You’ve probably heard the expression “there is no free lunch,” meaning you can’t benefit from something without paying the price. On the other hand, we have the term risk-free rate of return. So, one of these should be wrong, right? This guide will focus on finding out if investors have a real opportunity to ensure steady returns from investments that carry no risk. We’ll dive into the concept of risk-free return to examine what it means for investors. Let’s look at calculating it and go over the most famous examples of risk-free return investment opportunities.

What Is Risk-Free Rate Of Return?

The risk-free rate of return is a theoretical concept that traders use to define an investment that guarantees returns without bearing any risks. Alternatively, an investment that will always be profitable and never incur losses.

The risk-free rate of return represents interest on the invested money you can expect over a certain period from investments that carry no risk. At least on paper.

In reality, this concept is purely theoretical. The term risk-free doesn’t exactly guarantee that the asset won’t default. However, the chance for things to go south with similar investments is so low that we consider them to carry zero risks.

A risk-free rate of return is used for the most stable investments found in financial markets, such as U.S. Treasuries. Why U.S. Treasuries? Because the chance that the U.S. government will default on its debt is virtually zero. In theory, the investment is as secure as it can get. Due to this, the market often uses the interest rate on a three-month U.S. T-bill as the benchmark for the short-term risk-free rate.

The risk-free rate of return is one of the most basic and most essential concepts in finance at the same time. It is a pillar of many investment theories and lines of thought, including the capital asset pricing model (CAPM), the modern portfolio theory (MPT), and the Black-Scholes model for options pricing. Furthermore, it is also used to calculate the cost of equity and the weighted average cost of capital (WACC) of a company.

Due to how widespread and integral it is, any beginner investor should get a solid understanding of the risk-free rate of return concept if he is to be successful in financial markets.

What Does It Mean for Investors?

In theory, the risk-free rate of return means investors can ensure a guaranteed return without risking any investment capital. It is crucial for investors as they use it as a benchmark to evaluate the investment potential of other assets.

For example, if you can choose between an investment with a satisfying risk-free rate of return and a product that offers better return potential but at higher risk, then the reasonable thing to do is to always lean towards the opportunity that provides a better balance. Suppose you are offered a product with a net return (after management taxes and additional expenses) similar to the risk-free rate. In that case, it isn’t precisely an opportunity that will light up your portfolio.

In a nutshell, you should avoid tolerating risk unless the expected rate of return is greater (preferably much more significant) than the risk-free rate.

Who uses the Risk-Free Rate of Return?

Investment firms use the risk-free rate of return to develop products that offer higher risk-adjusted returns to attract investors. Alternatively, they add a risk premium along with the risk-free rate. The size of this premium can vary based on the type of asset. For example, the risk of a blue-chip company’s bonds would be way less than a startup’s risk.

When comparing investment opportunities, the risk-free rate of return comes in handy to evaluate how genuinely risk-free they are. Based on the investors’ expectations about the ideal rate of return for excess risk above the risk-free rate of return they are aiming at, investment firms can better shape their product offerings and appeal to their clients’ needs.

Another theoretical application of the risk-free rate of return is for borrowing purposes. Economic and finance theories assume that market participants should be able to borrow their assets at risk-free rates. However, in reality, this rarely is the case, especially when it comes to retail clients.

Calculation of Risk-Free Rates

You are probably curious to know the guaranteed risk-free return rate you can ensure, right? Unfortunately, there isn’t a unified answer. Risk-free rates of return can vary based on what instrument is used for their calculation and its yield.

We generally calculate the value of a risk-free rate of return by taking the current inflation rate and subtracting it from the yield of a treasury bond that matches the duration of your investment horizon. For example, if you are investing for the long-term, you should consider the 10-year Treasury bill. If you are in for the short-term, then you can stick to the 3-month Treasury bill.

Here is what the formula looks like:

Risk-free Rate of Return = [(1 + Government Bond Rate)/(1 + Inflation Rate)] – 1

Let’s look at an example. Imagine that you want to invest in a 10-years Treasury Bond that yields 3% for the duration. In that case, the risk-free rate of return would be that 3%, adjusted to inflation.

The Capital Asset Pricing Model (CAPM)

If we want to understand the risk-free rate of return concept fully, it is essential to say a few words about the Capital Asset Pricing Model (CAPM).

The CAPM is a foundational financial model used to calculate the expected return on an investable asset. It does that by equating the return on a security to the sum of the risk-free return and a risk premium (the security beta). Alternatively, it helps investors determine the return above the risk-free market rate they can expect from the particular asset. The CAPM formula is:

Ra = Rf + [𝞫 x (Rm – Rf)]

Where:

- Ra – return on a security

- 𝞫 – beta of a security

- Rf – risk-free rate

The most important part of the equation is defining the risk premium (Rm – Rf). As an investor, it gives you an indication about the excess return you would be compensated with for adopting more risk than the risk-free market rate.

