The first thing that many people imagine upon hearing the term “commodity” is often crude oil. The reason for that is crude oil’s popularity. It touches almost every industry in the global economy and has massively contributed to shaping the world as we know it. It affects all our day-to-day activities and is present in everything around us. Although the world is now actively seeking ways to turn to sustainable and green resources, crude oil is expected to continue holding its leading position in the commodity market for the long term.

Oil-related events dominate global news on a daily basis. From the largest IPO in history, through the constant volatility and bouncing liquidity, to international trade wars and military conflicts – oil has been a mainstay in the most significant events of the last few decades. However, although the commodity is so popular, it remains a hard-to-predict instrument that investors often struggle to trade successfully.

To become fully prepared and educated to trade crude oil futures successfully, you should first start by understanding the basics of the commodity. That way, you will be able to explain the key drivers of the price and make better predictions and more accurate analyses. So, let’s not waste more time and explore the world of the most widely-recognized commodity on a global scale – crude oil.

Getting to know Oil Futures

Crude oil is everywhere around us. When you turn on your light, when you cook your dinner, when you drive your car, even when you choose your clothes – all of these everyday activities are related to crude oil. But how is that?

Living organisms that died millionths of years ago decomposed over time and mixed with the soil. Under various external factors such as rain, wind, and sunlight, they transformed themselves into so-called “fossil fuels.” Coal, gas, and crude oil – all of these are examples of popular fossil fuels. They are found deep below the ground surface in the various layers of the Earth. Crude oil, for example, is mostly present in sedimentary rocks in the Earth’s crust. Over time, the mix of different organic molecules left from dead marine life combined with sediment, and under the influence of other natural factors, formed crude oil. However, crude oil is not always the same – its composition may vary, depending on its geo-location.

Crude oil can be extracted from the ground in three main ways. The first one is called “primary recovery” and is relatively more straightforward when compared to the others. It is applied when, under the influence of ground pressure, the oil has naturally risen to the surface and can be directly collected. The next method is called “secondary recovery.” It requires an injection of water or gas into the oil reservoir to move it to the surface for collection. The third one is called “Enhanced Oil Recovery” (EOR) and is also based on the use of additives (water, gas, or polymers) to affect the structure of the oil reservoir and make it flow smoothly to the surface for collection. While primary recovery usually collects 10% of the oil in the reservoir, secondary recovery accounts for 20% – 40%. EOR is the most efficient methodology as it recovers from 30% to 60% of the reservoir’s supply.

Today, crude oil can be found anywhere – from the production of gasoline, diesel, and kerosene, through the textile industry, cosmetics, steel, tires, and fertilizers production, to plastics, asphalt, sunscreen, and even smartphones. In fact, when combined with other chemicals and raw materials, crude oil is a base for more than 6 000 different products. However, although the resource is so important and widely adopted, it is worth noting that it is not ready for direct usage. First of all, crude oil has to be refined and separated into multiple petroleum products, all of which have different applications.

You may also like:

The Oil Futures Market

Oil futures contracts are the most commonly used method of buying and selling oil. They are used not only by traders but also importers and exporters who aim at hedging against unexpected events that may have an adverse effect on the oil price volatility.

Oil futures are traded on exchanges in the form of different oil benchmarks. The idea of having a benchmark is to help traders identify the quality and the origin of the oil they are trading. Due to the fact that oil may have different quality depending on its drilling location, it is always important for traders to get familiar with such details as they can influence the price of the commodity (for example – if the oil comes from Iraq and the country’s biggest importer introduces a trade restriction against it, then the cost of the commodity will be massively influenced).

