we’ve listed the potential payoffs for different possible Spot Prices:

| Spot Price (in $) | Payoff (in $) |

| 0 | 50 |

| 5 | 45 |

| 10 | 40 |

| 15 | 35 |

| 20 | 30 |

| 25 | 25 |

| 30 | 20 |

| 35 | 15 |

| 40 | 10 |

| 45 | 5 |

| 50 | 0 |

| 55 | 5 |

| 60 | 10 |

| 65 | 15 |

| 70 | 20 |

| 75 | 25 |

| 80 | 30 |

| 58 | 35 |

| 90 | 40 |

| 95 | 45 |

| 100 | 50 |

For example, if the price is $5, then the value of the call is 0 and the value of put or straddle is $45. Likewise, when the price is $90, the value of the call or the straddle is $40. While we have listed the Spot Price up to $100, that’s not the maximum. There is always a possibility that it could increase further, giving rise to potentially unlimited gains.

Adding The Premium

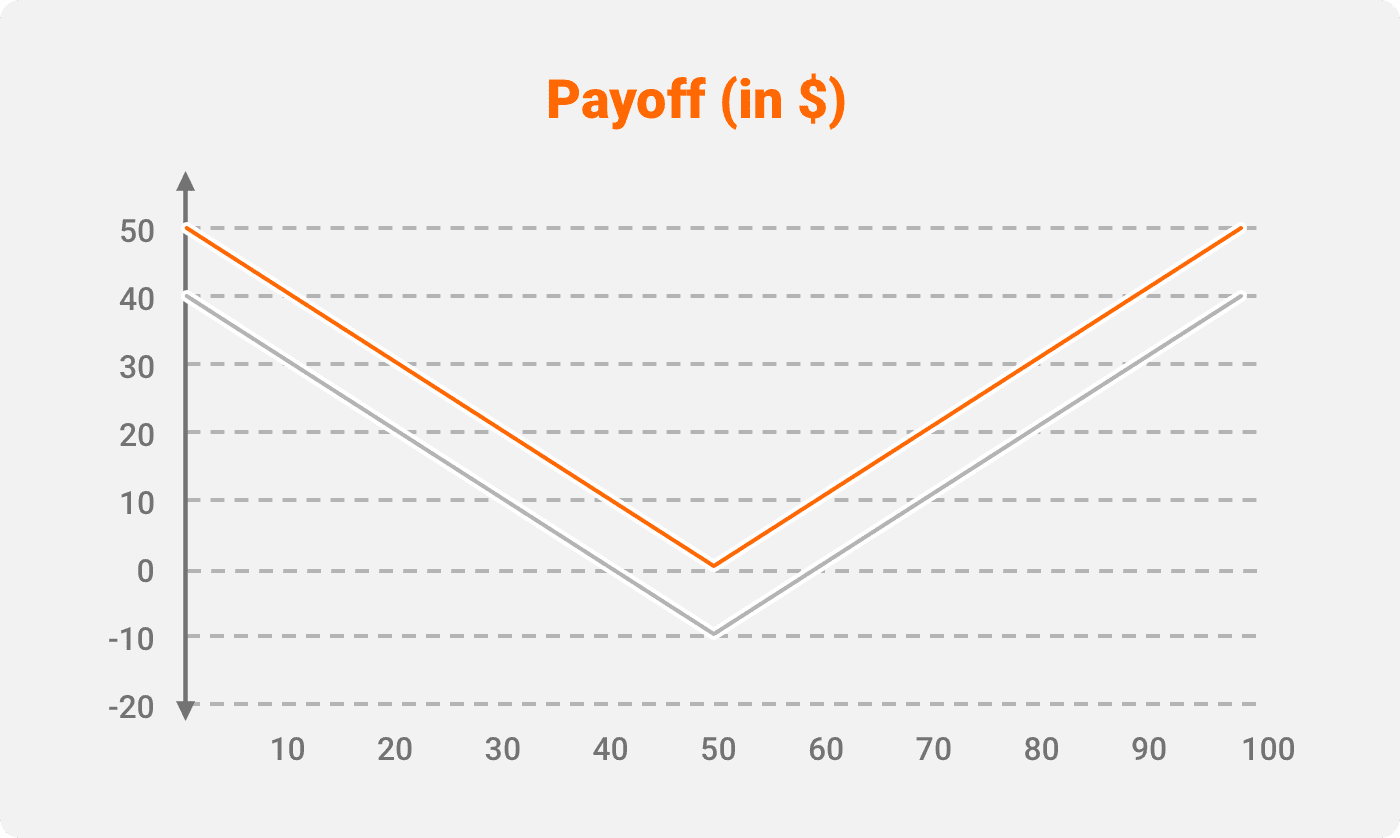

Now let us consider the impact of the premium we still have to pay. In this case, it is $10.

