Fluctuating gas prices have been an issue among consumers since, well since, gasoline became a thing. Despite being an integral aspect of everyday living, most people don’t understand why the money needed to fuel their cars rises and falls so frequently. If you find yourself in this category or if you’re a trader interested in the crude oil market, this article is for you.

Factors That Affect Gas Prices

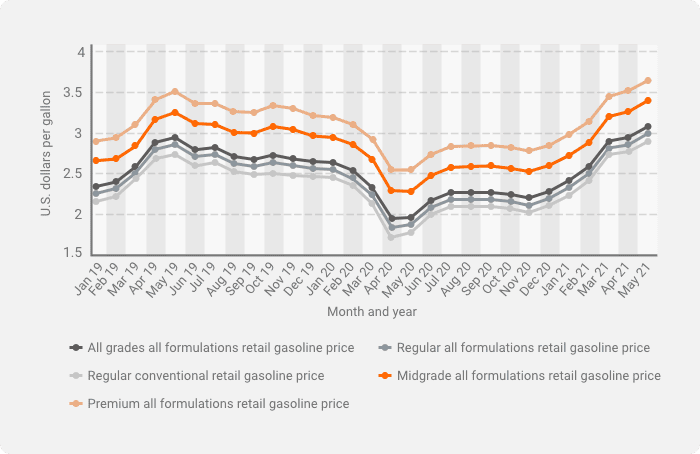

When the COVID-19 pandemic first hit, everyone hunkered down at home, effectively plunging the demand for gas. Prices were at all-time lows as a result. However, barely a year later, gas prices are climbing back up with a vengeance.

Now prices are rising steadily, cent by cent, and it only took around three months for prices to jump from $2.24 to $2.90 per gallon as of May 2021.

Why Should You Care So Much About Gas Prices?

Take a minute to add up how much you spend getting from A to B on your daily commute. Has it increased in recent times? If yes, it’s likely because of rising gas prices.

Fluctuating gas prices can also provide insight for investors in the oil and energy industries. Gas is a commodity, after all. A rise in prices correlates with higher economic activity to a certain degree; a dip can be an indication of a lull in economic activities, as was the case when the coronavirus rampage was at its peak in 2020.

So what exactly is behind this volatility?

Some say speculators are to blame for the day-to-day fluctuations in gas prices. But that’s just a tiny fragment of the bigger picture. Five fundamental factors dictate gas prices at your local gas station and on the global market as a whole.

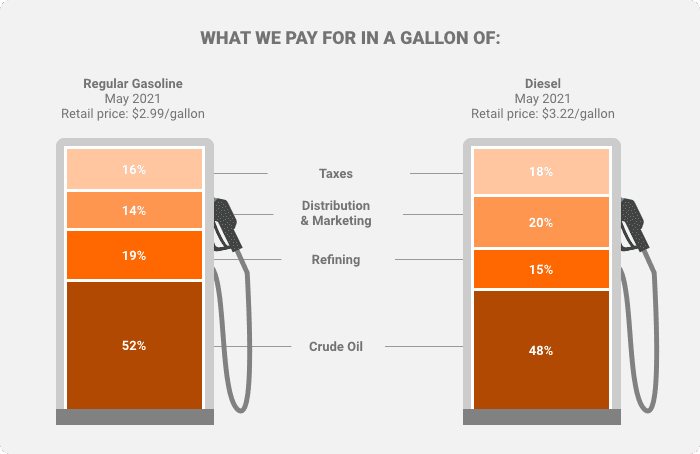

According to the U.S. Energy Information Administration (EIA), the main driver of gas prices is the cost of crude oil. The remainder is a combination of refining costs, marketing and distribution, taxation policies, and changes in the value of the U.S. Dollar. Let’s look at each one in turn, so you have a clearer picture.

Cost of Crude Oil

Consumers may buy gasoline locally, but fuel prices primarily depend on how crude oil is made performing in the global market. When crude oil prices change, the end consumer feels it in the prices that they pay at the pump.

The EIA estimates that fluctuating crude oil prices account for more than half of fluctuations in gas prices.

So what causes fluctuations in crude oil prices? Here are the three main factors:

1. Market Demand and Supply

On April 20, 2020, U.S. oil prices were negative for the first time ever as everyone was forced indoors and demand dried up. U.S. oil benchmark West Texas Intermediate (WTI) started the day at a new low of $17.85. By the close of trading, it was at -$37.63.

With little to no demand, supply was at an all-time high. Oil vessels and tankers were left stranded with nowhere to deliver their products.

Here’s a snapshot of the resulting drop in gas prices in that period.