Crude Oil Specifications

| Product symbol | CL |

| Contract size | 1,000 barrels (approx. 136 metric tons) |

| Price fluctuation | $10.00 per contract ($0.01 per barrel) |

| Trading months | Monthly contracts are listed for the current year and the next 10 calendar years, and 2 additional contract months. List monthly contracts for a new calendar year and 2 additional contract months following the termination of trading in the December contract of the current year. |

| Termination of Trading | Trading terminates 3 business days before the twenty-fifth calendar day of the month prior to the contract month. If the twenty-fifth calendar day is not a business day, trading terminates 3 business days before the business day preceding the twenty-fifth calendar day. |

| Trading hours | Sunday – Friday: 6:00 p.m. – 5:00 p.m. (5:00 p.m. – 4:00 p.m. CT) with a 60-minute break each day beginning at 5:00 p.m. (4:00 p.m. CT) |

Source: CME

The two most popular oil benchmarks are West Texas Intermediate (WTI) and Brent Crude. WTI is drilled mainly in the US, in states like Texas, North Dakota, and Louisiana. Brent Crude, on the other hand, is drilled from oil fields in a variety of locations, such as the North Sea, Oseberg, Ekosfisk, and others near the shores of Norway and the UK. Thanks to the oil being drilled so close to the coast, it is relatively easy and cheap to transport internationally.

In order to monitor the price of the commodity, the Organization of the Petroleum Exporting Countries (OPEC) has created a so-called “basket.” OPEC’s basket price takes the prices at which the commodity is traded in the separate member countries and calculates the average one. Usually, OPEC prices are lower because the oil from some of the nations included in the basket has higher sulfur content (which makes it less useful for fuel-related applications).

Tips on How to Trade Oil Futures

John Maynard Keynes has said that one should invest only in what he knows and what he understands. Although crude oil is one of the most popular commodities worldwide, many investors struggle to get the basics and understand the commodity’s price mechanics. It is worth knowing that oil’s price is not driven only by supply and demand. There are plenty of other factors and external drivers that may influence its price and future trajectory. To get a better sense of them, let’s deep-dive into some of the commodity’s characteristics:

