Those who hadn’t heard about quadruple witching probably wonder what can be so spooky about financial markets to be referred to with such an unconventional combination of words. No matter whether it is called quad witching, quadruple witching day, or quadruple witching hour, in the end, it all comes down to one thing – a day of increased trading activity and often high volatility. This guide explores the topic of quadruple witching. We’ll find out what it means to investors and the market as a whole. Being prepared will help you be more prepared when trading.

What is Quadruple Witching

Quadruple witching is a term to describe the days of the year when single stock futures, single stock options, stock index futures, and stock index options expire.

The more important thing is the scale at which this happens. All four asset classes expire simultaneously once per quarter. The specific days are the third Friday of March, June, September, and December at market close (4:00 pm EST). As a result, hundreds of billions worth of contracts expires simultaneously on the same day.

The name for this significant market event comes from the centuries-old folklore myth that supernatural beings start roaming the earth and causing chaos and destruction after the witching hour at midnight. Anybody unfortunate to encounter them is said to suffer from bad luck.

Now that you know what quadruple witching is and where its name originates, you can conclude its effect on the market. Years of market history had shown that quadruple witching days could lead to a substantial increase in volatility and (rarely) market havoc. While this isn’t always the case, it is essential to be aware that the markets might be unstable around these particular dates.

Quadruple witching is the biggest among all the “witching” events. The full list also includes double witching (when two of the asset classes expire simultaneously) and triple witching (when three of the four markets expire simultaneously).

What is The Effect of Quad Witching on The Market?

For many investors, especially beginner ones, learning how the market dynamics work is a complicated process that may be hard to grasp. However, there are few basic principles that you should remember to be better prepared around quad witching events.

The most significant effect of quadruple witching on the market is the increased trading volume surrounding the particular period. The reason is that many market participants face the urgent need to deal with their open positions.

Some might offset existing futures and options contracts that are profitable at the prevailing market price. That way, they can settle their loss or gain from the purchase and sale prices. Others might choose to extend the contract (to roll it forward) by offsetting the existing trade and simultaneously booking a new option or futures contract to be settled in the future.

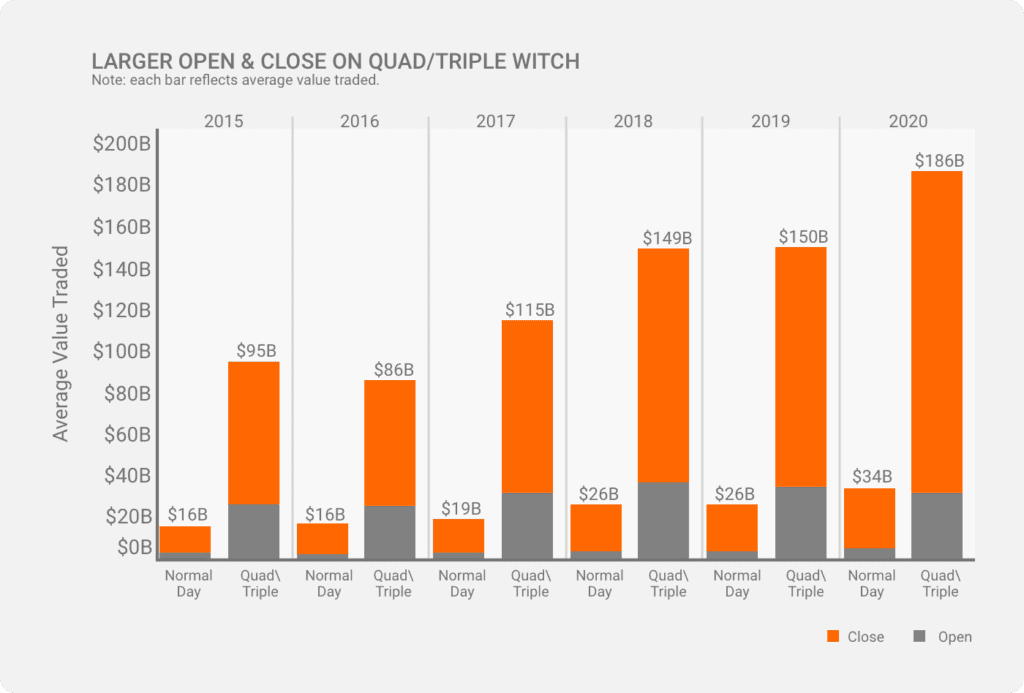

All these market moves usually result in increased trading activity. Below is an estimation of the average value traded on quadruple and standard days from 2015 – 2020 on Nasdaq.

Most traders usually see the vast trading volume is as a sign of a healthy market environment. However, there might be situations where it leads to price abnormalities. For example, a window of higher trading liquidity can make it difficult to tell whether it’s option expiration events or a change in business fundamentals driving a stock’s price movement.

