If you want to trade Nasdaq Futures, you have two choices: Trading the Micro E-mini Nasdaq (MNQ) or E-mini Nasdaq (NQ) futures. Both have been designed by the CME and are based on the same underlying index. And yet, from a trading perspective, the differences between them can be staggering.

Quick Overview of Micro Nasdaq Futures Trading

Founded in 1971, the Nasdaq is one of the largest stock and security exchanges in the world. It’s second only to the New York Stock Exchange (NYSE). All trades are made electronically through market makers, so traders don’t have to deal directly in a physical location.

Like other futures markets, the Nasdaq futures market is a derivative market. This means the traded futures contracts are tied to underlying instruments.

In this case, both micro Nasdaq futures (MNQ) and e-mini Nasdaq (NQ) futures are based on the Nasdaq-100 Index. Hence it is more appropriate to refer to them as micro e-mini Nasdaq-100 and e-mini Nasdaq-100 Index Futures, respectively.

About the Nasdaq-100 Index

The Nasdaq 100 is a large-cap growth index. It tracks the performance of the 100-plus largest non-financial companies by market capitalization that are listed on the Nasdaq stock exchange. Most of these companies operate in the technology and biotechnology industries, accounting for over 50% of the index’s weighting.

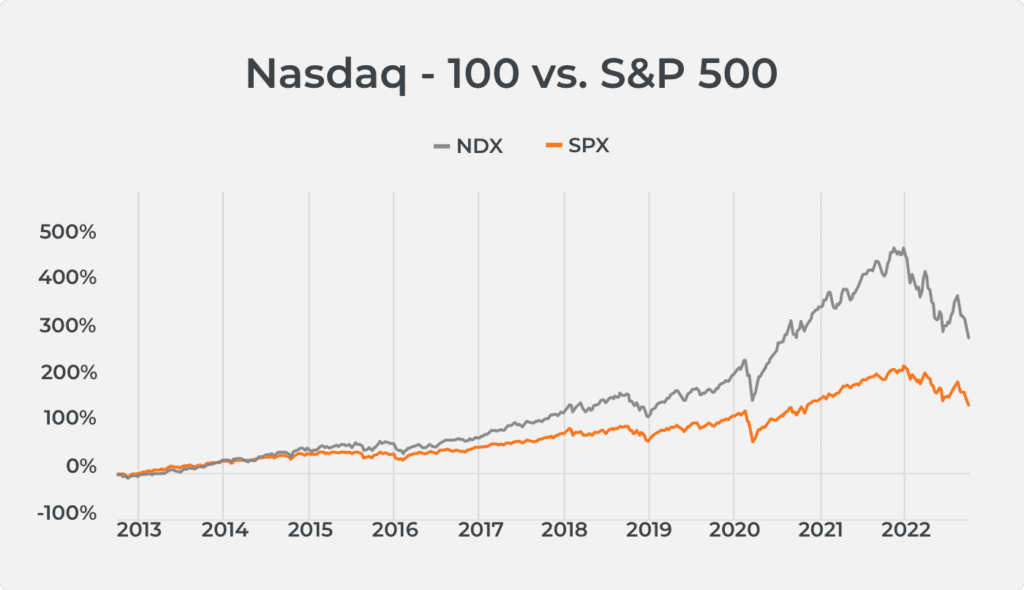

As for why it is such a popular option among today’s traders, it’s because, in recent years, the Nasdaq 100 has performed considerably better compared to many other leading indexes, including the S&P 500.

What are Micro Nasdaq Futures?

Micro e-mini Nasdaq-100 futures are leveraged instruments that enable futures traders to speculate on the Nasdaq-100 index in an efficient and cost-effective manner.

These futures contracts are deemed “micro” because they are 1/10th the size of standard e-mini Nasdaq-100 futures. MNQ contracts are priced at $2 times[1] [2] the Nasdaq-100 Index, and each tick is worth $0.50, compared to $5 for the NQ contract.

MNQ futures were launched by the Chicago Mercantile Exchange (CME) Group in May 2019. These futures are targeted at traders looking to gain exposure to the Nasdaq-100 index without having to raise large investing capital.

Like other types of futures contracts, the micro e-mini Nasdaq-100 obligates owners to fulfill their contracts at specific settlement dates. Micro Nasdaq futures are typically settled in cash. It’s calculated as the difference between the price when the contract was bought or sold and the index’s current price at the time of settlement.

MNQ futures are traded around the clock with participants from all over the world. Some traders turn to them as a way to hedge their exposure against overall market risk. Because it is a tech-heavy index instrument, many traders also use these micro futures as a way to find and capitalize on diversification opportunities.

What are e-mini Nasdaq-100 Futures?