1. The supply is finite

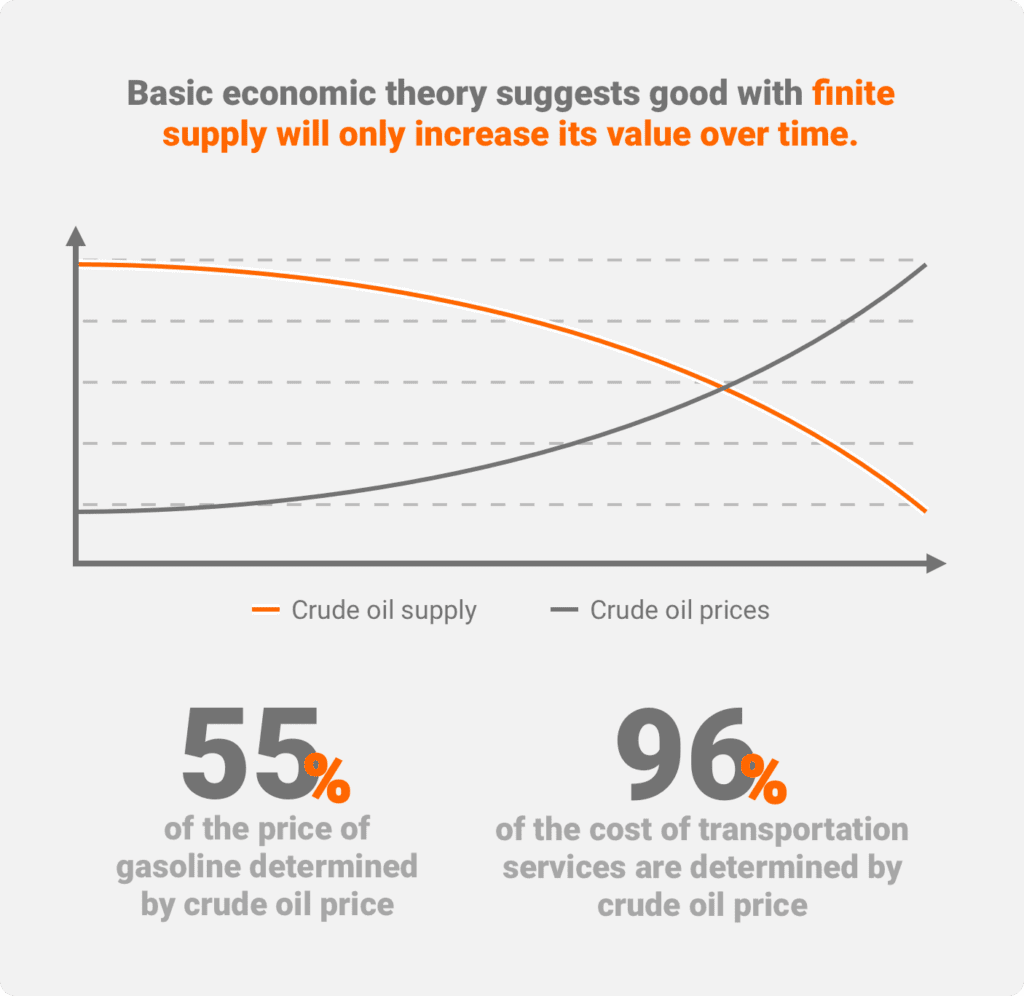

The basic economic theory suggests that a good with finite supply will only increase its value over time. However, the case with crude oil is unique since additional crude oil is frequently discovered, and its output is controlled. Although the planet’s oil reserves will, at some point, come to an end (experts suggest that the Earth will run out of crude oil in about 30 years, considering the current rate of usage), there are promising signs that humanity will try to mitigate the effect and migrate to sustainable technologies and products, in which crude oil is not a key ingredient.

Although a Canadian Geological Survey, conducted in 1975, concluded that it is likely that all larger pools of oil have already been found, nowadays, new sources are still being discovered. However, this does not mean that we will be able to use oil for eternity. It just prolongs the moment when oil supplies will finally dry up. And like every other commodity, the price of oil futures (CL) depends on supply and demand.

In addition, OPEC sets production quotas for member countries and tries to control the supply/demand ratio in order to maintain price stability. However, there are factors outside its control that may affect it in the long term. And of course, regardless of how many oil fields are discovered or how much the production of the commodity is regulated, we must come back to the fact that oil’s production and supply are finite.

So, why is the regulation of the oil price so important? The truth reveals the fundamental importance of crude because changes in its price can directly influence many other industries. For example, crude oil’s price determines approximately 55% of the price of gasoline and 96% of the cost of transportation services. The chain effect from all this is well-known as it affects everything from industrial products and manufacturing, through electricity, to food prices. In a nutshell – the oil price is so systemically important that it can create inflation.

2. Two main factors drive the price of crude oil

Crude oil is often considered a useful indicator for the state of the global economy. To understand why we should, first of all, focus on the two major factors that influence its price:

The economic factor

In recessions or periods with low economic growth, people often seek ways to cut their costs. One of the major expenses on the family budget is the cost of fuel. That is why if the economy is in a bad state, individuals tend to drive less often. Airlines also witness a drop in the number of tickets sold as people do not have the spending power to afford to go abroad and travel as much as when the economy is booming. This means that there is an overall decline in the demand for oil which directly influences its price.

The geopolitical factor

The global political landscape is the other detrimental factor when it comes to oil prices. Wars (think of the one in Afghanistan and Iraq) and political turmoil often lead to changes in the cost of the commodity. For example, when the Libyan Civil war began in 2011, crude prices rose 25% in the space of just a few months. It is worth noting also that some of the biggest oil producers worldwide happen to be countries and regions that are known for their fragile political environment. A big chunk of crude oil’s production comes from Saudi Arabia, Kuwait, Nigeria, Russia, and others.

Aside from those two, there are other secondary factors that may influence the price of oil. For example, think about the seasonality factor. During the summer people usually travel more and enjoy vacations at more exotic destinations. This means that there is a higher demand for fuel. During the colder periods of the year, however, households have much higher costs and demand for energy to heat their homes.

3. Being able to predict its price is hard. Even for industry-professionals

At an event in July 2015, we were speaking to one of the world’s most recognized oil industry experts. He is in a crucial management position in one of the top three oil production companies worldwide. His signature authorizes the launch of multi-million research operations in basins all around the world. He told us back then that he was willing to make a bet with anyone and for anything that the price of crude oil would close the year at no less than $65 per barrel (at the time, it was approximately $56 per barrel). Needless to say, we didn’t have the courage to risk betting against such an expert in his field and decided just to observe his prognosis. Five months later, the price of the crude oil futures (CL) closed the year at $37 per barrel.

