Managing risk and optimizing profits are two basic tenets of any successful trade. That’s why you’ll be pleased to know that a properly executed trailing stop order can help you achieve both and more. With that in mind, this article will cover everything you need to know about trailing stop orders. This includes examples of sell orders, examples of buy orders, and answers to the questions: How does a buy order work? How does a sell order work?

What Is a Trailing Stop Order?

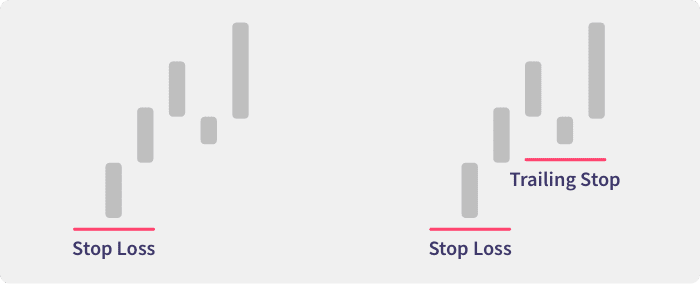

Put simply, a trailing stop order is a risk management technique where a trader sets their stop loss level to trail the current market price by a specified value or percentage. The difference is, instead of using a fixed stop price, a trailing stop follows the market price at a predefined distance during a trend. Thus, it’s an offshoot of the original stop-loss order. This way, you can maximize your profit and minimize loss potential.

The trailing stop is not typically used as an entry order. Traders mostly use it when they have an open position already accumulating profit with each market movement.

Incorporating a trailing stop order strategy can help you solve one of the biggest dilemmas you’ll ever face as a trader. You might have a winning trade that’s already in the money by several pips. Then suddenly, you start to worry about a market reversal. Should you cut your losses or keep the position open to take more profit? At the same time, you also wonder just how much more profit would come in if you rode the trend only a little bit longer.

You might also enjoy:

Value vs Percentage Distance

Value vs. percentage distance just means deciding whether to place your trailing stop loss at a fixed price relative to the market price or at a fixed percentage. When talking about value and percentage distances, it’s also worth mentioning decline.

The first type is value decline. This is the idea of setting your stop loss at a predefined amount. For example, if the current market price is $180, you can set your trailing stop loss at a fixed $20 below $180. If the price rises to $210, your trailing stop loss will still be $20 below $210, which means more potential profit.

The other type is percentage decline. In this case, you place the trailing stop loss at a fixed percentage, like 20% below the market price. In doing so, it will follow the trend but still maintain that fixed distance. You should always be doubly sure which one you’re using when placing an order. There is a huge difference between 20% and $20.

How Does The Order Work?

To help you better understand how a trailing stop order works, let’s look at two trading scenarios – open long position and open short position. These scenarios are also useful in deciding when to execute Sell orders and Buy orders.

Trailing Stop Order In An Open Long Position

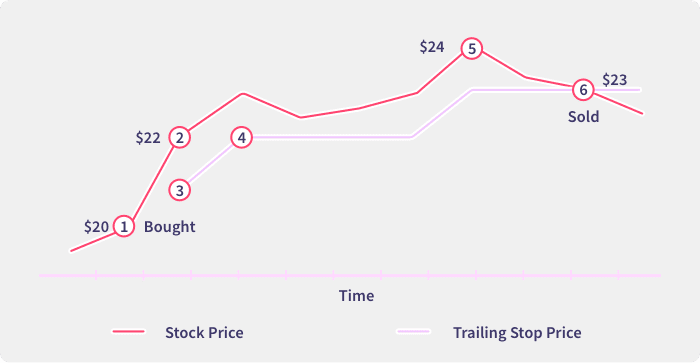

If you have an open long position, your trailing stop price will be placed at a fixed distance below the market price. Assume you bought XYZ stock at $200. There was a sustained market uptrend over the last few trading sessions, and the price is now at $300. Naturally, you want to secure this potential profit but still, continue accumulating more.

To secure part of your current potential profit, you set the trailing stop at $25 below the current price ($275). As the market price increases, the trailing stop increases as well. Meanwhile, it’s still keeping its distance of $25 below the current market price.

