The FOMC, or Federal Open Market Committee, is a component of The Federal Reserve. The latter is the central bank of the United States. Most of us just call it The Fed. The FOMC is responsible for dictating the monetary policy of the Federal Reserve System and controls open market operations. Open market operations refer to when the FOMC buys or sells securities to speed or slow inflation. This helps them control economic growth.

The FOMC’s functions and actions affect your day-to-day lives in many ways. For one, the FOMC meeting largely dictates economic sentiment. At these FOMC meetings, the Fed always explains its actions based on economic performance. Primarily as it relates to inflation and unemployment. Second, the FOMC essentially stimulates or restricts economic growth and employment.

If the Fed wants to stimulate the economy, promote inflation, and grow employment, the FOMC will increase the money supply. They do this by lowering the Fed interest rate and buying more treasuries. If the Fed wants to slow inflation, or if the economy is growing too fast and overheating, the FOMC will decrease the money supply. The way to do that is by hiking the Fed interest rate and selling more bonds. All these actions behind the scenes affect your day-to-day life. Probably life more than you realize.

You might also enjoy:

What is the Federal Open Market Committee (FOMC), and what does it do?

Essentially, the FOMC is the Federal Reserve branch responsible for overseeing the Fed’s open market operations. The FOMC basically dictates monetary policy. It determines when to have an expansionary or dovish monetary policy. Alternatively, it can also choose to have a contractionary or hawkish monetary policy. These key policy decisions all revolve around cutting or hiking the Fed interest rate. Said decisions are based on the growth of the United States money supply, inflation, long-term goals of price stability, and economic growth.

Additionally, the FOMC oversees The Fed interest rate, otherwise known as the federal funds rate. This interest rate is the interest that banks charge each other for overnight loans. The FOMC also collaborates with the Federal Reserve Board of Governors to control the discount rate and reserve requirements. The discount rate refers to the percentage that the Fed charges member banks to borrow from its discount window. This is necessary for banks to maintain their cash reserve requirements.

The reserve requirements refer to the required total amount of funds that a bank must hold daily. It is a percentage of the bank’s deposits. The FOMC’s involvement in dictating the Fed interest rate is important because banks use these loans to ensure they have enough capital to meet the Fed’s reserve requirement. Monetary policy and the Fed interest rate are the main discussion topics 8 times a year at FOMC meetings. The FOMC minutes from these meetings are available to the public.

Why is it Important?

We cannot overstate the importance of the FOMC. It is a critical component of the Federal Reserve System. The board is entirely responsible for managing the money supply growth for the world’s largest economy. The FOMC essentially dictates the price of goods in everyday life by controlling inflation, dictates economic sentiment, contributes to providing liquidity in times of crisis, and secures the financial system’s integrity. The FOMC oversees monetary policy and keeps the US Financial system afloat. Without the FOMC dictating monetary policy, stimulating and bailing out the US economy during both the financial crisis of 2008 and the COVID crisis, who knows where the economic landscape would be today. It is often predicted that the recession we are currently in, and the prior one, would have developed into a much deeper, more prolonged economic crisis.

Who are its Members?

The FOMC is made up of 12 members. The members include seven members from the Fed’s Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Fed presidents who serve one-year terms on a rotating basis. The rotating members are filled by Fed presidents from the following location groups: Boston, Philadelphia, and Richmond; Cleveland and Chicago; Atlanta, St. Louis, and Dallas; Minneapolis, Kansas City, and San Francisco.

The members of the 2020 FOMC Committee are as follows:

- Jerome H. Powell, Board of Governors, Chairman

- John C. Williams, New York, Vice Chairman

- Michelle W. Bowman, Board of Governors

- Lael Brainard, Board of Governors

- Richard H. Clarida, Board of Governors

- Patrick Harker, Philadelphia

- Robert S. Kaplan, Dallas

- Neel Kashkari, Minneapolis

- Loretta J. Mester, Cleveland

- Randal K. Quarles, Board of Governors

Fed Interest Rate Decisions

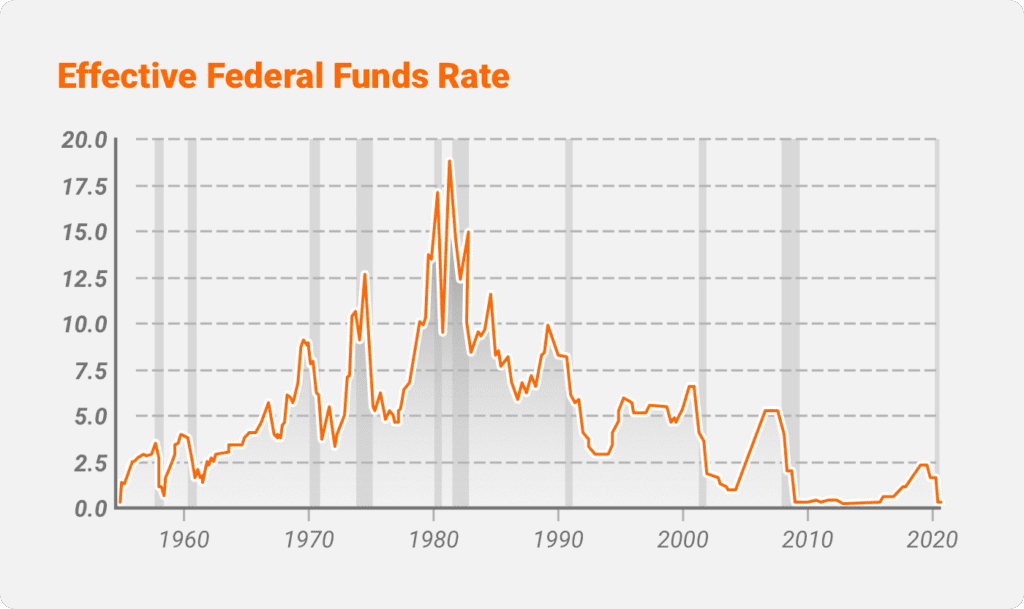

The chart above shows the effective federal funds rate or Fed interest rate going back to 1954. The Fed’s interest rate decisions affect everything and can cause ripple effects across the broader economy. From spending to borrowing to economic performance to stock and bond prices. When the Fed decides to lower interest rates, it does so to stimulate economic growth. These lower interest rates encourage borrowing and investing since it makes it cheaper to borrow money. When it is cheaper to borrow money, consumers and businesses are willing to spend more and invest more. As a result, in times of lower interest rates, stocks often rise.

However, when rates are too low for too long, growth can become excessive and overheat, causing unhealthy inflation. When there is inflation, everyday goods become too expensive, and purchasing power declines. This type of growth is not sustainable, and therefore the Fed needs to raise interest rates to curb this inflation and slow transition to an acceptable level. Often when the Fed raises interest rates, stocks will not perform as well, and consumers and businesses will be more fiscally conservative.

A Recent FOMC Decision

Most recently, Fed Chair Jerome Powell doubled down on the current dovish monetary policy. He pledged to keep interest rates low for years to stimulate and support economic recovery from the recent COVID recession. In the long run, the Fed will seek an average 2% inflation rate and “broad-based and inclusive” gains in the jobs market. This means the Fed will continue to stimulate the economy and inflation even if it is above the former 2% target, so long as the average inflation remains muted. The current Fed interest rate is at an all-time low of 0-0.25 percent. Not to mention, Powell left the door open for further monetary easing to better support the struggling US economy as COVID continues.

Famous Examples of FOMC Decisions

In chronological order, these are some of the most famous examples of FOMC decisions since 1960:

Operation Twist (1961)

The FOMC wanted to flatten the yield curve to promote capital inflow and strengthen the dollar and decided to shorten the maturities of public debt in the open market. The “twist” tactic came about by re-selling some of this same short-term debt back into the open market and using the proceeds to buy longer-term debt. However, Operation Twist was only marginally successful in reducing the yield curve and spread between short-term and long-term debt. Mainly because the operation did not continue long enough to be effective. The FOMC took similar action in 2011.