Volatility Spikes

Based on the buying and selling dynamics and the prevailing positions, the market can experience increased volatility. The extent of it depends on various factors. First is the number of traders that would want to offset their contracts. The second is the way they want to do it. For example, the so-called “long-gamma” condition where options traders go against the trend instead of hedging their positions. Finally, it includes the events in the buildup to the quadruple witching day and more.

However, bear in mind that the price instabilities are usually intraday and rarely extend to the following trading sessions.

Contracts Types Involved

Quadruple witching involves four different types of instruments – single options contracts, single futures contracts, index options, and index futures. Bear in mind that many non-US contracts (the DAX futures, for example) can also expire on the same days.

Here is a bit more about each of the involved contracts:

Single Stock Options Contracts

Stock options contracts are derivatives, meaning their value is based on an underlying security.

Options contracts give the buyer the freedom to choose whether he wants to complete a transaction for the particular instrument before a specific date and a pre-determined strike price or not. He doesn’t bear any responsibility, so he can let the options contract expire if he doesn’t deem it suitable for trading.

There are two types of options – call and put. The former gives its holder the right to buy a stock, while the latter can sell the instrument.

Single Stock Futures Contracts

Futures contracts are agreements to buy or sell an asset at a predetermined price. The future transaction date is also specified in the contract. Futures contracts are standardized instruments and trade on a futures exchange.

Upon a futures contract agreement, the buyer is obligated to buy, while the seller has to sell the underlying asset at expiry.

Index Options Contracts

Index options contracts give you the right, but not the obligation, to buy a whole index like the S&P 500 or the Dow Jones Industrial Average.

Functionally, Index options contracts resemble what ETFs do by making it easy to get better diversification by “buying the market.”

These instruments are cash-settled and don’t give you any ownership of the index constituents.

Index Futures Contracts

The difference between the index futures contracts and the single stock futures contracts is that the former allows you to buy a whole index instead of just the shares of a single company.

The profit and loss of these instruments are calculated when the existing position is offset.

Investors often use index futures contracts if they are willing to speculate on the direction of the particular index. They are also suitable instruments for investors willing to hedge a portfolio of separate stocks.

Quadruple Witching Dates

All asset classes involved in quadruple witching expire four times a year, or once per quarter. This happens on the third Friday of March, June, September, and December.

The exact time quadruple witching happens is at market close (3.00 to 4:00 pm EST).

The quadruple witching dates for the years 2021, 2022, and 2023 are as follows:

- 2021 – March 19, June 18, September 17, December 17;

- 2022 – March 18, June 17, September 16, December 16;

- 2023 – March 17, June 16, September 15, December 15.

Why is Quadruple Witching Important?

Quadruple witching is crucial if you are trading futures or options, as it is the decisive time to choose what to do with your contracts and how to deal with your open positions. Of course, if you leave that important decision for the quadruple day, the chance is you will most likely make the wrong decision, or at least not the best one. That is why it is essential to always plan in advance and have a proper risk management strategy to know what to do once the quadruple witching day comes. You can adjust your strategy on the go, but having an idea about the direction you will follow is essential.

Quadruple witching is also essential for other market participants as well. The reason is that it might distort the market information for particular instruments and result in increased volatility. For example, once the quadruple witching day comes, the trader might not be able to distinguish whether price changes in a particular stock are caused by its fundamentals, latest announcements, and related news or because of the expiration of the large number of derivative contracts taking place on the same day.

In a nutshell, quadruple witching is important for traders and their predictions about the behavior of the market. One common fact is that after the quadruple witching week, the market usually gets calmer and declines due to the exhausted near-term stocks demand.