Then at $375, the price changes direction and starts to drop. The trailing stop loss freezes below the highest price the asset reached. If the price falls and reaches the trailing stop limit at $350, it closes the position. In this way, the trailing stop order allows you to keep accumulating profit and minimize your risk exposure when the market turns against you.

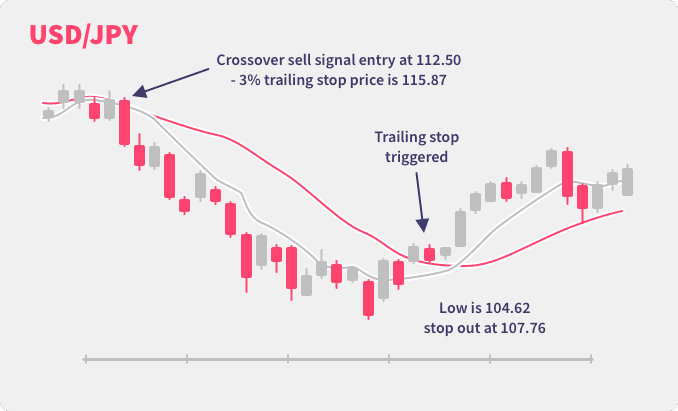

Trailing Stop Order In An Open Short Position

In the second case scenario, we’re attempting to place a trailing stop to execute a stop order following a market swing. If you have a short position, your trailing stop will be set at a specified amount above the current market price.

Let say the market is in a downtrend, and you sold the stock at $300. The price continues to decline and is now at $200, so you decide to set a value-based trailing stop that will keep a distance of $25 above the current price ($225).

As the price decreases, so do the trailing stop as well, maintaining its fixed distance. Then at $185, the market trend begins reversal, and the price starts to increase. The trailing stop price freezes above at the lowest price the asset reached. The trailing stop price, in this case, is $210. When the price reaches the set limit of $210, a stop order will be executed. This way, you were able to protect your profits and, at the same time, minimize your risk on the trade.

Buy Orders vs Sell Orders

Trailing stop orders can also be used to determine when to execute a buy order or a sell order. Based on the two scenarios discussed, we can set a trailing stop sell order when trading in an open long position. This is done to maximize and protect our profit in a rising market and limit our losses when the market swings the other way.

Following the open long example above, our stop loss was triggered at $350 in a falling market. Instead of just exiting the trade, it executes a sell order, so you were on the other side of the trade with the potential to make even more profit.

On the other hand, when you short sell, a trailing stop buy order helps limit your losses when the market is going up. It also maximizes and protects your profits when the market goes down. Borrowing from the open short example above, our stop loss was executed at $210 in a rising market. By triggering the buy order, we can own more of the stock at a low price. Later we can sell them again using a trailing stop sell order.

As you can see, respective buy and sell orders protect you regardless of where the market swings. The trailing stop price follows the market price, but the trigger price doesn’t change when the market changes direction.

Why Use a Trailing Stop Order?

By now, you can already see why using a trailing stop order strategy is so important in your trading arsenal. There are three main benefits:

- It allows you to secure profits when the market swings against you.

- While securing your profit, it doesn’t place a cap on potential profits.

- It simultaneously helps you set a limit on potential losses.

Simply put, a trailing stop order allows you to ride a trend safely. At the same time, you also have an effective exit strategy in place.

How to Trade With a Trailing Stop Order?

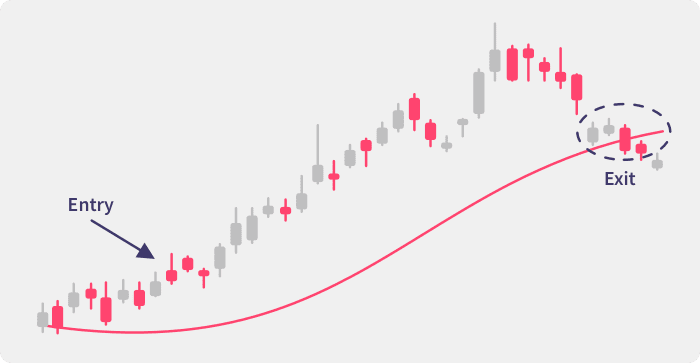

The key to successfully utilizing a trailing stop order in a trade is to set it at the right level. By this, we mean the fixed value or percentage distance from the current market price must be big enough so that minor fluctuations in price do not prematurely trigger a trade execution. At the same time, it should also be small enough so that it doesn’t take up the bulk of your potential profit.

