Paper trading has a long history. The concept originated long before the advent of the Internet and online-based trading platforms. It dates back to the days before online demo accounts became popular. At the time, beginner stock traders would write down at what price they wanted to buy or sell a stock. At the end of the day, these novice traders would compare the market price with their entry price. Doing so helped them measure their speculative performance. This article will talk in-depth about what paper trading is. At the end we’ll also give you a few tips on how to use it.

What is Paper Trading?

The best aspect of paper trading is that you get to experience trading without risking a single penny.

However, the concept of paper trading has evolved over a few decades as trading became more digitized. Now, traders do not need to use a pen and a piece of paper to track their so-called “open positions.” Instead, most trading platforms offer traders a built-in demo trading account. The demo account allows them to mimic the trading experience of live trading. This way they can try out all the bells and whistles that the platform has to offer.

Let’s make it simple. If you wanted to buy a stock and the stock price closed below your market entry price, you write it off as a loss. If you wanted to short the stock and the stock price ended up closing above your market entry, that’s also a loss. With paper trading, it’s better to note your number of losing trades rather than their dollar value. Alternatively, you may simply want to evaluate the performance of a trading strategy. The most common measures to examine are the win rate, the risk to reward ratios, and the system’s overall profitability.

Nowadays, the process of paper trading with a demo account seems almost identical to trading with real money. However, there is a key difference. When paper trading with a demo account, you are not putting your hard-earned capital on the line. Instead, you are trading with virtual money. This lets you test the trading platform, your own trading strategy, and develop confidence in your day trading ability.

The use of paper trading to improve your real trading performance seems simple and straightforward. However, there is more to paper trading than meets the eye.

The benefits of paper trading

- You can use paper trading to explore your comfort zone.

- It can help you earn the confidence you need to deal with stress while trading with live funds.

- You can test your strategy to see if it’s viable on the market.

Once you learn how to place trades on a demo trading account, the next step is to hone your money management skills. Doing so will help you avoid trading more than your account can support. Moreover, while paper trading, you can try out different order placement methods. For example, using pending stop and limit orders to get comfortable with them and discover your preferred way of trading. You can also try trading the markets on different time frames. That will help you see how well you can deal with a fast-moving price on a five-minute chart. The experience is significantly different from simply looking at a daily chart.

Doing all of the above on a paper trading account will add up to building your confidence. However, the most important aspect would be learning if you can trade profitability over a certain number of weeks and months. If you can trade profitably for several consecutive months, it will work wonders to build your confidence.

You may also like:

How does paper trading work? Important tips for beginners

If you’re just starting out and don’t have much experience with paper trading or you don’t know how it can help you improve, here are a few valuable tips.

It Can Help You Gain Confidence

Most people grow up to admire certainty. Partly because most skills we learn in schools have hardly any ambiguity to them. In most jobs, two plus two always add up to four. However, trading by its nature always deals with uncertainty and risks.

Professional traders, who come from a finance background, are often trained to quantify uncertainty. On the other hand, most retail traders do not know how to cope with the stress that is part and parcel of being a day trader.

Even if you have the best trading strategy, ample capital, and all the confidence in the world, it’s not necessarily enough. If you don’t know how to deal with uncertainty and risks, day trading can end up being an emotional rollercoaster. For some traders, it can crush self-confidence and cut their trading career short.

However, if you start with paper trading, it can help you earn the confidence you need.

By contrast, if you know that you do not have the patience to sit in front of a screen the whole day, you can start looking for more short-term oriented trading systems. For example, try using a 5 and 20-period moving average cross.

If you can use paper trading to explore your comfort zone, you can become confident in your ability to trade. It will help you become profitable in the long run. Imagine paper trading as a virtual reality cockpit, and you are training to become a pilot. Some day you will need to maneuver a multi-million-dollar aircraft! Your job is to reach your destination without crashing.

Would you suddenly sit in the real cockpit and have the confidence to fly a Boeing 777? Most people don’t.

Match Your Paper Trading Account Balance to Your Live Account

If you’ve visited any broker’s website, you have probably seen the advertisements for free $50,000 paper trading accounts. When trading with virtual money, it doesn’t matter if you have $50,000 in your account or a million.

However, there is a strong case for keeping your demo account balance close to what you would have in a live account. As far as human psychology goes, we are creatures of. We are prone to judge the changing numbers based on our short-term memory or recent experiences. Trading is no exception.

