Considering that McDonald’s operates in over 100 countries, have you ever wondered how its prices differ across borders?

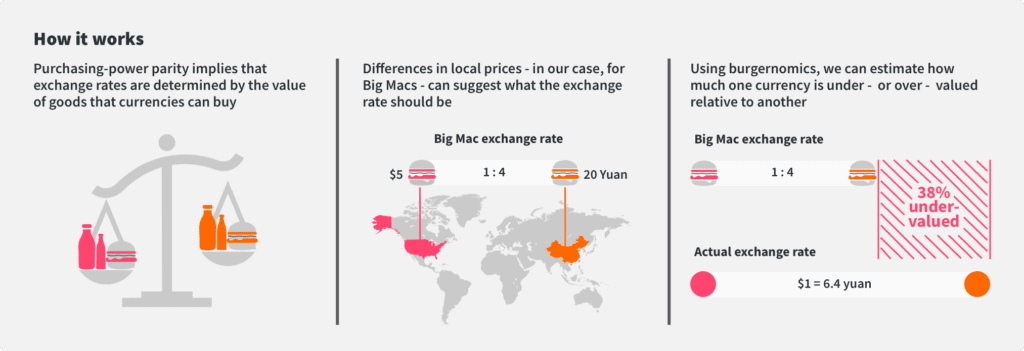

Interestingly, these differences can give you an insight into currency valuation. What’s more, this methodology was considered so reliable that it resulted in the Big Mac Index – an informal indicator showcasing the purchasing power parity (PPP) between different countries. It compares the prices of the McDonald’s burger, Big Mac, in various countries to reveal whether the currencies are undervalued or overvalued in relation to the US dollar.

This article will explore the significance of the Big Mac Index in understanding global currency movements.

Understanding the Big Mac Index

The Big Mac Index was introduced in 1986 by the Economist. It illustrates the purchasing power in a specific country by measuring how many Big Macs can be bought for $50. For example, in 2012, for $50, you could purchase 7 Big Macs in Norway or Switzerland and 30 in India.

The underlying theory of the Big Mac Index is that the prices should be similar when currency exchange rates are factored in.

Here is an example. Consider that two countries have the Big Mac at the same price in USD. However, the average citizen in the first country earns twice as much as the other. In that case, the first country charges half the relative price.

However, it is essential to note that Big Mac prices often fluctuate. As of 2011, some standouts are Brazil and Argentina, with prices far above what exchange rates would suggest. As reported in 2021, the price of a Big Mac in Brazil was about $3.98. Considering the purchasing power and the Brazilian currency, it equals $21.05 in the US. Based on the Big Mac Index, it is cheaper in the US ($5.66) and the Eurozone ($5.16). Thus, the Brazilian currency is undervalued against the burger.

The average price for a Big Mac in Brazil increased to $4.44 in January 2023, according to Statista.

How Do You Calculate the Big Mac Index?

The Big Mac Index can be calculated by dividing the price of a Big Mac in one country by the cost of the Big Mac in another country. You can achieve this by using the respective local currency to get the exchange rate. Then compare this rate to the official exchange rate of the two currencies.

For example, let’s assume that a Big Mac costs $5 in the US and 250 Mexican Pesos (MXN) in Mexico. You can calculate the Big Mac Index by dividing the price of a Big Mac in the US by the price in Mexico:

$5 / 250 MXN = 0.02 USD/MXN

Equating the exchange rate, we get 0.018 USD/MXN.

As a result, the Big Mac Index indicates that the Mexican currency is undervalued against the US dollar because the calculated rate is higher than the official rate.

What Makes the Big Mac Index Popular?

The index, which many also refer to as the core idea of “burgernomics,” has gained traction due to various characteristics, including:

Wide Availability

The Big Mac Index relies on a uniform product, ensuring consistency when comparing purchasing power parity in various countries.

The Big Mac has wide availability in different countries, and the ingredients, price, and quality are consistent.

Inflation Rate Measurement

The index enables investors to measure the inflation trends over time, which aids them in comparing these trends with official records. Many enthusiasts even use it to evaluate the pricing of bonds and other securities that are usually affected by inflation.

Measures the Value of a Currency

The Big Mac Index provides valuable insights into whether a currency is undervalued or overvalued, enabling investors to make informed foreign exchange trades.

Useful in Data-Scarce Regions

The index is valuable in regions without trustworthy indexes due to manipulated government data or an absence of officially published information.

You may also like: What Is the Mcclellan Summation Index, and How Can You Use It?

What Are the Limitations of the Big Mac Index?

The Big Mac Index has various limitations. For example, the prices of non-tradable goods can vary in different countries, and the cost of a Big Mac can be influenced by factors such as labor expenses which may not reflect currency rates accurately.

In response to this criticism, the Economist has employed the GDP-adjusted index to address that average burger prices are expected to be cheaper in less wealthy countries.

In addition, the Big Mac only includes a single item. This lack of diversity in the data seen in other economic indicators, such as the Consumer Price Index (CPI), is a critical drawback.

Takeaway: The Big Mac Index Can Help Indicate Global Currency Trends

The Big Mac Index provides valuable insights into the rates of different currencies based on the price of a single burger.

It is a simple yet powerful concept that enables investors to measure the PPP and inflation over time in a particular country. As a result, you can determine if a currency is undervalued or overvalued.

However, the index has limitations, such as the need for more diverse data and the influence of the prices of non-tradable goods. Yet, despite that, it is a good starting point for investors planning to dip their toes in regions that lack accurate or reliable data.