NQ futures are also instruments designed by the CME group. Its purpose is to facilitate cost-effective access to the Nasdaq-100 Index and participate in its price developments. They were launched in 1999 at $20 times the value of the Nasdaq 100. Doing so allowed traders who before couldn’t trade the highly-priced Nasdaq 100 futures (priced at $100 times the index) to finally get in on the action.

E-mini Nasdaq futures are traded nearly 24 hours every trading day.

Because they are leveraged products, traders are able to enter and exit trades with less capital. However, it’s important to remember that while there is a chance for high gains when trading with leverage, there’s also the chance for significant losses.

MNQ Tick Value And Contract Details

To better understand how MNQ futures work, here’s a quick look at the contract specs for micro Nasdaq futures as outlined on the CME website:

| Contract Unit | $2 x Nasdaq-100 Index |

| Price Quotation | MNQ futures prices are expressed in U.S. dollars and cents |

| Trading Hours | Trading on CME Globex is open from Sunday 6:00 PM to Friday 5:00 PM Eastern Time (5:00 PM. – 4:00 PM Central Time).There’s a one-hour maintenance period every day from 5:00 PM to 6:00 PM ETOn CME ClearPort, trading is open from Sunday 6:00 PM to Friday 6:45 PM ET |

| Product Code | CME Globex: MNQCME ClearPort: MNQClearing: MNQ |

| Minimum Price Fluctuation | MNQ futures have a minimum tick of 0.25 index points, and tick value of $0.50 |

| Listed Contracts | Contracts are listed quarterly — March, June, September, and December — for five consecutive quarters |

| Method of Settlement | Financially Settled (most of the time, cash) |

| Trading Termination | Trading is terminated on the 3rd Friday of the contract month at 9:30 AM Eastern Time |

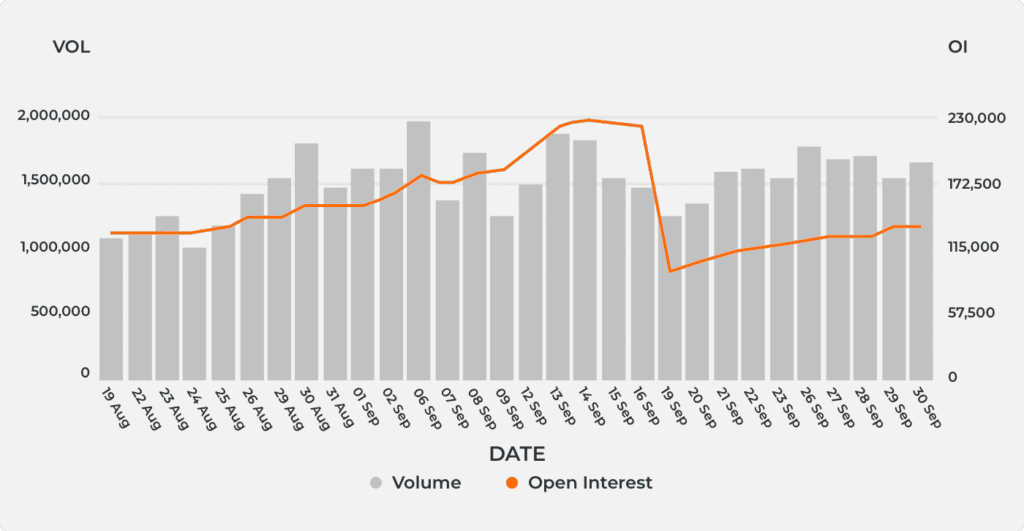

Since their official launch in 2019, micro Nasdaq futures have enjoyed a strong start in the market, with trading volumes that continuously rose month on month. And even though it was terribly affected by the COVID pandemic in 2020, much like every other traded instrument on the Nasdaq exchange, MNQ futures were able to maintain a reasonably strong trading volume throughout the period.

Due to its heavy representation of technology companies, the Nasdaq-100 index is a widely used indicator of how the telecom, technology, and biotechnology sectors are performing. However, this also means that the index’s performance is somewhat tied to the performance of individual stocks in certain sectors.

Apple, Microsoft, Alphabet (Google’s parent company), Amazon, Meta (formerly Facebook), and Tesla are among the biggest movers in the index. So if any of these stocks are down for the day, there’s a good chance the Nasdaq 100, and by extension, MNQ futures trading, will be impacted. That’s why it’s important to master a few trading strategies before committing your capital to it.

Popular Strategies for Trading MNQ Futures

There are a number of strategies worth looking at when it comes to trading MNQ futures, especially for beginner traders. These include:

Breakout Trading

As the name suggests, this strategy is applied when the asset’s price breaks out of its usual chart patterns. There is a huge potential for profitable trading when this occurs because the price becomes volatile, allowing you to take positions in the direction of the price movement. However, this means you need to know how to recognize chart patterns and what they signal.