You probably wonder – if the risk-free rate of return works only on paper and there are no real zero-risk opportunities, how can concepts like the CAPM or the MPT be considered trustworthy? Although it’s easy to criticize theories that use a risk-free asset as their foundation, the truth is there are limited alternatives. Furthermore, these concepts have been working in practice for decades already. Essentially we can trust the risk-free rate of return for accurate investment analysis with reasonable confidence.

Examples

If the concept for the risk-free rate of return sounds somewhat blurry to you, let’s back it up with some examples.

U.S. Treasuries are usually the best proxy for a risk-free investment for US investors. The reason is that it is hard to imagine a scenario where the government defaults on its debt. While this is possible in theory, the chance is negligible, and the slightest potential risk would most definitely not materialize. Furthermore, the market for US treasury instruments is intense and liquid, meaning it is a safe and sound investment environment. As a result, the market usually uses the interest rate on a three-month U.S T-bill as the basis for the risk-free rate for US investors.

By “US investors,” we mean all investors with positions in securities that trade in USD. For market participants investing in securities traded in Euros, it is advisable to use a German T-bill. As a rule of thumb, always stick to the treasury instruments of the country you trade in when doing your analysis.

In some cases, we can also use instruments like blue-chip bonds as a proxy for the risk-free rate of return.

Is It Really Free of Risk?

There can never be an entirely risk-free rate, especially in today’s volatile and increasingly dynamic markets. Even the safest investments carry some amount of risk, even if it is negligible.

Why is it called risk-free then? The truth is that the risk associated with the assets used for proxies is so low that it is considered non-existent. Yes, the US government might default on its debt, at least in theory. However, the risk is so low that investors don’t even consider it. If we assume that the US faces insolvency risk due to insufficient cash flow, the government can simply print more money to cover its interest payment and principal repayment obligations. So far, the USA has never defaulted on its debt.

Due to this, investors use the interest rate on a three-month U.S. Treasury bill (T-bill) as a proxy for the short-term risk-free rate as they have virtually zero risk of default.

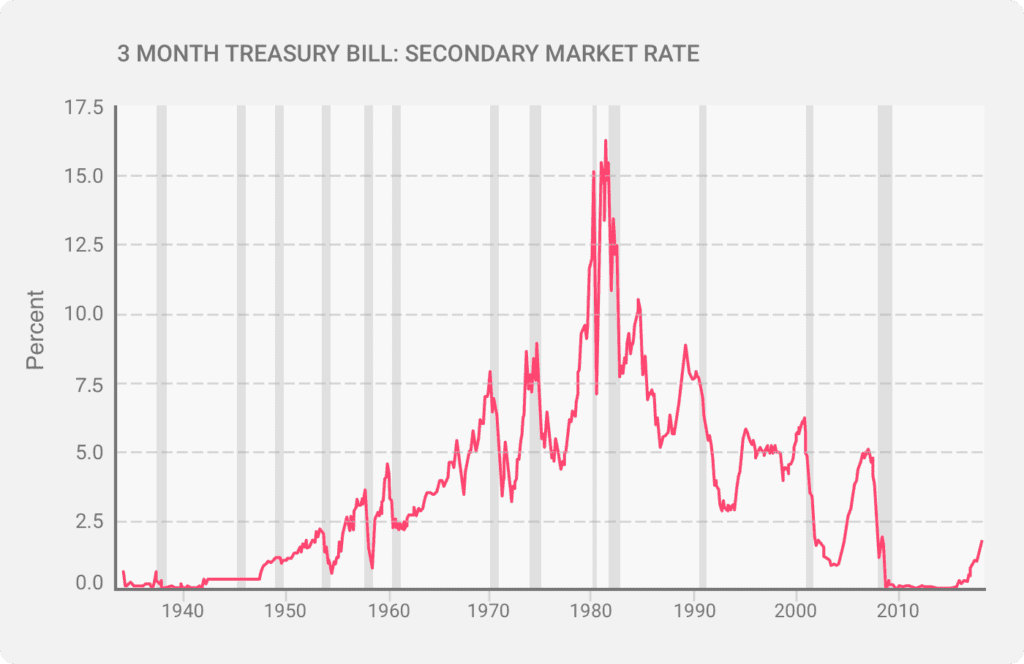

Lastly, let’s talk numbers for a bit. You’re probably wondering about the range in which the risk-free rate of return has been moving over the years.

During periods of economic crisis or their aftermath, like the 1940s and the 2010s, T-bills fell as low as 0.01%. The market history shows that they can go as high as 16% like during the 1980s. High T-bill rates indicate a flourishing and healthy economy.