Saturday Night Special (1979)

The FOMC increased the Fed interest rate by a full percentage point as soon as Paul Volcker became Fed Chair. Volcker oversaw the interest rate increase from 11% to 12% during the weekend of October 6, 1979.

2001 Interest Rate Changes (2001)

As a result of the Dot Com Crash and the effects of 9-11 on the economy, the FOMC cut interest rates 9 times in the year 2001 and 4 times after the 9-11 attacks, bringing the interest rate to its lowest level since 1962. At its lowest, the FOMC lowered the Fed rate from 2% to 1.75%. To put that in perspective, the Fed interest rate was up to 5% in just April 01. The Fed was desperate to bolster the money supply and stimulate consumer spending.

Quantitative Easing 1 (QE1, December 2008 to March 2010)

In the first step in recovering from the 2008 financial crisis, the FOMC embarked on its first Quantitative Easing (QE) policy decision. This would forever change the Fed’s policy and the way the Fed functioned. Essentially, with QE, the Fed pumps almost limitless amounts of capital into the open market to robustly stimulate the economy. To begin this shift to QE, the FOMC purchased up to $600 billion in agency mortgage-backed securities (MBS) and agency debt. The purchases, however, had no impact on the Fed’s balance sheet since they were in large part offset by Treasury sales by the System Open Market Account (SOMA) desk. March 2009 can be considered the real beginning of this QE policy.

In March, the FOMC announced that they would purchase an additional $750 billion in agency MBS and agency debt and $300 billion in purchases of Treasury securities. This time there was nothing to offset the growth of the Fed’s balance sheet this time. That’s why we consider this the real start of the Fed’s QE policy.

Zero Interest Rate Policy (ZIRP) (December 2008 to December 2015)

Due to the impact of the financial crisis, for the first time in its history, the FOMC’s Fed interest rate was nearly 0. The FOMC had no other choice but set these rates to face the challenges of the crisis head-on and help with the easing of money and credit. With the zero interest rate policy, the Fed could more effectively use its monetary policy to promote a more robust economic recovery, job creation, and sustainable and stable markets and prices.

Quantitative Easing 2 (QE2, November 2010 to June 2011)

The Fed initiated its second QE initiative in November 2010 by purchasing $600 billion in long-term debt at a rate of $75 billion per month. QE2 concluded in June 2011.

Operation Twist 2 (2011)

The FOMC implemented another Operation Twist by purchasing $400 billion worth of bonds with maturities of 6 to 30 years and selling bonds with a maturity of under 3 years. By doing this, the Fed extended the average yield to maturity of its own portfolio. The Fed wanted to create a similar type of effect as QE without expanding its balance sheet. By doing this, they hoped to reduce the risk of inflation. It succeeded in some ways; the US Dollar did strengthen. However, US sovereign debt was downgraded, and the stock market suffered some of the worst one-day drops in its history and two corrections. The FOMC extended this policy throughout 2012 by injecting an additional $267 billion.

Quantitative Easing 3 (QE3, September 2012 to December 2013)

The Fed further expanded its QE policy in September 2012. The Fed made an unprecedented move by purchasing $40 billion in agency mortgage-backed securities per month indefinitely until the job market substantially improved. This was further expanded several months later in December by purchasing an additional $45 billion worth of long-term debt per month. This QE program gradually began to ease about a year later during the December 2013 FOMC meeting and fully ended in October 2014.

December 2015 historic interest rate hike

The Fed hiked its interest rate for the first time since June 2006 by 25 basis points. Previously, the Fed interest rate was in the range of 0-.25%. They increased the rates to .25-.5%

March 2020 Coronavirus interest rate cut

Most recently, the FOMC played a crucial role in the economic survival and subsequent stock market recovery from the unprecedented COVID-19 crash. In an emergency decision, the interest rate was cut by 50 basis points to 1-1.25%- the first emergency rate cut since the financial crisis. This rate was further lowered in another emergency announcement by a full 100 basis points to 0-.25%.

How do FOMC Announcements Affect Traders?

Whenever the FOMC makes its announcements, it can cause significant volatility in the markets. FOMC changes will likely affect the value of the US dollar. Considering that the US Dollar is the world’s main reserve currency today, each Fed announcement has a ripple effect across capital markets worldwide, especially in foreign exchange futures.