To properly utilize breakout trading, it’s important to prepare for breakouts beforehand. You do it by setting up pending buy and sell stops so you can automatically make money when the breakout begins. It’s also a good idea to set up stop-loss targets. That way, you minimize your risk of loss should the breakout turn in the other direction.

Pullback Strategy

This strategy involves taking advantage of price pullbacks to make money. A “pullback” is when the price reverses after an initial upward or downward movement past the Support/Resistance levels.

Depending on the direction of the underlying trend, traders can enter long or short positions to make a profit from the resulting price changes.

Pullbacks are generally inevitable in any trading scenario. They typically occur when traders start cashing out their profits. Doing so drives the price in the opposite direction, causing a “pullback.”

Fundamental Trading

As mentioned before, micro Nasdaq futures are based on the performance of 100 companies. As such, conducting fundamental analyses for these companies can help provide very useful insights into how they might perform in the short and long term.

This requires continuously studying reports about the companies in the Nasdaq-100 index and tracking major announcements that may impact their individual stock prices.

Some of the most important indicators in fundamental trading include Earnings per Share (EPS), Price to Earnings Ratio (P/E), Free Cash Flow (FCF), Dividend Payout Ratio (DPR), and Debt-to-Equity Ratio (D/E). You can usually find these in company reports.

MNQ Futures vs. NQ Futures

The biggest difference between MNQ and NQ futures is the size of the notional values of their contracts. Where NQ futures have a contract size of $20 x Nasdaq-100 Index, MNQ futures have a contract size 1/10th of NQ futures — $2 x Nasdaq-100 Index.

The difference in contract size also impacts their minimum tick values. NQ futures have a minimum tick value of $5.00, whereas MNQ futures are at 1/10th of the value at $0.50.

This makes MNQ futures trading considerably more accessible to traders who do not possess high amounts of trading capital.

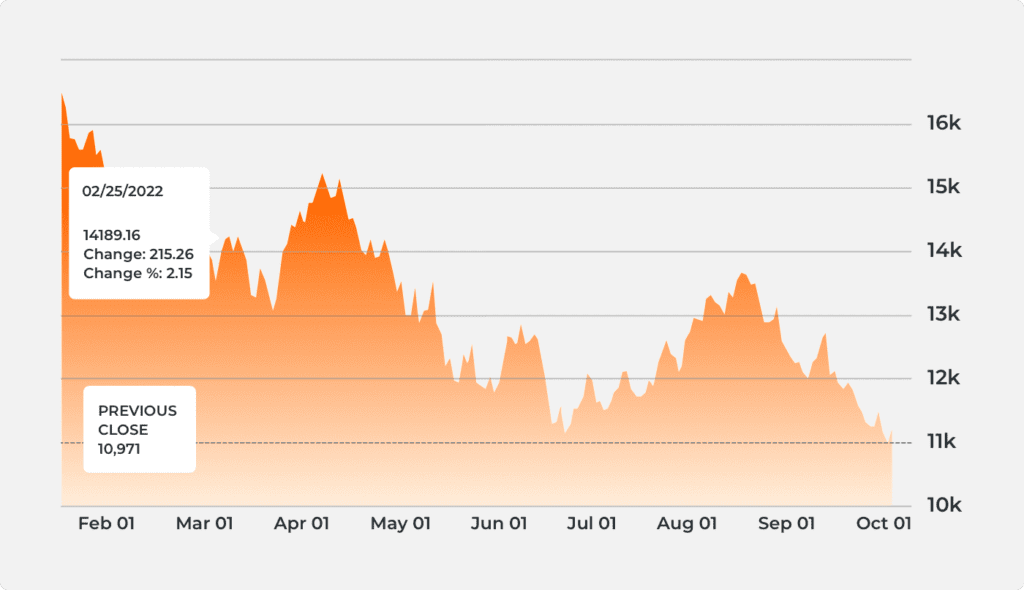

At the same time, MNQ and NQ futures have huge differences in potential profits and losses. For example, based on the chart below, let’s assume that the NASDAQ-100 Index is at 11,200 points as of October 3, 2022.

If NQ futures rise or fall by 100 points, this would mean a gain or loss of $2,000

- (100 points/0.25 min tick = 400 ticks)

- 400 x $5.00 = $2,000

On the other hand, if MNQ futures rise or fall by the same number of points, this will equate to a gain or loss of only $200.

- (100 points/0.25 min tick = 400 ticks)

- 400 x $0.50 = $200

Final Thoughts

Both instruments are pegged to the same underlying index. However, NQ and MNQ futures have different capital requirements and cost efficiencies. Ultimately, when deciding between them, you’ll have to determine which opportunities and risks best suit your financial goals and capital resources.

As with any other traded financial instrument, keep in mind that trading micro futures involves substantial risk of loss. Therefore, it may not be suitable for all traders/investors.