The Week Before

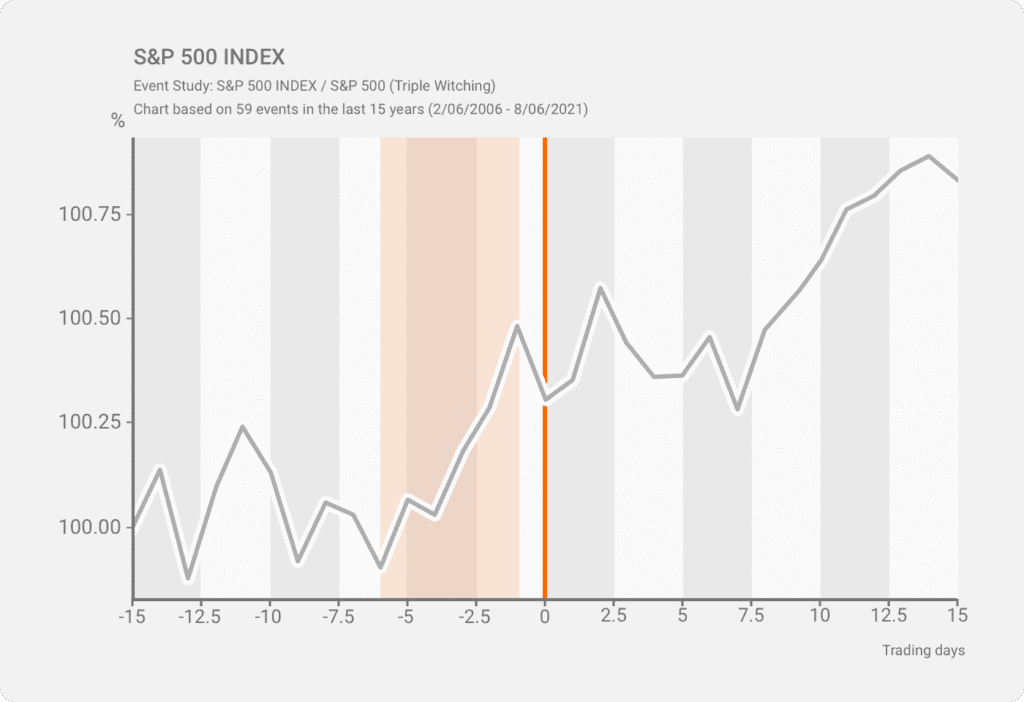

Things aren’t the same in the week leading up to the quadruple witching. An in-depth analysis of the performance of the S&P 500 in the 15 days before and after the quad day over the last 15 years (58 quad days in total) shows that the index typically rallies from the 6th day before to the day before quad witch day. On the day itself, the market usually declines. However, the trading that day is more aggressive, and the market isn’t necessarily friendly for beginners.

An Example of Quadruple Witching

The last couple of years have provided plenty of worthy examples of quadruple witching and the increased trading activity these days.

On March 15, 2019 (the first quadruple witching days for the particular year), over 10.8 billion shares were traded, compared to 7.5 billion on average over the prior 20 days.

The quadruple witching event in June 2021 led to a near-record dollar amount of single stock equity options. That Friday saw $818 billion in single stock options expiration at the close of the trading session.

Enough with the statistics. Now let’s see what a quadruple witching day might mean for a futures trader. By default, the futures contract is an agreement between two parties upon which the underlying security is delivered to the buyer at a predetermined price and date.

Assume that you are interested in trading one of the most popular futures contracts – S&P’s 500 E-mini (ES), settled in cash. The E-mini futures contract has a contract unit of $50 x S&P 500 Index. If the index has a value of 4,000, then one futures contract is worth $200,000 ($50 x 4,000). This is also what would be delivered to the contract owner if it is left open at expiration.

Another thing to bear in mind is that for most traders, what matters is the minimum price fluctuation and tick value. These are the two factors that determine the precise gains and losses on a futures contract. In the E-mini (ES) case, the instrument moves in 0.25 point increments, each of which equals $12.50 per contract. Alternatively, this means that a single-point move would result in a $50 profit or loss.

Taking Advantage of Quadruple Witching

Quadruple witching events are moments when arbitrage traders thrive. Due to the increased volatility, high-frequency trading firms or algorithmic traders, capable of quickly exploiting price discrepancies among several markets or instruments, usually dominate the market, further increasing the trading volume.

The chance is you probably aren’t one of the guys with millisecond trading infrastructure at home. However, in reality, you still might be able to benefit from quadruple witching days. In this case, capitalizing on the temporary price distortions probably won’t be on top of your agenda. However, it is essential to, first of all, hedge your positions.

Make sure to be in tune with your risk management strategy and its profit target so that you can make the best decision for each of your positions. No matter whether you plan to roll out a new contract, or offset your existing futures and options contracts, don’t leave the decision for the dying hours. Have a strategy in place to avoid high-stress situations and having to make split-second decisions.

The good thing is that the futures and options markets are highly liquid. It’s particularly liquid on quadruple witching days, meaning you won’t end up being locked in a trade. However, it is always better to close out all of your open positions before expiration. Even more so if you are trading the four asset classes that expire simultaneously.

Final Thoughts

Don’t let yourself be greedy. This is especially important for traders with many positions that need to be dealt with on the last trading day. Be methodical and stick to your plan. Bear in mind that profits on quad witching days are usually modest, and you probably won’t make a fortune. Even arbitrageurs benefit from the scale of trading rather than the individual profit of each trade.

Last but not least, do your best to be informed about all events taking place on the particular quadruple witching Friday. The event often coincides with stock-specific announcements, geopolitical events that might significantly affect the market, index rebalancing cycles, and more. The more you know, the better protected you are against the market noise.