While traders need to monitor the macroeconomic situation, employment levels, inflation levels, and economic growth, the FOMC meeting is usually considered the most important date on any traders’ calendar. That is because of the impact that interest rates have on investments. Any little change that the FOMC makes to its target interest rate affects other rates, including foreign exchange rates and bond prices.

Overall, here is how interest rates affect different markets:

Forex

The US Dollar is the world’s most traded currency and its reserve currency. Any interest rate changes can have a significant impact on it. If rates are higher, the USD normally strengthens. However, this means that it is bad to trade shares of other currencies. Lower rates, while weakening the US dollar, can be a boon for other currencies.

Stock Indices

Higher rates are generally bad for stocks since it leads to even more risk aversion. Lower rates have been a boon for the stock market in the past because investors looked to take on more risk. Stock traders seemingly dislike interest rate hikes, especially when they deem them unnecessary. Many traders view the Fed as a significant factor in causing the corrections at the end of 2018-beginning of 2019. They mainly see the interest rate hikes at the time as overly hawkish and unnecessary.

Bonds

US bonds often feel the brunt of interest rate policies. One of the fundamental principles of investing in bonds is that interest rates and T-bond prices are inversely correlated. When interest rates rise, bond prices fall, and when interest rates decline, bond prices rise. This is what is known as interest rate risk.

How to Trade the FOMC Meetings?

When looking to trade the FOMC, the most important thing to do is prepare the day before with what is expected while simultaneously preparing for the unexpected. It is vital to keep track of what its members say in real-time. That is what helps traders always stay up to date. It really depends on the trader’s risk appetite.

Each FOMC meeting announcement is a high-impact event on the markets and can induce significant volatility. It is essential to be aware of all macroeconomic conditions and assess risk exposure in their portfolio. If a trader is more on the risk-averse side, it may be better to just avoid the market altogether during FOMC announcements.

But if a trader is more comfortable with risk, then this is always an exciting day to trade with a lot of promise. Long-term investors often enjoy buying the dips on these days as well. The bottom line is there is no one right way to trade the FOMC meetings. These events significantly increase price volatility, upwards or downwards. It is up to individual investors to assess their own risk tolerance and expectations versus market expectations.

FOMC Trading Strategies

There is no one right way to trade the FOMC announcements. Although, if you do choose to do so, the most critical first step is to have your charts open at all times, and monitor, monitor, monitor. It may be better not to trade within the first 15 minutes of any announcement. It could be better to wait it out and see how the market reacts. Occasionally, the first initial move the markets make after the report is the actual direction the market wants to go. That goes for stocks, futures, bonds, or otherwise. This is typically the real reaction the market has to the Fed announcement. However, because the market is based mainly on emotion and impulse, there can be an overreaction one way or another.

It is best to stay levelheaded. Stay patient, monitor the charts as the days go on, and based on the market’s direction and what kind of trader you are, buy the dips or take profits.

Is it Worth Trading During FOMC Events?

If you are the type of trader who enjoys taking on risk and enjoys volatile trading, it is worth making moves during FOMC events. Usually, this is best for day traders or swing traders or, in some rare cases, long-term investors that are always looking for opportunities to buy securities at undervalued and irrational prices. The bottom line is, it’s only worth trading the FOMC announcements if you can handle the volatility and have done your research.

Final Thoughts

The FOMC and the Fed have never been as important or as influential as they are today. The stock and futures indexes’ recovery is at least partly due to the unprecedented liquidity the Fed infused into the US economy. For the first time ever, the Fed is also buying high-yielding corporate bonds and ETFs. In addition, it is pushing Quantitative Easing further into unpredictable territory. This poses high inflation risks and significant risks to the strength of the US dollar. However, considering how the market expects the Fed interest rate to stay this low for the foreseeable future poses exciting opportunities for equities and economic stimulation. But as an investor, it is always important to be mindful of any moves that the Fed decides to make.

Before anything else, always assess your individual risk tolerance. There are many ways to make money in the market, and there is no right or wrong answer. It is simply up to you as the investor to decide what works for you.