The value of straddle now has to be adjusted by this amount to get the actual payoff. Hence, the equation changes to:

Value of long straddle = max (S – X, X – S) – premium

Let’s revise the table and the payoff diagram accordingly.

| Spot Price (in $) | Payoff (in $) |

| 0 | 40 |

| 5 | 35 |

| 10 | 30 |

| 15 | 25 |

| 20 | 20 |

| 25 | 15 |

| 30 | 10 |

| 35 | 5 |

| 40 | 0 |

| 45 | -5 |

| 50 | -10 |

| 55 | -5 |

| 60 | 0 |

| 65 | 5 |

| 70 | 10 |

| 75 | 15 |

| 80 | 20 |

| 85 | 25 |

| 90 | 30 |

| 95 | 35 |

| 100 | 40 |

We can see that there is a parallel shift in the line once we account for the premium. After we adjust it, each point in the blue line essentially corresponds to a point in the red line.

For the trader to breakeven the share now has to move $10 in either direction. This can be seen in the graph where the blue line touches the X-axis i.e. at $40 and $60 (also highlighted in red in the table).

How can the Long Straddle Help You?

The long straddle is particularly helpful when a trader expects a significant change in price without knowing the direction. Unlike with many other options strategies like short calls, the max loss for the trader is capped at the premium invested. However, there is no limit to the gains that can be obtained. This is possible when the price rises significantly, and the call seeks to gain from such an increase in price.

Straddles have also been an effective strategy when traders anticipate a market crash or a recovery. Not only does it help hedge the portfolio, but there is also a chance that the trader could possibly obtain significant gains. In such cases, paying an extra premium for the straddle is justified. Traders can also use it during times when the implied volatility of an asset is trading extremely low. This could happen during periods of consolidation which is often followed by a breakout that can happen in either direction.

Long Straddle Strategies

You’ll find some of the popular strategies involving the Long Straddle mentioned below:

- During an announcement or event: Traders generally buy a straddle when there is an announcement regarding the earnings or performance of a company. During such instances, the outcome can play a significant role in the movement of price. Other events like interest rate decisions by the Fed also have a significant bearing on the market. These can cause significant momentum swings in the price of an asset.

- When the implied volatility of a share is low: The implied volatility of shares can be calculated using different models and is generally available information. Traders can use this knowledge to predict large possible movements in the share price. When the implied volatility is already high, it would not make sense to buy the straddle since there is a possibility for volatility to come down. Likewise, low implied volatility could create an opportunity for traders.

- Economic slowdown or growth: When there is a significant slowdown or growth in the economy, it often translates into movements in the broader markets. Traders can buy a straddle when they anticipate such changes in the economy.

- Buying Straddle that is not at the money: Traders could have a bias in the direction of movement and accordingly tweak the exercise price. Such strategies can also lead to a reduction in premiums.

Long Straddle vs. Short Straddle

We have discussed the straddle from the perspective of the holder. There are a number of differences between traders going long and those going short.

| Long Straddle | Short Straddle |

| Useful when there is significant movement in the price of an asset | Useful when the price is range-bound |

| It involves simultaneously buying a call and a put at the same exercise price and expiry time | It involves simultaneously selling a call and a put at the same exercise price and expiry time |

| Loss is capped at the premium charged to buy the straddle | No limit on the loss amount; this is due to the fact that the position involves a short call as well |

| An upfront premium is paid to purchase the Straddle | Receives a premium for selling the options |

The short position can be considered a riskier position because there is an unlimited potential for loss associated with it. Unless traders are very sure about the stability of the share price, they generally would not opt to trade a straddle.

F.A.Q.

Theoretically, there is no limit to the maximum profit that can be realized using a long straddle. This happens when the payoff keeps on increasing along with the share price.

The maximum loss that one can incur in a long straddle is the initial premium that is paid. It can, therefore, be considered as a relatively lower risk strategy.

In order to exit a long straddle position, the trader needs to exit his position from both the call and the put that was bought.

A long straddle is profitable during volatile periods. The strategy breaks even when the price moves by the premium amount in either direction. Any further movement away from the exercise price results in a profit for the long position.