Everything has a limit, even Tesla. The company’s stocks experienced an explosive growth in the first few days of February 2020, rising as much as 10-20% per day. For a company of their size, this can mean an extra 10-15 million dollars. By February 4th the company’s value exceeded 150 billion dollars.

The typical stock market jargon used to describe this phenomenon is “panic buying.” It could also be called “short covering.” The two phrases aren’t synonymous, but rather two different processes that can happen simultaneously. It’s might be a combination of both that’s causing Tesla’s prices to soar, but at the same time it’s also a sign of of what’s to come.

Panic buying refers to when investors avoid a stock out of caution, but when its prices suddenly start rising they rush to buy it out of a fear of missing out. The impulsive nature of these purchases means they’re typically bought at market price as soon as the exchanges open. They often do so without examining the order book and whether there are enough sell orders to satisfy the sudden surge in buy orders. Market buy orders are filled at the first available price, so they tend to soak up all sell orders.

This is where short covering comes into play. Sudden price hikes on stocks with questionable fundamentals like this one are often promising opportunities for short sellers as well. This allows panic buyers to buy their positions not just from previous holders exiting their positions, but also from speculators who are trying to build up a short position. The risk here is that when the number of panic buyers doesn’t decline, prices will continue to rise to the point where short sellers can’t afford it anymore. Once it gets to the point where short sellers need to cut their losses and exit the position, they do so by buying the asset. This is typically done in the form of a stop order that triggerst at a specific price, at which point they turn into market orders. The outcome is that it produces the same overabundance of buy orders that resulted from the panic buyers in the first place.

At that stage the stock’s prices start to ignore the company’s current or potential performance and become completely divorced from reality. This theory is further backed by S3 Analytics on February 4th. According to the results, it’s possible that short sellers lost up to $2.5 billion dollars during that day’s 20% price hike. Losing such a massive amount of money requires a similarly large number of short traders, enough to affect which direction the market is going.

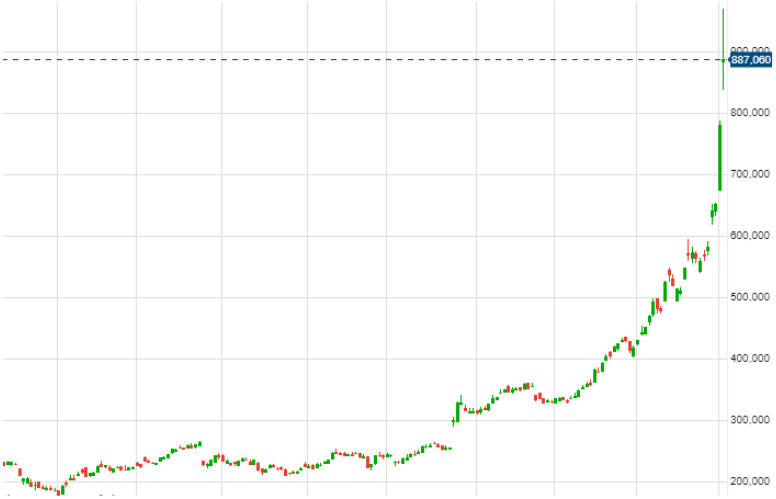

The above chart illustrates how quickly prices escalated while the stock’s liquidity completely dried up. It’s important to note the gaps between the last few candles because the indicate that opening price was significantly higher than the closing price. This means people were trying to be the first in line and get their positions in even before the market opens, This pattern indicates that the stock’s price may be consolidating. If that’s the case, then the concerns surrounding the company might lead to the number of strategic buy positions declining, leaving the traders who didn’t miss out on the first upwards price movements with a tidy profit. Those who got their positions early enough can now sell their shares at a 200% profit knowing that further price growth is not sustainable. As the trend reverses and prices begin declining, short sellers are likely to make an effort to recover their lost capital. Under those conditions, price could plummet back to to the $500 to $600 range, possibly making the current price increase the final stage of the ongoing upward trend.