If you’re a retail trader who wants to start trading with only $10,000 but practices on a paper trading account of $100,000, a lot can go wrong. First, you will train your brain to see much higher numbers in your account statement’s profit and loss column. Second, when you calculate your position size, your orders will be ten times higher than what you would normally be trading with a real account. Even with a sound money management system, that can be quite jarring.

| Account | Paper trading account with a balance of $100,000 | Live trading account with a balance of $10,000 |

| Risk Level | A loss of $1,000 is 1% of your account balance | A loss of $1,000 is 10% of your account balance |

| Position Sizing | Orders are 10x bigger | You might feel desensitized to relatively smaller losses |

| Loss Tolerance | You train your brain to see much higher numbers in your P&L column | You may hold your losses for too long hoping they’ll reverse |

There’s no guaranteed negative effect

We’re not saying conclusively that it will harm how you trade. Nonetheless, if you train your brain to deal with larger numbers during paper trading, it can certainly mess with your judgement. Especially if you are just starting out as a trader.

Once you switch to a live account with a much lower account balance, you might feel emotionally desensitized to relatively smaller losses. For example, let’s say you have been risking $1,000 per trade on a $100,000 demo account. Suddenly you switch to a $10,000 live account, and seeing a $500 loss may not alarm you as much as it should.

Many beginner traders make the mistake of holding on to their losses for longer than they should. Holding onto losing trades in hopes that the market will soon reverse is dangerous. It may sound counter-intuitive, but the larger the accumulated losses, the harder it becomes for novice traders to accept it. Do not let trading with a large demo account negatively affect how you deal with stress and assign a value to the capital in your account.

Use It to Avoid Curve Fitted Systems

You have probably heard about backtesting. It is essentially the process of finding out if a strategy would have worked in the past. You can find thousands of allegedly “profitable trading strategies” for sale with a simple Google search. The developers of these software often promise an outrageous return on your investment.

The problem is, most of these ready-made trading systems are created by curve fitting. Developing a profitable strategy is hard work. However, it’s surprisingly easy to make your system look like it works like magic. All it takes is looking at the chart history and tweak your indicator settings to match the historical data.

When you come across a system claiming to offer extraordinary returns, be skeptical. Always make sure you try out the system for several months. Don’t forget to use a mixture of assets and timeframes on a paper trading account before you start using it with your live account.

The importance of forward testing

Trading a system with a demo account in real-time is called forward testing. When you forward the test, you can also play around with certain system parameters to match your personal trading style. That’s how you find something that suits your comfort zone.

Some veteran traders say that forward testing with a paper trading account does not give them a realistic psychological experience since no real money is lost or gained. They often advocate traders to open micro trading accounts and trade pennies to get a feel for it.

It is always better to test a system out with paper money instead of risking even pennies when forward testing. After all, you can always forward test a system for a few weeks before trying out with your micro account. If all goes well, trade your larger account with the system later.