What this example comes to show is that even the biggest players in the industry often struggle to make accurate prognoses and can go way out of bounds with their price estimations. Warren Buffet has a very interesting quote that is entirely legitimate when it comes to oil futures as well:

“We have long felt that the only value of stock forecasters is to make fortune-tellers look good.” –

Warren Buffett

Predicting oil futures prices is among the hardest tasks for commodity analysts. Frequently referred to as the “wild west” of financial markets, oil futures trading has a reputation of being a very volatile and dynamic process. This is all because of the multiple factors that can influence the price of the commodity, as well as the futures trading mechanics. For example, since futures have an expiration date and lose much of their value as they draw close to expiry, traders often must move quickly. This creates pressure, which sometimes is very hard to bear for beginners.

Although determining the exact price of oil futures (CL) is difficult, you should do your homework and base your trading decisions on proper research and analysis, including but not limited to supply and demand charts, current political landscape, weather patterns, seasonality, progress in other fields (alternative fuels, for example), and so on.

Last but not least, don’t forget that even when you have done all your homework, the oil futures market can still surprise you with a black-swan event. So is the case of Stephen Perkins – an employee of the London-based PVM Oil Futures who, after a weekend of heavy drinking, traded 7 million barrels of oil, worth approximately $520 million in the span of 2.5 hours. The case took place in June 2009 and resulted in a worldwide price increase of $1.5 per barrel for Brent Crude (from $71.40 to $73.50 per barrel). It was followed by a sharp market reverse. Such a price jump usually is associated with major geopolitical events.

4. Reports and industry analysis to keep track of

Although oil price movements are often unpredictable, it is mandatory to keep track of industry developments and potential price-moving events. That is why it is a good idea to keep an eye on the weekly reports from the Energy Information Administration (EIA). The Crude Oil Inventories segment measures the weekly change in the number of barrels of commercial crude oil held by US firms. This can help you get a sense of potential price movements for petroleum products, which can have a direct effect on inflation. For example – if there is an increase in crude oil inventories, there will be a weaker demand which will decrease the price and vice-versa. The reports are issued weekly and are released every Wednesday, around 10:30 p.m. ET.

Energy Information Administration (EIA)

- Weekly release

- Measures the weekly change in the number of barrels of commercial crude oil held by US firms

American Petroleum Institute (API)

- Released every Wednesday

- Highlights the most important petroleum products that account for more than 80% of total refinery production

The American Petroleum Institute (API) also issues a very useful report for traders. The weekly statistical analysis highlights the most important petroleum products that account for more than 80% of total refinery production, and crude oil inventories are also included. This data is typically released on Tuesday at 16:30ET/21:30 London time.

5. A major environmental concern and the main reason for the greenhouse effect

Although oil remains the most popular and efficient fuel, its days may be numbered due to the harm it does to our planet. The process of burning oil and gasoline releases CO2 into the environment. The gas remains in the atmosphere and acts like a blanket covering the earth – it captures the heat that bounces back from the surface and creates the so-called “greenhouse effect.”

According to environmentalists, since 1880, oil-burning has resulted in a 43% increase in CO2 emissions, which has raised global temperature by 1°C. Moreover, the worst part is that this whole process continues. The consequences of global warming are well-known – from increased droughts and heatwaves, through wildfires and hurricanes, to shorter and colder winters and longer and warmer summers. That is why humanity is seeking ways to wean off of oil and find alternatives that will help us conserve our planet.

New sources of energy (also known as green energy) are developed and tested all the time. The mainstream adoption of new energy sources, which will undoubtedly become a reality at some point, will drastically reduce the price of oil. That is why the biggest producers of the “black gold” have started to seek additional ways to maintain their economic growth rate and prepare for a future with less oil.