Establishing the ideal trailing stop distance can be somewhat challenging. In reality, there’s no ideal distance that guarantees the best returns since markets and stock movements are always changing. Despite this, trailing stop orders are a pretty effective exit method.

How Do You Place a Trailing Stop Order?

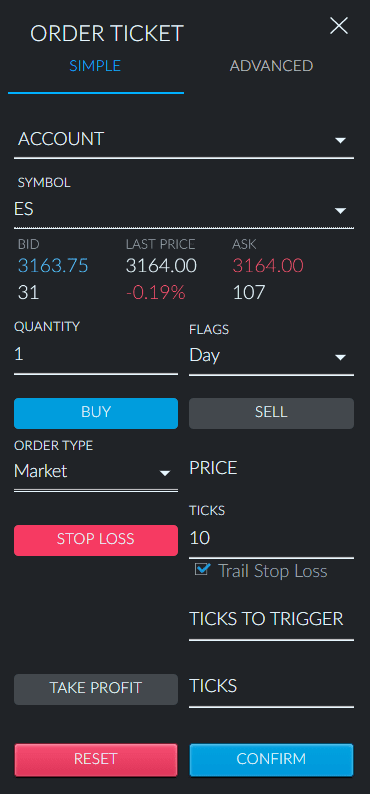

The exact process for placing a trailing stop order will depend on the broker you use to execute the trade. Here’s a quick step-by-step of how to set it up on the Finamark platform.

- Click the Order icon in the menu on the top right. You can also bring it up with the Buy Market or Sell Market buttons on your charts.

- Fill in your Order Ticket with the relevant information: asset, quantity, buy or sell, etc.

- Click the Stop Loss button under order type, so it lights up red. Next, tick the Trail Stop Loss Option box and enter the number of trailing ticks.

- Check to make sure you have entered all the right parameters, then click Confirm.

Finamark currently only supports value trailing stop orders.

Trailing Stop Order Examples

Let’s look at some more examples of trailing stop orders so you can fully grasp the concept and possibly see how you can put it to good use.

Trailing Stop Buy Order Example

Alan borrowed 1 BTC from Kate and sold it at $9,500. When the time comes to pay it back, he needs to buy 1 BTC but is reluctant to risk more than $300 on the trade should the market price go up. As you’re probably aware, the cryptocurrency market is one of the most volatile ever, so Alan’s concern is more than justified.

Alan decides to set a trailing stop buy order with a price distance of $300 in a rising market. This way, as the market price and the ask price go up to $9,800, the trailing stop order will be executed, and the buy order placed automatically.

With that, he simply bought BTC at $9,800 automatically to pay back Kate. He already had $9,500 from his BTC sale earlier. He can stay in that long BTC position to recoup more profit for that BTC or exit the trade, in which case he only lost $300.

Trailing Stop Sell Order Example

Now assume Kate is in an open long position after purchasing 1 BTC at $9,500. She doesn’t want to lose more than 5% ($475) from this position should the market price drop.

So she sets a trailing stop sell order with a fixed percentage distance of 5% in a falling market. If the market price declines further and the bid price drops to $9,025, the stop order will be triggered and automatically place a market sell order.

But what if the value of the asset keeps rising? Her position and profits are still secured since the trailing stop price moves along with the market price at the fixed percentage deviation. So, if the price of BTC rises to $10,000, the triggering price will rise to $9,500 ($10,000 – $10,000 X 5%).

Conclusion

Prudent risk management is at the forefront of every solid trading strategy. Developing a trading strategy with dynamic stop-loss levels allows you to maximize your returns without being subjected to undue risks. Seeing as timing the market is practically impossible, a properly executed trailing stop order may well be the next best thing.