The above chart is just one of many examples of how market demand and supply can destabilize crude oil prices, which ripples in effect to influence the prices of gas, diesel, kerosene, and other end products.

2. Commodity Market Speculation

Commodity trading is an excellent way for speculators to turn in a nice profit. Regular investors also see commodities as a great way to diversify their portfolios beyond stocks and other traditional securities, as well as a hedge against volatility.

Because of this interplay, crude oil as a commodity is subject to market fluctuations. In the past, trading in commodities was a fairly complex affair, often requiring large amounts of money and time. But today, there are more and more options available, such as futures contracts, options, and exchange-traded funds (ETFs).

With speculative trading, the futures market records increased liquidity — the speculators think the price of crude oil will rise or drop in the future, so they enter the contract based on the direction they expect.

For example, prices tend to rise during the summer because that’s when travel picks up. Speculators can start buying futures contracts in the spring or even winter to anticipate the summer price rise. The result is a massive incentive for the production and storage of crude oil to rise to meet future demand.

Additionally, sizeable speculative buying or selling of futures contracts can introduce short-term volatility and distort the demand and supply signals in the market. In both cases, the result is typically a significant impact on the price of crude oil.

3. OPEC

The Organization of Petroleum Exporting Countries (OPEC) has a say in global crude oil prices. After all, the countries that are part of OPEC control around 40% of the world’s supply of crude oil. As such, they have a say in the price per barrel of their prized commodity.

Examples of OPEC countries include Saudi Arabia, Kuwait, Qatar, Nigeria, Gabon, and Venezuela. Because of OPEC, other oil-producing countries like Russia and Kazakhstan have to revise their oil prices to maintain a balance and price consistency in pricing across global markets.

Refining Costs and Profits

Crude oil is only the base product and is unusable as is. The gasoline that you pump into your car or machinery has undergone specialized refining. As you can imagine, refinery operations are not cheap, mainly since most refineries are situated offshore.

The maintenance costs alone are astronomical. For instance, the cost of maintaining Nigeria’s refineries sits at over $26.5 billion.

The companies manning these refineries are in it for profit. So their margins have to be competitive as well. They add their margins on top of the price, with the end-users picking up the tab.

Seasonality also plays a crucial role in determining the costs of refining crude oil. During the cold months, production tends to drop as demand dwindles but then picks up during summer to meet rising demand. The price of crude oil is therefore affected during these months.

Distribution and Marketing Costs

Retail oil prices typically include the costs of transporting the gasoline to the depots and pump stations across the country. The marketing expenses incurred by the oil companies are also passed directly to the consumers. ,

These are not small costs. For example, the estimated cost of building the 1,172-mile Dakota Access Pipeline in the U.S. was over $3.78 billion. Additionally, the average cost of transporting crude oil or finished products by ship tankers from Saudi Arabia to the U.S. Gulf is around $300,000 per day.

Some gas stations are owned and operated directly by the oil companies, while others are independent retail outlets that buy and resell to the public. The pump price would be different as each station will want to include a markup to their pump prices to cover lease payments, employee payroll, equipment financing, and overhead.

Taxation

Federal, state, and local government taxes all influence retail gas prices. Here’s a quick breakdown:

And then there are sales taxes and other fees or charges levied by local and municipal governments on a state-by-state basis.

The Value of the Dollar

Because oil is traded on the global world market in U.S. dollars, fluctuations in the currency will resonate in the retail price of gasoline.

Producers need the value of the U.S. dollar relative to other major currencies to be high to maximize their earnings. If the U.S. dollar drops in value, producers compensate for their losses by increasing the price per barrel.

What Determines Gas Prices in the Different States?

There are many reasons for this — the main one being that retail gas prices are generally more expensive the farther they are sold from the primary point of supply. These include the refineries, product pipelines, shipping ports, blending depots, and so on. The underlying reason is that these remote areas have to pay much higher transportation costs. Other reasons include:

- Differences in provincial tax on gasoline — These taxes vary from one municipality to the other, but you can be sure to feel its effect on your wallet.

- Fixed operating costs — Gas stations in some small towns and remote areas aren’t selling as much gas as their counterparts in the big cities. And yet, they have fixed costs to cover, so they may feel inclined to sell at a higher price.

- Competition — Some regional areas have more gas stations than others. This amps up the competition with the players looking to lower their retail prices to maintain a competitive edge.

- Additional gas station services — Some gas stations offer add-on value services like a car wash or a convenience store. These services bring in extra income to afford to lower their retail prices to attract more customers.

The Bottom Line

Oil is the backbone of the world’s most expensive trades. Even if you’re not an end-user of crude oil products, understanding how gas prices work is still something you should understand.