“There is an urgent need to stop subsidizing the fossil fuel industry, dramatically reduce wasted energy, and significantly shift our power supplies from oil, coal, and natural gas to wind, solar, geothermal, and other renewable energy sources.” –

Bill McKibben

6. Oil production is a time-consuming process and requires megaprojects

Oil production requires years of research and lots of investments. Think of the process as something similar to the pharmaceutical industry – there are years of laboratory analysis, and in the end, the result may still not be as satisfactory as planned. That is why in the last few decades, oil companies have tried to change their trajectory in a bid to cut costs. Today, an oil company will commence drilling when it is close to 90% confident about the quality and the amount of oil that it will be able to extract from the ground. And even today, many companies spend millions of dollars on projects that do not live up to their initial potential and estimated ROI.

EY’s “Spotlight on Oil and Gas Megaprojects” report states that megaprojects are becoming the norm in the industry. It also adds that the era of “easy oil” is nearing its end, and companies are now seeking additional ways to extract oil. However, all these alternative methodologies (shale gas, light tight oil, oil sands, ultra-deepwater, etc.) require massive investments. These megaprojects often fail to deliver on time or meet their initial budgets – EY’s statistics point out that 64% of megaprojects are facing cost overruns, while 73% report schedule delays. It adds that completion costs are 59% higher than initially expected, which represents an incremental cost of $500 bn.

But how is this important to you, the trader? When trading oil futures (CL), you should be fully aware of all the developments in the sector – not only the present ones but also those that have taken place during the last few years. If, for example, there is a major research project that is entering its final phase and will soon reveal whether a particular basin has abundant oil resources, you should expect it and keep track of it as it will have a notable effect on the price of the commodity. The uncertainty around megaprojects (whether they will prove to be a success or not) usually leads to increased price volatility. Combine that with ongoing global economic developments or a shaky macroeconomic situation, and you will end up in a hard-to-navigate situation where you will have to hedge your portfolio against upcoming market disruptions.

7. Trading oil futures (CL) is recommended after initial backtesting

Many traders make the mistake of jumping directly into the deep water. Although this may sometimes work with instruments where you buy the market (ETFs) and catch a long-term trend, when it comes to oil futures, things are quite the opposite. Even the most informed and educated professionals often have periods where they struggle to remain profitable.

That is why, before risking real money, the best thing to do is to focus on hours of preliminary research. Or, in other words – to backtest your initial strategy and see how it would have performed, should you have applied it a few years back. Such trading scenarios are handled through statistical software like R or Python, as well as pre-programmed spreadsheets or integrated features in the most popular trading platforms. So, there really are a lot of options to choose from. Once you choose a suitable backtesting tool, make sure to test your strategy not only backward but in real-time as well by using simulating real trading activity. That way, you will be able to understand in detail how your trading plan performs in the current market environment. Before you risk real money…

- The best thing to do is to focus on hours of preliminary research.

- Backtest your initial strategy and see how it would have performed through statistical software like R or Python.

- Once you choose your backtesting tool, test your strategy not only backward, but in real-time as well, by using simulating real trading activity.

Bear in mind that the more you backtest, the more information you gather and the better analysis you will be able to conduct. By analyzing the performance of your strategy in different market conditions (low/high demand for oil futures, increased volatility periods, performance of the commodity during trade wars or global conflicts, dependence on the seasonality factor, etc.), you will be more prepared about what to expect in the future, thus becoming a better and more confident trader. This will also help you create a reasonable trading plan and a positive profit expectancy for your trades. By sticking to the plan, you will be able to control your emotions, respect the risk and become more balanced in your decisions, and thus avoid the devastating losses typical for rash traders in the oil futures markets.

In a nutshell

Oil futures (CL) trading is one of the most lucrative niches. However, it is one of the riskiest as well. Traders often get involved due to the massive profit opportunities. Blinded by the extreme potential returns, they often forget how to control their emotions and navigate such a dynamic niche. However, this overexcitement often leads to negative outcomes. From corporate to individual traders – many have ended up underestimating the risks of oil futures trading, which have resulted in some of the biggest losses in history.

The good thing, though, is that if you do your homework and back your intuition and trading skills with enough knowledge and in-depth industry understanding, then trading oil futures can certainly become a full-time career. Make sure to create a concrete trading plan and stick to it, no matter what happens. That way, you will remain focused and trade in a balanced and organized way.

If you’re curious about what’s going on in the Crude Oil markets right now, check out this update by Chris:

Once you have your trading plan, try putting it to the test by taking The Trader Career Path here.