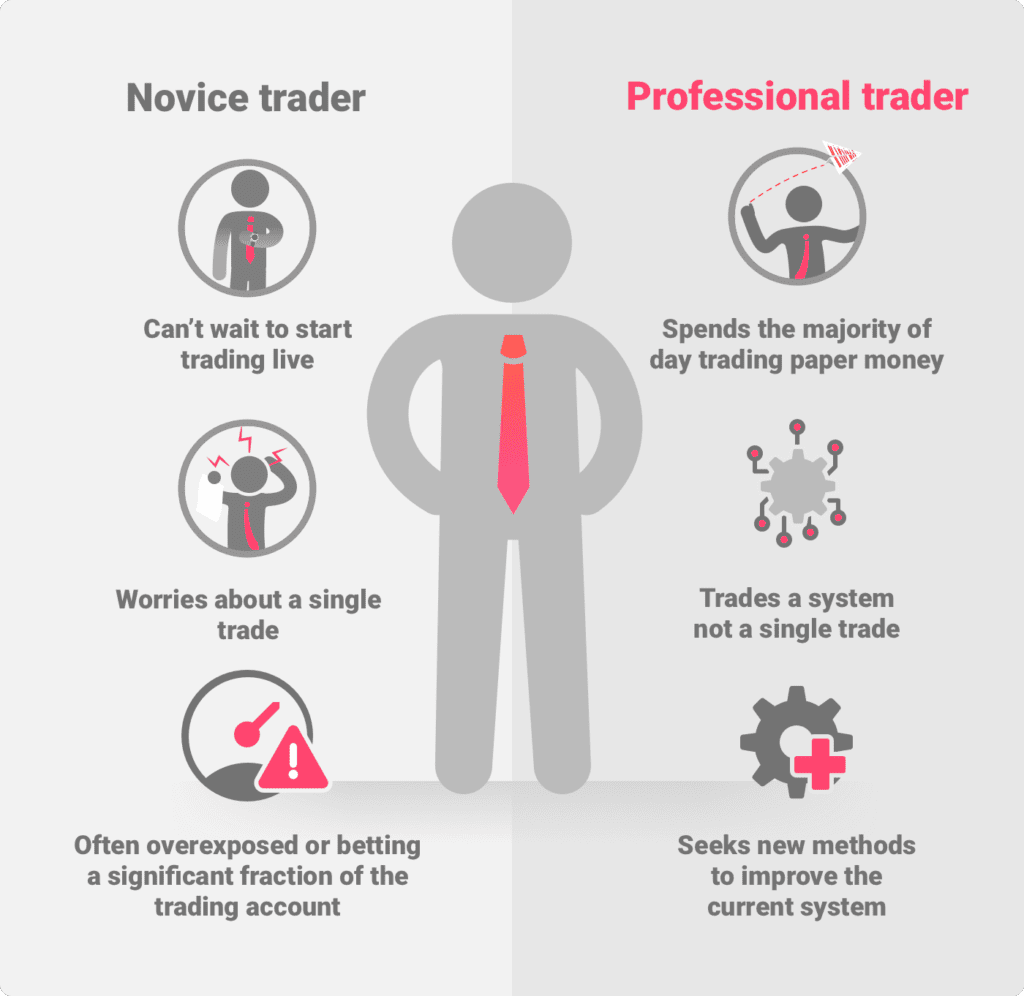

Professional Traders Do More Paper Trading than Actual Live Trading

When starting out as a day trader, people are often eager to get right into it with real money. For many novice traders, the inherent risks associated with trading are a source of excitement rather than something to be worried about.

That’s why a lot of people associate inexperienced retail traders with gamblers. The two groups often share the same need for thrill. On the contrary, many professional traders will tell you they actually spend more time trading paper money. Professional traders do not trade to win a particular trade. They trade a system.

Most inexperienced traders worry about the outcome of a single trade. Probably because they are overexposed or staking 10 percent of their account in one go. Professional traders are much more meticulous about their risk management.

Institutional traders know that their system offers them an edge over the market if they strictly follow their rules. Over a series of 100 trades, they will win a certain percentage with a certain risk-reward ratio that will make them profitable.

That’s why professional traders take their paper trading seriously. They don’t just sit on their hands waiting for the market to present them with the perfect entry opportunity. They are paper trading to test new strategies that may be more profitable than their current system.

A Demo Account is No Substitute for a Real Account

Keep in mind that paper trading is not a substitute for trading with a real account. In fact, if you trade a demo account for extensive periods of time, it can backfire and hurt your trading career later on.

Paper trading has no consequences. With paper trading, you only invest your time and have no “skin in the game.” If you want to gain real trading experience, a paper trading account will never give you the full picture.

Humans are built to deal with risky situations by releasing a hormone called adrenaline that prepares our bodies and minds to clear and present danger. When you paper trade, you do not feel the same adrenaline rush that manifests itself during physical feelings of intense excitement and stimulation.

To become a seasoned trader, you need to have hours of “screen time” with a real account to get familiar with this sensation of that adrenaline high.

Regardless of how good you get or how profitable you become with a demo account unless you have risked real money and went through dealing with losing or making money in the market, you have not really experienced what it really feels like to trade.

At the end of the day, trading is a game of psychology where the market tests how emotionally stable and resilient you are. Hence, emotional stability and discipline are what separate the profitable traders from the amateurs. This is why only a tiny fraction of traders end up earning all the profits in the market, and the majority lose in the long run.

The Bottom Line

You will never learn to trade properly unless you accept that trading involves accepting losses, if not embracing them. All trading systems, regardless of how accurate they are, will occasionally lose. The way to become a profitable trader is thinking in terms of statistics, like thinking about ten trades with similar criteria. Maybe most of those trades end up profitable, but you will still inevitably lose a few. However, a successful system will emerge to be profitable in the long run.

Demo accounts will never give you the sensation of seeing a large loss and coping with realizing the loss. This is a bitter pill you have to swallow. Traders with live accounts have to live with this discomfort daily to get familiar with their comfort zone.

Unless you are emotionally conditioned to see a large loss and realizing it, instead of moving your stop-loss further in the hope that the market may turn in your favor, you can never become a successful trader.

Having said that, demo accounts can still play a vital role in helping you get used to the world of trading in terms of knowing how to trade or learning how to manage your money. If you successfully paper trade for a few months and see that you’re consistently profitable, do not wait too long. Start trading with a live account to get into the game as early as possible.